Exam 2: The Recording Process

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

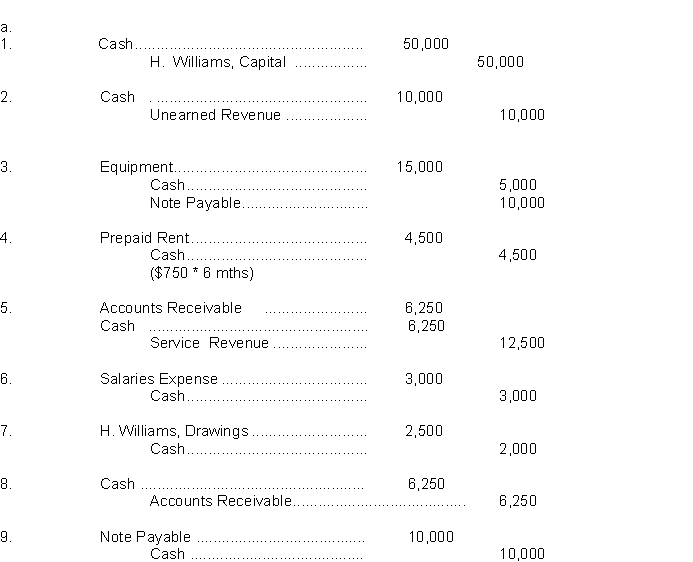

Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions.

1. The owner, Hank Williams, invested $50,000 to start a record Company operating as a sole proprietorship.

2. Received a $10,000 deposit from a customer to produce a record.

3. Purchased $15,000 of sound equipment using cash and a $10,000 loan.

4. Paid 6 months rent in advance. Monthly rent is $750.

5. Provided services for $12,500, half of which was collected in cash at the time of the sale.

6. Paid staff salaries of $3,000.

7. Paid himself $2,500.

8. Collected the remaining outstanding balance on customer accounts.

9. Paid the outstanding loan, in full, from the purchase of the sound equipment.

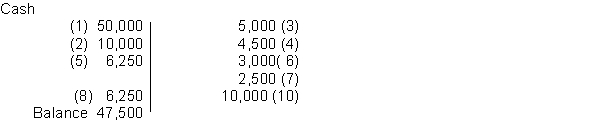

b. What is the cash balance that would appear on the trial balance at the end of the period?

a. Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions.

Free

(Essay)

4.7/5  (35)

(35)

Correct Answer:

b. The balance in the cash account on the trial balance is $47,500.

b. The balance in the cash account on the trial balance is $47,500.

A simple journal entry requires only one debit to an account and one credit to an account.

Free

(True/False)

4.9/5  (28)

(28)

Correct Answer:

True

A transaction must be analyzed to determine which accounts it will effect.

Free

(True/False)

4.9/5  (36)

(36)

Correct Answer:

True

When three or more accounts are required in one journal entry, the entry is referred to as a

(Multiple Choice)

4.9/5  (37)

(37)

Transactions are entered in the trial balance and then transferred to journals.

(True/False)

4.8/5  (36)

(36)

Listed below are the transactions for August 2014, the first month of operations of Peggy's' Pet Grooming, owned and operated by Peggy Markham.

August 1 Peggy invested $5,000 in the business, which was comprised of $3,500 in cash plus equipment valued at $1,500.

August 3 Paid rent of $400 for one month's rent.

August 3 Hired a salesperson who will be paid on commission.

August 4 Purchases supplies on account for $125.

August 12 Purchased a used van for $6,000, paying cash of $1,000 and signing an 1 year, 6% note payable for the balance.

August 15 Completed services for clients. Of the services completed, $350 was paid in cash, and the remainder, $500 was on account.

August 18 Paid telephone expense of $60.

August 26 Received a utility bill for August of $110.

August 27 Collected $250 of the accounts receivable balance.

August 29 Billed clients for $400 in services.

August 30 Paid an assistant $225 in wages.

August 30 Peggy Markham withdrew $500 for personal use.

Instructions

a. Journalize the transactions.

b. Prepare a trial balance at August 31, 2014. Hint: You may want to use T accounts.

(Essay)

4.8/5  (33)

(33)

After a transaction has been posted, the trial balance will balance.

(True/False)

4.9/5  (47)

(47)

After a business transaction has been analyzed and entered in the book of original entry, the next step in the recording process is to transfer the information to

(Multiple Choice)

5.0/5  (37)

(37)

For transactions to be recorded correctly, debits must always be greater than credits.

(True/False)

4.8/5  (43)

(43)

All business transactions must have a corresponding journal entry.

(True/False)

4.8/5  (42)

(42)

Preparing the trial balance is the first step in the accounting cycle.

(True/False)

4.8/5  (43)

(43)

Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions.

1. Jennie Beagle invests $25,000 cash to start a law firm, Legal Beagles, operating as a proprietorship.

2. Paid $2,100 cash for the first three month's rent.

3. Purchased office equipment for $10,000, paying $3,500 in cash and signed a 30-day, 5% note payable for $6,500.

4. Paid $600 cash for the purchase of office supplies.

5. Received a bill for $500 for advertising for the current month.

6. Billed $4,000 to clients for legal services.

7. Paid $200 cash on account for the advertising in transaction 5.

8. Paid $2,500 cash for office salaries.

9. Jennie withdrew $1,200 cash.

10. Received a cheque for $2,000 from a client in payment on account for services billed in transaction 6.

(Essay)

4.9/5  (36)

(36)

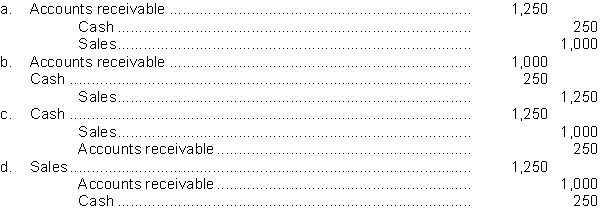

Which of the following journal entries records the cash collection for sales and outstanding accounts receivable?

(Short Answer)

5.0/5  (36)

(36)

Showing 1 - 20 of 163

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)