Exam 17: Uncertainty

Exam 1: Introduction59 Questions

Exam 2: Supply and Demand150 Questions

Exam 3: Applying the Supply-And-Demand Model124 Questions

Exam 4: Consumer Choice125 Questions

Exam 5: Applying Consumer Theory118 Questions

Exam 6: Firms and Production128 Questions

Exam 7: Costs122 Questions

Exam 8: Competitive Firms and Markets127 Questions

Exam 9: Applying the Competitive Model156 Questions

Exam 10: General Equilibrium and Economic Welfare122 Questions

Exam 11: Monopoly147 Questions

Exam 12: Pricing and Advertising135 Questions

Exam 13: Oligopoly and Monopolistic Competition128 Questions

Exam 14: Game Theory109 Questions

Exam 15: Factor Markets103 Questions

Exam 16: Interest Rates, Investments, and Capital Markets120 Questions

Exam 17: Uncertainty122 Questions

Exam 18: Externalities, Open-Access, and Public Goods123 Questions

Exam 19: Asymmetric Information119 Questions

Exam 20: Contracts and Moral Hazards107 Questions

Select questions type

Searching the Internet for information to help select a product that is more reliable is most likely to be done by a

(Multiple Choice)

4.8/5  (39)

(39)

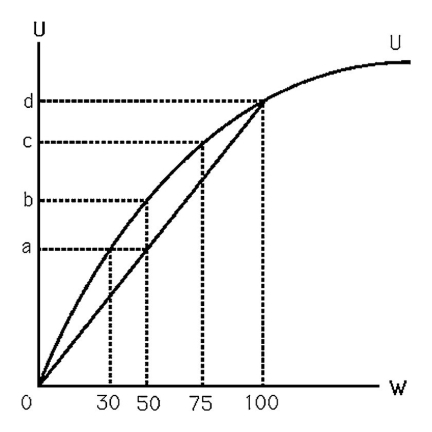

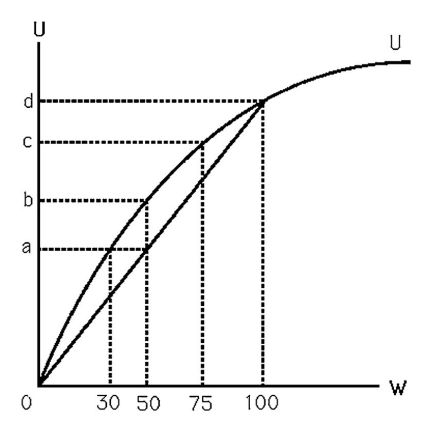

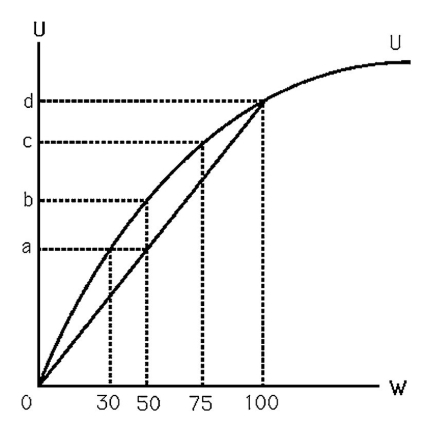

-The above figure shows Bob's utility function. He currently has $100 of wealth, but there is a 50% chance that it could all be stolen. Living with this risk gives Bob the same expected utility as if there was no chance of theft and his wealth was

-The above figure shows Bob's utility function. He currently has $100 of wealth, but there is a 50% chance that it could all be stolen. Living with this risk gives Bob the same expected utility as if there was no chance of theft and his wealth was

(Multiple Choice)

4.9/5  (26)

(26)

If global warming began to cause random world-wide damage to crops, insurance companies

(Multiple Choice)

5.0/5  (47)

(47)

You purchased two stocks that are perfectly negatively correlated.

(Multiple Choice)

4.8/5  (36)

(36)

Fair insurance is a contract between an insurer and a policyholder in which.

(Multiple Choice)

4.9/5  (31)

(31)

Your friend Dimitre tells you that he thinks that his favorite basketball team has a 70% chance of winning the next game. This is an example of a(n)

(Multiple Choice)

4.9/5  (28)

(28)

-Bob's utility function is shown in the above figure. He currently has $100 worth of property, but there is a 50% chance that all of it will be stolen. An insurance company offers to reimburse Bob for his loss if the money is stolen. What is the most that Bob would pay for such a policy? Explain.

-Bob's utility function is shown in the above figure. He currently has $100 worth of property, but there is a 50% chance that all of it will be stolen. An insurance company offers to reimburse Bob for his loss if the money is stolen. What is the most that Bob would pay for such a policy? Explain.

(Essay)

4.8/5  (40)

(40)

Describe how the risk premium for a person with a convex utility function is determined.

(Essay)

4.8/5  (33)

(33)

Which of the following evidence does NOT support the expected utility theory?

(Multiple Choice)

4.8/5  (35)

(35)

-The above figure shows Bob's utility function. He currently has $50 and is considering investing all of it in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0. Bob will

-The above figure shows Bob's utility function. He currently has $50 and is considering investing all of it in an investment that has a 50% chance of being worth $100 and a 50% chance of being worth $0. Bob will

(Multiple Choice)

4.8/5  (41)

(41)

Johnny owns a house that would cost $100,000 to replace should it ever be destroyed by fire. There is a 0.1% chance that the house could be destroyed during the course of a year. Johnny's utility function is U = W0.5. How much would fair insurance cost that completely replaces the house if destroyed by fire? Assuming that Johnny has no other wealth, how much would Johnny be willing to pay for such an insurance policy? Why the difference?

(Essay)

4.9/5  (41)

(41)

Farmers who purchase insurance against crop failures tend to be pooled with farmers far away. Why might this be the case?

(Multiple Choice)

4.8/5  (32)

(32)

Explain why insurance companies usually do not offer earthquake insurance.

(Essay)

4.9/5  (41)

(41)

The certainty effect occurs when people put ________ weight on outcomes that they consider to be ________ relative to ________ outcomes.

(Multiple Choice)

4.8/5  (47)

(47)

Showing 61 - 80 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)