Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions

Patti Company owns 80% of the common stock of Shannon, Inc. In the current year, Patti reports sales of $10,000,000 and cost of goods sold of $7,500,000. For the same period, Shannon has sales of $200,000 and cost of goods sold of $160,000. During the year, Patti sold merchandise to Shannon for $60,000 at a price based on the normal markup. At the end of the year, Shannon still possesses 30 percent of this inventory.Assume the same information, except Shannon sold inventory to Patti. Compute consolidated sales.

C

What is an intra-entity gross profit on a transfer of inventory, and how is it treated on a consolidation worksheet?

In intra-entity transfers, a transfer price often exceeds the underlying cost of the inventory. Hence, the seller recognizes gross profit on its books that, with respect to the entire controlled group, is deferred until the asset is consumed or sold to an outside party. Any unrecognized intra-entity gross profit on merchandise still held by the buyer must be eliminated for consolidated financial statement purposes. With respect to the year of transfer, this consolidation procedure requires unrecognized intra-entity gross profit be deducted from the inventory account on the balance sheet, and from the ending inventory balance within cost of goods sold. In the year following the transfer (if the goods are resold or consumed), the unrecognized intra-entity gross profit must again be deducted for purposes of the consolidated financial statements. This second reduction is recorded on the worksheet as a reduction to the beginning inventory component of cost of goods sold, as well as to the beginning retained earnings balance of the original seller. This functions to defer the recognition of gross profit from the year of transfer to the year the underlying asset is consumed or sold to an unrelated third party. If the transfer was made on a downstream basis, and the parent company applied the equity method of accounting, a subsequent year adjustment must be recorded in the subsidiary investment account as opposed to the retained earnings account.

Kenzie Co. acquired 70% of McCready Co. on January 1, 2021. During 2021, Kenzie made several sales of inventory to McCready. The cost and sales price of the goods were $150,000 and $220,000, respectively. McCready still owned one-fourth of the goods at the end of 2021. Consolidated cost of goods sold for 2021 was $2,280,000 due to a consolidating adjustment for intra-entity transfers less intra-entity gross profit in McCready's ending inventory.How would consolidated cost of goods sold have differed if the inventory transfers had been for the same amount and cost, but from McCready to Kenzie?

A

Pepe, Incorporated acquired 60% of Devin Company on January 1, 2020. On that date Devin sold equipment to Pepe for $45,000. The equipment had a cost of $120,000 and accumulated depreciation of $66,000 with a remaining life of 9 years. Devin reported net income of $300,000 and $325,000 for 2020 and 2021, respectively. Pepe uses the equity method to account for its investment in Devin.What is the gain or loss on equipment recognized by Devin on its internal accounting records for 2020?

Stark Company, a 90% owned subsidiary of Parker, Inc., sold land to Parker on May 1, 2020, for $80,000. The land originally cost Stark $85,000. Stark reported net income of $200,000, $180,000, and $220,000 for 2020, 2021, and 2022, respectively. Parker sold the land purchased from Stark for $92,000 in 2022. Both companies use the equity method of accounting.Compute Stark's reported gain or loss relating to the land for 2022.

Kenzie Co. acquired 70% of McCready Co. on January 1, 2021. During 2021, Kenzie made several sales of inventory to McCready. The cost and sales price of the goods were $150,000 and $220,000, respectively. McCready still owned one-fourth of the goods at the end of 2021. Consolidated cost of goods sold for 2021 was $2,280,000 due to a consolidating adjustment for intra-entity transfers less intra-entity gross profit in McCready's ending inventory.How would net income attributable to the noncontrolling interest be different if the transfers had been for the same amount and cost, but from McCready to Kenzie?

On January 1, 2021, Kapoor Co. sold equipment to its subsidiary, Howard Corp., for $125,000. The equipment had cost $150,000, and the balance in accumulated depreciation was $70,000. The equipment had an estimated remaining useful life of eight years and no salvage value. Both companies use straight-line depreciation. On their separate 2021 income statements, Kapoor and Howard reported depreciation expense of $86,000 and $64,000, respectively. The amount of depreciation expense on the consolidated income statement for 2021 would have been:

Strayten Corp. is a wholly owned subsidiary of Quint Inc. Quint decided to use the initial value method to account for this investment. During 2021, Strayten sold Quint goods, which had cost $48,000. The selling price was $64,000. Quint still had one-eighth of the goods purchased from Strayten on hand at the end of 2021.Required:Prepare Consolidation Entry *G, which would have to be recorded at the end of 2022.

