Exam 11: Aggregate Demand II: Applying the Is-Lm Model

Exam 1: The Science of Macroeconomics50 Questions

Exam 2: The Data of Macroeconomics108 Questions

Exam 3: National Income: Where It Comes From and Where It Goes158 Questions

Exam 4: Money and Inflation162 Questions

Exam 5: The Open Economy111 Questions

Exam 6: Unemployment103 Questions

Exam 7: Economic Growth I: Capital Accumulation and Population Growth76 Questions

Exam 8: Economic Growth II: Technology, Empirics, and Policy61 Questions

Exam 9: Introduction to Economic Fluctuations81 Questions

Exam 10: Aggregate Demand I: Building the Is-Lm Model105 Questions

Exam 11: Aggregate Demand II: Applying the Is-Lm Model59 Questions

Exam 12: Aggregate Supply and the Short-Run Tradeoff Between Inflation and Unemployment88 Questions

Exam 13: Stabilization Policy88 Questions

Exam 14: Government Debt and Budget Deficits84 Questions

Exam 15: Introduction to the Financial System57 Questions

Exam 16: Asset Prices and Interest Rates80 Questions

Exam 17: Securities Markets83 Questions

Exam 18: Banking85 Questions

Exam 19: Financial Crises82 Questions

Select questions type

In the IS-LM model, the impact of an increase in government purchases in the goods market has ramifications in the money market, because the increase in income causes a(n) in money .

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

B

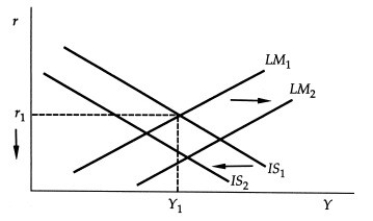

Suppose that people finally realize that they must save a larger proportion of their income in order to retire and that they simultaneously begin to use new technology, which allows them to reduce their holdings of real cash balances as a proportion of their income. Use the IS-LM model to illustrate graphically the impact of these two changes in household behavior on output and interest rates. Be sure to label: i. the axes; ii. the curves; iii. the initial equilibrium values; iv. the direction the curves shift; and v. the terminal equilibrium values.

Free

(Essay)

4.8/5  (37)

(37)

Correct Answer:

The interest rate decreases, but the impact on output is ambiguous, depending on whether the IS or LM curve shifts more.

The interest rate decreases, but the impact on output is ambiguous, depending on whether the IS or LM curve shifts more.

In the IS-LM model when M remains constant but P rises, in short-run equilibrium, in the usual case, the interest rate and output .

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

A

An increase in money supply shifts the LM curve to the right, but an increase in money

demand shifts the LM curve to the left. Explain why there is a difference.

(Essay)

4.8/5  (40)

(40)

In the IS-LM model, a decrease in output would be the result of a(n):

(Multiple Choice)

4.9/5  (42)

(42)

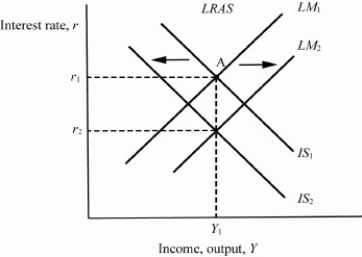

Use the IS-LM model to predict the short-run impact on the interest rate and output if the Fed pushes interest rates down at the same time that both consumption and investment fall due

to a financial crisis. Illustrate your Answer graphically. Be sure to label: i. the axes; ii. the curves; iii. the initial equilibrium; and iv. the direction the curves shift. Explain your Answer in words.

(Essay)

4.8/5  (38)

(38)

According to the IS-LM model, if Congress raises taxes but the Fed wants to hold the interest rate constant, then the Fed must the money supply.

(Multiple Choice)

4.9/5  (33)

(33)

In the IS-LM model, changes in taxes initially affect planned expenditures through:

(Multiple Choice)

4.8/5  (31)

(31)

In the IS-LM model when government spending rises, in short-run equilibrium, in the usual case, the interest rate and output .

(Multiple Choice)

4.8/5  (37)

(37)

An increase in investment demand for any given level of income and interest rates-due, for example, to more optimistic "animal spirits"-will, within the IS-LM framework, output and interest rates.

(Multiple Choice)

4.8/5  (31)

(31)

Using the IS-LM analysis, if the LM curve is not horizontal, the multiplier for an increase in government spending is for an increase in government purchases using the Keynesian-cross analysis. .

(Multiple Choice)

4.8/5  (38)

(38)

If inflation is bad, why isn't deflation good? Use the IS-LM model to explain how deflation could result in a contraction in output.

(Essay)

4.7/5  (28)

(28)

In the IS-LM model when taxation increases, in short-run equilibrium, in the usual case, the interest rate and output .

(Multiple Choice)

5.0/5  (27)

(27)

How can the Fed keep the economy from falling into a recession if the budget deficit is reduced? Use the IS-LM model to illustrate graphically the impact of both the fiscal policy reducing the deficit and the monetary policy, which prevents output from falling. Be sure to label: i. the axes; ii. the curves; iii. the initial equilibrium values; iv. the direction the curves shift; and v. the terminal equilibrium values.

(Essay)

4.7/5  (41)

(41)

If taxes are raised, but the Fed prevents income from falling by raising the money supply, then:

(Multiple Choice)

4.9/5  (28)

(28)

In the IS-LM model when M/P rises, in short-run equilibrium, in the usual case, the interest rate and output .

(Multiple Choice)

4.8/5  (35)

(35)

A change in income in the IS-LM model for a fixed price represents a

(Multiple Choice)

4.8/5  (38)

(38)

Policymakers are contemplating undertaking either an increase in government spending or an increase in the money supply. Either policy is forecast to have the same impact on income in the short run. Use the IS-LM model to compare the impact on consumption and investment of the two policy alternatives.

(Essay)

4.9/5  (35)

(35)

According to the macroeconometric model developed by Data Resources Incorporated, the response of GDP four quarters after an increase in government spending, with the nominal interest rate held constant, will be the response of GDP to a similar change with the money supply held constant.

(Multiple Choice)

4.8/5  (39)

(39)

Showing 1 - 20 of 59

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)