Exam 11: Aggregate Demand I: Building the Islm Model

Exam 1: The Science of Macroeconomics58 Questions

Exam 2: The Data of Microeconomics108 Questions

Exam 3: National Income: Where It Comes From and Where It Goes159 Questions

Exam 4: The Monetary System: What It Is and How It Works99 Questions

Exam 5: Inflation: Its Causes, Effects, and Social Costs86 Questions

Exam 6: The Open Economy102 Questions

Exam 7: Unemployment and the Labour Market90 Questions

Exam 8: Economic Growth I: Capital Accumulation and Population Growth99 Questions

Exam 9: Economic Growth II: Technology, Empirics, and Policy83 Questions

Exam 10: Introduction to Economic Fluctuations94 Questions

Exam 11: Aggregate Demand I: Building the Islm Model87 Questions

Exam 12: Aggregate Demand Ii: Applying the Islm Model92 Questions

Exam 13: The Open Economy Revisited: the Mundellfleming Model and the Exchange-Rate Regime106 Questions

Exam 14: Aggregate Supply and the Short-Run Tradeoff Between Inflation and Unemployment88 Questions

Exam 15: A Dynamic Model of Economic Fluctuations83 Questions

Exam 16: Alternative Perspectives on Stabilization Policy78 Questions

Exam 17: Government Debt and Budget Deficits75 Questions

Exam 18: The Financial System: Opportunities and Dangers92 Questions

Exam 19: The Microfoundations of Consumption and Investment112 Questions

Select questions type

The theory of liquidity preference states that, other things being equal, an increase in the real money supply will:

(Multiple Choice)

4.9/5  (36)

(36)

Assume that a government decides to maintain a constant interest rate in the money market and adjusts the money supply accordingly. What would be the impact of such a policy on the LM curve and on the IS curve?

(Essay)

4.8/5  (35)

(35)

According to the theory of liquidity preference, decreasing the money supply will _____ nominal interest rates in the short run, and, according to the Fisher effect, decreasing the money supply will _____ nominal interest rates in the long run.

(Multiple Choice)

4.8/5  (40)

(40)

Two interpretations of the IS-LM model are that the model explains:

(Multiple Choice)

4.8/5  (30)

(30)

In the Keynesian-cross analysis, if the consumption function is given by C = 20 + 0.7 (Y - T), and planned investment is 100, G is 100, and T is 100, then equilibrium Y is:

(Multiple Choice)

4.8/5  (34)

(34)

Compare the predicted impact of an increase in the money supply in the liquidity preference model versus the impact predicted by the quantity theory and the Fisher effect. Can you reconcile this difference?

(Essay)

4.8/5  (34)

(34)

Assume that money demand is given by (M / P)d = 0.5Y - 100r, and (M / P)s equals 800.

a.Write the LM curve two ways, expressing Y as a function of r and r as a function of Y.

(Essay)

4.8/5  (29)

(29)

In the Keynesian-cross analysis, assume that the analysis of taxes is changed so that taxes, T, are made a function of income, as in T = T + tY, where T and t are parameters of the tax code and t is positive but less than 1. As compared to a case where t is zero, the multiplier for government purchases in this case will:

(Multiple Choice)

4.7/5  (40)

(40)

According to the Keynesian-cross analysis, when there is a shift upward in the government-purchases schedule by an amount ΔG, then equilibrium income rises by:

(Multiple Choice)

4.8/5  (32)

(32)

The government-purchases multiplier indicates how much _____ change(s) in response to a $1 change in government purchases.

(Multiple Choice)

4.8/5  (50)

(50)

Consider a closed economy to which the Keynesian-cross analysis applies. Consumption is given by the equation C = 200 + 2 / 3 (Y - T). Planned investment is 300, as are government spending and taxes.

a.If Y is 1,500, what is planned spending? What is inventory accumulation or decumulation? Should equilibrium Y be higher or lower than 1,500?

b.What is equilibrium Y?

c.What are equilibrium consumption, private saving, public saving, and national saving?

d.How much does equilibrium income decrease when G is reduced to 200? What is the multiplier for government spending?

(Essay)

4.8/5  (29)

(29)

According to classical theory, national income depends on _____, while Keynes proposed that _____ determines the level of national income.

(Multiple Choice)

4.8/5  (37)

(37)

In the Keynesian-cross model, if taxes are reduced by 100, then planned expenditures _____ for any given level of income.

(Multiple Choice)

4.8/5  (33)

(33)

Two identical countries, Country A and Country B, can each be described by a Keynesian-cross model. The MPC is 0.7 in each country. Country A decides to increase spending by $2 billion, while Country B decides to cut taxes by $2 billion. In which country will the new equilibrium level of income be greater?

(Essay)

4.9/5  (37)

(37)

In the Keynesian-cross model, if the MPC equals 0.75, then a $2 billion increase in government spending increases planned expenditures by _____ and increases the equilibrium level of income by _____.

(Multiple Choice)

4.8/5  (33)

(33)

Equilibrium levels of income and interest rates are _____ related in the goods and services market, and equilibrium levels of income and interest rates are _____ related in the market for real money balances.

(Multiple Choice)

5.0/5  (39)

(39)

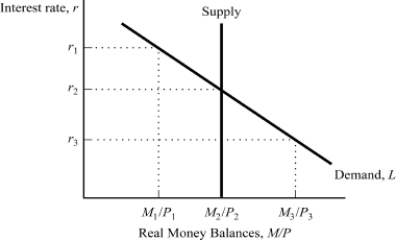

Exhibit: Market for Real Money Balances  Based on the graph, the equilibrium levels of interest rates and real money balances are:

Based on the graph, the equilibrium levels of interest rates and real money balances are:

(Multiple Choice)

4.7/5  (32)

(32)

Showing 61 - 80 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)