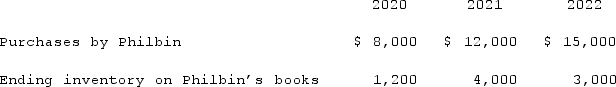

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

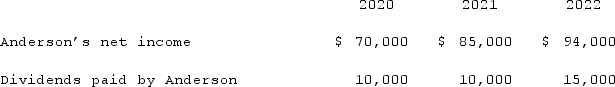

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2022.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2022.

Strickland Company sells inventory to its parent, Carter Company, at a profit during 2020. Carter sells one-third of the inventory in 2020.In the consolidation worksheet for 2020, which of the following accounts would be debited to eliminate unrecognized intra-entity gross profit with regard to the 2020 intra-entity transfers?

Walsh Company sells inventory to its subsidiary, Fisher Company, at a profit during 2020. With respect to one-third of the inventory sold to Fisher, Walsh accounts for it using the equity method of accounting.In the consolidation worksheet for 2020, which of the following accounts would be credited to eliminate unrecognized intra-entity gross profit with regard to the 2020 intra-entity transfers?

Vickers Inc. acquired all of the common stock of Scott Corp. on January 1, 2021. During 2021, Scott sold land to Vickers at a gain. No consolidation entry for the sale of the land was made at the end of 2021. What errors will this omission cause in the consolidated financial statements?

Why do intra-entity transfers between the component companies of a business combination occur so frequently?

On January 1, 2021, Musical Corp. sold equipment to Martin Inc. (a wholly-owned subsidiary)for $168,000 in cash. The equipment originally cost $140,000 but had a book value of only $98,000 when transferred. On that date, the equipment had a five-year remaining life. Depreciation expense was calculated using the straight-line method.Musical earned $308,000 in net income in 2021 (not including any investment income)while Martin reported $126,000. Assume there is no amortization related to the original investment.Prepare a schedule of consolidated net income and the share to controlling and noncontrolling interests for 2021, assuming that Musical owned only 90% of Martin and the equipment transfer had been upstream

During 2020, Odyssey Co. sold inventory to its wholly-owned subsidiary, Civic Co. The inventory cost $40,000 and was sold to Lord for $58,000. For consolidation reporting purposes, when is the $18,000 intra-entity gross profit recognized?

Lewis Corp. acquired all of the voting common stock of Vance Co. on January 1, 2021. Lewis owned land with a book value of $84,000 that was sold to Vance for its fair value of $120,000. How should this transfer be accounted for by the consolidated entity?

Pot Co. holds 90% of the common stock of Skillet Co. During 2021, Pot reported sales of $1,120,000 and cost of goods sold of $840,000. For this same period, Skillet had sales of $420,000 and cost of goods sold of $252,000.Included in the amounts for Skillet's sales were intra-entity gross profits related to Skillet's intra-entity transfer of merchandise to Pot for $140,000. There were no intra-entity transfers from Pot to Skillet. Intra-entity transfers had the same markup as sales to outsiders. Pot still had 40% of the intra-entity gross profit remaining in ending inventory at the end of 2021. What are consolidated sales and cost of goods sold for 2021?

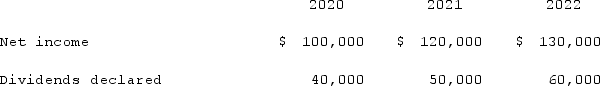

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

What amount should be recorded on Wilson's books in 2020 as gain on the transfer of equipment, prior to preparing consolidating entries?

Brooks Co. acquired 90% of Hill Inc. on January 3, 2021. During 2021, Brooks sold goods to Hill for $2,500,000 that cost Brooks $1,850,000. Hill still owned 30% of the goods at the end of the year. Cost of goods sold was $11,200,000 for Brooks and $6,600,000 for Hill. What amount of intra-entity gross profit should be deferred in 2021?

Macklin Co. owned 70% of Holland Corp. During 2021, Macklin sold to Holland land with a book value of $51,000. The selling price was $75,000. For purposes of the December 31, 2021 consolidated financial statements, at what amount should the land be reported?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)