Exam 8: Operating Assets: Property, Plant, and Equipment, and Intangibles

Exam 1: Accounting As a Form of Communication487 Questions

Exam 2: Financial Statements and the Annual Report259 Questions

Exam 3: Processing Accounting Information219 Questions

Exam 4: Income Measurement and Accrual Accounting240 Questions

Exam 5: Inventories and Cost of Goods Sold262 Questions

Exam 6: Cash and Internal Control224 Questions

Exam 7: Receivables and Investments231 Questions

Exam 8: Operating Assets: Property, Plant, and Equipment, and Intangibles253 Questions

Exam 9: Current Liabilities, Contingencies, and the Time Value of Money206 Questions

Exam 10: Long-Term Liabilities204 Questions

Exam 11: Stockholders Equity244 Questions

Exam 12: The Statement of Cash Flows234 Questions

Exam 13: Financial Statement Analysis255 Questions

Exam 14: International-Financial-Reporting-Standards58 Questions

Select questions type

Royal Company purchased a dump truck at the beginning of 2012 at a cost of $60,000. The truck had an estimated life of 6 years and an estimated residual value of $24,000. On January 1, 2014, the company made major repairs of $20,000 to the truck that extended the life 1 year. Thus, starting with 2014, the truck has a remaining life of 5 years and a new salvage value of $8,000. Royal uses the straight-line depreciation method.

When calculating depreciation for 2014, Royal should

(Multiple Choice)

4.8/5  (35)

(35)

Depreciation has no effect on income taxes, since it only reduces a plant asset's book value.

(True/False)

4.8/5  (42)

(42)

Creighton, Inc. determined that it had incorrectly estimated both the useful life and the estimated residual value of equipment which it purchased 2 years ago. When accounting for the change in its accounting estimates, Creighton must

(Multiple Choice)

4.9/5  (33)

(33)

For each of the following items, indicate whether each would be treated as a

-Costs incurred after putting the asset into service which keep the asset in normal operating condition.

(Multiple Choice)

4.8/5  (37)

(37)

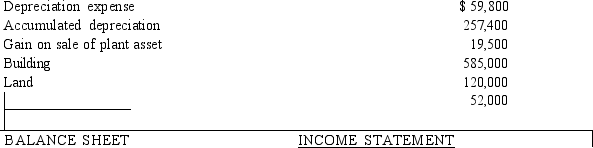

Given below are several accounts and balances from Carrier Corporation's 2015 financial statements. Prepare the Property, Plant, and Equipment section of the balance sheet and a partial income statement in the space provided below using the accounts provided.

(Essay)

4.8/5  (36)

(36)

A machine with a cost of $100,000 and accumulated depreciation of $80,000 was sold at a loss of $6,000. What amount of cash was received from the sale?

(Multiple Choice)

4.7/5  (41)

(41)

Given below is a list of items that may be reported on a statement of cash flows. Identify each as one of the following using the indirect method:

-Purchase of equipment for cash

(Multiple Choice)

4.9/5  (31)

(31)

Oakland Corp. purchased land and a building for a combined cost of $500,000. Oakland must

(Multiple Choice)

4.8/5  (32)

(32)

Tasty Catering purchased a van on January 1, 2014 for $48,000. The company decided to depreciate the van over a 5-year period using the straight-line method. The company estimated its residual value at $3,000. Show how the costs should be presented on Tasty's balance sheet and income statement for the full year ended June 30, 2016. Label the statements properly.

(Essay)

4.8/5  (33)

(33)

The three reasons why a company might choose an accelerated depreciation method are

__________________________________________________,

__________________________________________________, and

__________________________________________________.

(Essay)

4.9/5  (30)

(30)

Wind Chime and Fire Hut Companies purchased identical equipment having an estimated useful life of ten years. Wind Chime uses the straight-line depreciation method and Fire Hut uses the double-declining-balance method of depreciation. Assuming the two entities are similar in all other respects, which of the following statements is correct?

(Multiple Choice)

4.8/5  (40)

(40)

On January 2, 2013, Hannah Company sold a machine for $1,000 that it had used for several years. The machine cost $12,000, and had accumulated depreciation of $9,000 at the time of sale. What gain or loss will be reported on the income statement for the sale of the machine?

(Multiple Choice)

5.0/5  (35)

(35)

Fall Corp. uses plant assets that are subject to rapid decreases in value due to obsolescence and physical deterioration. Which of the following depreciation methods is most appropriate to measure the decline in the usefulness of the company's assets?

(Multiple Choice)

4.8/5  (34)

(34)

Wyoming Real Estate purchased a building for $600,000 in 2002. At the end of 2014, when it had a book value of $450,000, it was appraised for $1,000,000. A potential buyer offered $900,000. Wyoming rejected the offer. What

Amount should is recorded on Wyoming's records at the end of 2014 in the account called Buildings?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following below is an example of a capital expenditure?

(Multiple Choice)

4.9/5  (34)

(34)

In general, FASB standards concerning property, plant, and equipment are similar to the international accounting standards, with two important differences.

(True/False)

4.8/5  (38)

(38)

Showing 181 - 200 of 253

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)