Exam 5: Retailing Operations

Exam 1: The Role of Accounting in Business131 Questions

Exam 2: Recording Business Transactions63 Questions

Exam 3: The Adjusting Process111 Questions

Exam 4: Completing the Accounting Cycle118 Questions

Exam 5: Retailing Operations130 Questions

Exam 6: Retail Inventory141 Questions

Exam 7: Accounting Information Systems94 Questions

Exam 8: Internal Control and Cash165 Questions

Exam 9: Receivables157 Questions

Exam 10: Non-Current Assets: Property, Plant and Equipment, and Intangibles150 Questions

Exam 11: Current Liabilities and Payroll98 Questions

Exam 12: Non-Current Liabilities, Debentures Payable and Classification of Liabilities on the Balance Sheet110 Questions

Exam 13: Partnerships75 Questions

Exam 16: The Cash Flow Statement47 Questions

Exam 17: The Framework of Accounting70 Questions

Exam 18: Financial Statement Analysis70 Questions

Exam 19: Introduction to Managerial Accounting and the Master Budget121 Questions

Exam 20: Job Costing92 Questions

Exam 22: Short-Term Business Decisions132 Questions

Exam 23: Capital Investment Decisions and the Time Value of Money71 Questions

Exam 24: Appendix115 Questions

Select questions type

Sales revenues were $20 000, Sales returns and allowances were $300, Sales discounts were $700, Cost of sales were $12 000, and all other expenses totaled $4 500. The first closing entry would include which of the following line items?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

D

Which of the following is subtracted from Sales revenue to arrive at Net sales revenue?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

B

Which of the following is GENERALLY the major cost of inventory?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

A

A firm uses the perpetual inventory method. Which of the following entries would be made to record a purchase of inventory on credit?

(Multiple Choice)

4.9/5  (26)

(26)

A company's cost of sales is $1 000 000. Its average inventory is $100 000. Which of the following is its rate of inventory turnover?

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is the result of cost of sales divided by average inventory?

(Multiple Choice)

4.8/5  (39)

(39)

Cost of sales appears on both a descriptive format income statement and a functional format income statement.

(True/False)

4.9/5  (33)

(33)

An invoice is dated 28 April for $235.00 and is shown with payment terms of 5/10, n/30. If the invoice is paid on 12 May, the amount to pay will be:

(Multiple Choice)

4.8/5  (24)

(24)

If a firm uses the periodic inventory method, which of the following is subtracted from Purchases to arrive at Net purchases?

(Multiple Choice)

4.8/5  (28)

(28)

A firm uses the periodic inventory method. Which of the following entries would be made to record a purchase of inventory on credit?

(Multiple Choice)

4.7/5  (39)

(39)

A firm sells inventory for $1 000, including GST, on credit with terms of 2/10, n/30. Defective inventory of $200, including GST, is returned 2 days later. Which of the following entries would be made to record the cash receipt for the sale if the payment is received within 10 days?

(Multiple Choice)

4.8/5  (44)

(44)

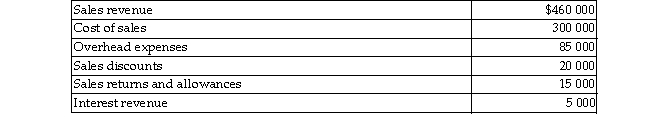

Referring to the following table, what is Net sales revenue?

(Multiple Choice)

4.8/5  (35)

(35)

Credit terms of 2/10, n/30 mean that the purchaser may deduct 2 percent if the invoice is paid within 10 days, with the full amount due in 30 days if the early payment option is NOT exercised.

(True/False)

5.0/5  (23)

(23)

Using the perpetual inventory system, discounts taken on an invoice, such as 3/10, n/30, would be:

(Multiple Choice)

4.9/5  (36)

(36)

When a firm is purchasing inventory, and there are either returns or allowances for damaged goods, those amounts are recorded as a debit to the Sales returns and allowances account.

(True/False)

5.0/5  (43)

(43)

A firm receives an invoice that indicates that title to the inventory will pass to the firm when they receive the goods. This situation is described as FOB destination.

(True/False)

4.8/5  (33)

(33)

A firm that uses the perpetual inventory method purchases inventory of $1 000 on credit with terms of 2/10, n/30. Defective inventory of $200 is returned 2 days later and the accounts are appropriately adjusted. If the firm paid the vendor 25 days later, which of the following entries would be made to record the payment? All amounts include GST.

(Multiple Choice)

4.7/5  (32)

(32)

Michelin Jewellers completed the following transactions. Michelin Jewellers uses the perpetual inventory system. On 2 April, Michelin sold $9 900 of inventory, including GST, to a customer on credit with terms of 3/15, n/30. Michelin's cost of the inventory sold was $5 000, net of GST. On 4 April, the customer reported damaged goods and Michelin granted a $1 100 sales allowance, including GST. On 10 April, Michelin received payment from the customer. If this were the only transaction for the period, what amount would be shown on the income statement for Net sales revenue?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 1 - 20 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)