Exam 12: Monetary Policy and the Federal Reserve

Exam 1: Thinking Like an Economist143 Questions

Exam 2: Comparative Advantage111 Questions

Exam 4: Spending, Income, and GDP141 Questions

Exam 5: Inflation and the Price Level143 Questions

Exam 6: Wages and Unemployment124 Questions

Exam 7: Economic Growth141 Questions

Exam 8: Saving, Capital Formation, and Financial Markets165 Questions

Exam 9: Money, Prices, and the Financial System86 Questions

Exam 10: Short-Term Economic Fluctuations121 Questions

Exam 11: Spending, Output, and Fiscal Policy145 Questions

Exam 12: Monetary Policy and the Federal Reserve116 Questions

Exam 13: Aggregate Demand, Aggregate Supply, and Business Cycles101 Questions

Exam 14: Macroeconomic Policy74 Questions

Exam 15: Exchange Rates, International Trade, and Capital Flows129 Questions

Select questions type

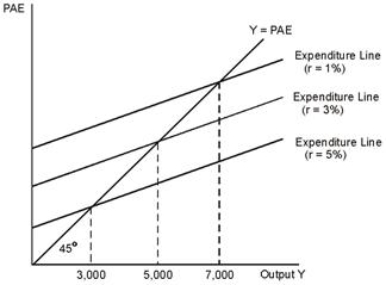

Refer to the figure below.Based on the diagram, if potential output equals 5,000 and the real interest rate is 5%, then there is ______ gap and the Fed must ______ the real interest rate so that output will equal potential output.

(Multiple Choice)

4.8/5  (34)

(34)

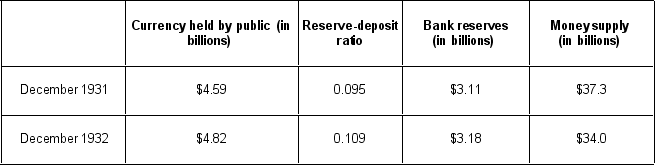

During the Great Depression in the United States between 1929 and 1933, banks'reserve/ deposit ratio ______ and the amount of currency held by the public ____, while the money supply ______.

(Multiple Choice)

4.9/5  (29)

(29)

One problem with using monetary policy to address "bubbles" in asset markets is that:

(Multiple Choice)

4.9/5  (39)

(39)

A lower real interest rate ______ saving and ______ consumption spending.

(Multiple Choice)

4.8/5  (39)

(39)

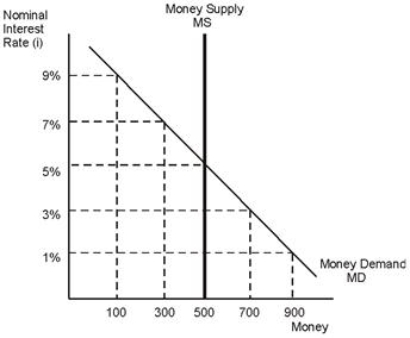

Lower nominal interest rates ______ the amount of money demanded and lower real income ______ the amount of money demanded.

(Multiple Choice)

4.9/5  (38)

(38)

If the Federal Reserve is currently paying 0.75% interest on bank reserves, but then increases that interest rate to 1%, banks may decide to hold ______ reserves, and the money supply may _____.

(Multiple Choice)

4.8/5  (38)

(38)

The most important, most convenient, and most flexible way in which the Federal Reserve affects the supply of bank reserves is through:

(Multiple Choice)

4.8/5  (29)

(29)

When commercial banks borrow reserves from the Fed, the quantity of reserves in the banking system ______ and, ultimately, the money supply _____.

(Multiple Choice)

4.8/5  (42)

(42)

If the Fed wishes to reduce nominal interest rates, it must engage in an open market ______ of bonds that ______ the money supply.

(Multiple Choice)

4.8/5  (34)

(34)

If the Federal Reserve wants to increase the money supply, it should:

(Multiple Choice)

4.8/5  (30)

(30)

If the nominal interest rate is above the equilibrium value, then the quantity demanded of money is ______ than the quantity supplied of money, bond prices will ____, and the nominal interest rate will ____.

(Multiple Choice)

4.8/5  (38)

(38)

Based on the information in the table, what quantity of reserves would the Federal Reserve have had to inject into the economy in 1932 to prevent the money supply from falling, given that the public increased the amount of currency it held and that banks increased the reserve-deposit ratio?

(Multiple Choice)

4.8/5  (36)

(36)

If the income-expenditure multiplier equals 2.5 and a 1 percent increase in the real interest rate reduces autonomous spending by 200 units, then a 1,000 unit expansionary gap can be eliminated by ______ the real interest rate by ______ percent.

(Multiple Choice)

4.9/5  (38)

(38)

If commercial banks are maintaining a 4 percent reserve/deposit ratio and the Fed raises the required reserve ratio to 6 percent, then banks will ______ their loans based on current deposits, and the money supply will _____.

(Multiple Choice)

4.8/5  (33)

(33)

Higher nominal interest rates ______ the amount of money demanded and higher real income ______ the amount of money demanded.

(Multiple Choice)

4.9/5  (35)

(35)

If the nominal interest rate is below the equilibrium value, then the quantity demanded of money is ______ than the quantity supplied of money, bond prices will ____, and the nominal interest rate will ____.

(Multiple Choice)

4.8/5  (37)

(37)

Refer to the figure below.If the Federal Reserve wants to lower the interest rate to 3%, it must ______ the money supply to _____.

(Multiple Choice)

4.9/5  (44)

(44)

If the quantity supplied of money is less than the quantity demanded of money, people will ______ bonds which will cause bond prices to ______ and the nominal interest rate to ______ until the quantity demanded and quantity supplied of money are equal.

(Multiple Choice)

4.9/5  (30)

(30)

Showing 21 - 40 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)