Exam 21: Variable Costing for Management Analysis

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

Which of the following statements is correct using the direct costing concept?

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

C

Electricity purchased to operate factory machinery would be included as part of the cost of products manufactured under the absorption costing concept.

Free

(True/False)

4.9/5  (39)

(39)

Correct Answer:

True

Under absorption costing, increases or decreases in operating income due to changes in inventory levels could be misinterpreted to be the result of operating efficiencies or inefficiencies.

Free

(True/False)

4.9/5  (43)

(43)

Correct Answer:

True

Under absorption costing, the cost of finished goods includes only direct materials, direct labor, and variable factory overhead.

(True/False)

4.8/5  (41)

(41)

In determining cost of goods sold, two alternate costing concepts can be used: direct costing and variable costing.

(True/False)

4.9/5  (23)

(23)

Under variable costing, which of the following costs would be included in finished goods inventory?

(Multiple Choice)

4.9/5  (38)

(38)

For short-run production planning, information in the absorption costing format is more useful to management than is information in the variable costing format.

(True/False)

4.8/5  (29)

(29)

If variable manufacturing costs are $15 per unit and total fixed manufacturing costs are $200,000, what is the manufacturing cost per unit if:

a. 20,000 units are manufactured and the company uses the variable costing concept?

b. 25,000 units are manufactured and the company uses the variable costing concept?

c. 20,000 units are manufactured and the company uses the absorption costing concept?

d. 25,000 units are manufactured and the company uses the absorption costing concept?

(Essay)

4.8/5  (30)

(30)

On the absorption costing income statement, deduction of the cost of goods sold from sales yields contribution margin.

(True/False)

4.9/5  (37)

(37)

Match each of the following descriptions with the appropriate costing concept (a-c).

-Required by generally accepted accounting principles

A)Absorption costing only

B)Variable costing only

C)Both absorption and variable costing

(Short Answer)

5.0/5  (36)

(36)

The absorption costing income statement does not distinguish between variable and fixed costs.

(True/False)

4.8/5  (30)

(30)

Under which inventory costing method could increases or decreases in operating income be misinterpreted to be the result of operating efficiencies or inefficiencies?

(Multiple Choice)

4.8/5  (39)

(39)

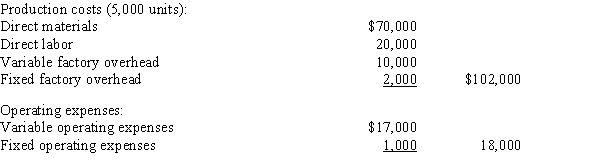

The level of inventory of a manufactured product has increased by 8,000 units during a period. The following data are also available:  The effect on operating income if absorption costing is used rather than variable costing would be a(n)

The effect on operating income if absorption costing is used rather than variable costing would be a(n)

(Multiple Choice)

4.7/5  (33)

(33)

S&P Enterprises sold 10,000 units of inventory during a given period. The level of inventory of the manufactured product remained unchanged. The manufacturing costs were as follows:  Which of the following statements is true?

Which of the following statements is true?

(Multiple Choice)

4.7/5  (38)

(38)

The amount of income under absorption costing will be more than the amount of income under variable costing when units manufactured

(Multiple Choice)

4.8/5  (37)

(37)

The level of inventory of a manufactured product has increased by 4,000 units during a period. The following data are also available:  The effect on operating income if absorption costing is used rather than variable costing would be a

The effect on operating income if absorption costing is used rather than variable costing would be a

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following terms is commonly used to describe the concept whereby the cost of manufactured products is composed of direct materials cost, direct labor cost, and variable factory overhead cost?

(Multiple Choice)

4.9/5  (36)

(36)

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, the amount of contribution margin that would be reported on the variable costing income statement is

If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, the amount of contribution margin that would be reported on the variable costing income statement is

(Multiple Choice)

4.9/5  (30)

(30)

The amount of income under absorption costing will be less than the amount of income under variable costing when units manufactured

(Multiple Choice)

4.9/5  (31)

(31)

Showing 1 - 20 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)