Exam 15: Financial Leverage and Capital Structure Policy

Exam 1: Introduction to Corporate Finance71 Questions

Exam 2: Corporate Governance99 Questions

Exam 3: Financial Statement Analysis112 Questions

Exam 4: Introduction to Valuation: the Time Value of Money101 Questions

Exam 5: Discounted Cash Flow Valuation68 Questions

Exam 6: Bond Valuation128 Questions

Exam 7: Equity Valuation128 Questions

Exam 8: Net Present Value and Other Investment Criteria119 Questions

Exam 9: Making Capital Investment Decisions112 Questions

Exam 10: Project Analysis and Evaluation108 Questions

Exam 11: Some Lessons From Recent Capital Market History105 Questions

Exam 12: Return, Risk and the Security Market97 Questions

Exam 13: Cost of Capital100 Questions

Exam 14: Raising Capital100 Questions

Exam 15: Financial Leverage and Capital Structure Policy89 Questions

Exam 16: Dividends and Payout Policy97 Questions

Exam 17: Short-Term Financial Planning and Management103 Questions

Exam 18: International Corporate Finance109 Questions

Exam 19: Behavioural Finance101 Questions

Exam 20: Financial Risk Management97 Questions

Exam 21: Options and Corporate Finance98 Questions

Select questions type

The amount paid to an underwriter who participates in a standby underwriting agreement is called a(n):

(Multiple Choice)

5.0/5  (49)

(49)

The Warm Shoe Co.has concluded that additional equity financing will be needed to expand operations and that the needed funds will be best obtained through a rights offering.It has correctly determined that as a result of the rights offering, the share price will fall from $100 to $90 ($100 is the rights-on-price; $90 is the ex-rights price, also known as the when-issued price).The company is seeking $18 million in additional funds with a per-share subscription price of $50.How many shares of stock are outstanding, before the offering? (Assume that the increment to the market value of the equity equals the gross proceeds of the offering.)

(Multiple Choice)

4.9/5  (39)

(39)

Denver Liquid Wholesalers recently offered 50,000 new shares of stock for sale.The underwriters sold a total of 53,000 shares to the public.The additional 3,000 shares were purchased in accordance with which one of the following?

(Multiple Choice)

4.9/5  (34)

(34)

Wagner Trucking is considering investing in a new project that will cost $13 million and increase net income by 6.5 percent.This project will be completely funded by issuing new equity shares.Currently, the firm has 1.25 million shares of stock outstanding with a market price of $42 per share.The current earnings per share are $1.82.What will the earnings per share be if the project is implemented?

(Multiple Choice)

4.7/5  (38)

(38)

The Motor Plant wants to raise $21.4 million through a rights offering so it can modernize its facilities.The subscription price for the offering is set at $11 a share.Currently, the company has 2.6 million shares of stock outstanding at a market price of $12.50 a share.Each shareholder will receive one right for each share of stock they own.How many rights will a shareholder need to purchase one new share of stock in this offering?

(Multiple Choice)

4.9/5  (36)

(36)

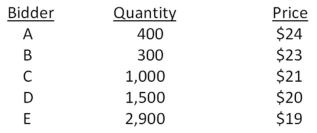

Miller Motors has decided to sell 1,800 shares of stock through a Dutch auction.The bids received are as follows:  How much will Miller Motors receive in total from selling the 1,600 shares? Ignore all transaction and flotation costs.

How much will Miller Motors receive in total from selling the 1,600 shares? Ignore all transaction and flotation costs.

(Multiple Choice)

4.9/5  (34)

(34)

Flagler, Inc.needs to raise $30 million to finance its expansion into new markets.The company will sell new shares of equity via a general cash offering to raise the needed funds.The offer price is $40 per share and the company's underwriters charge a 10 percent spread.How many shares need to be sold?

(Multiple Choice)

4.7/5  (31)

(31)

Which one of the following statements is correct concerning the issuance of long-term debt?

(Multiple Choice)

4.8/5  (36)

(36)

Direct business loans typically ranging from one to five years are called:

(Multiple Choice)

4.9/5  (38)

(38)

The Huff Co.has just gone public.Under a firm commitment agreement, Huff received $21.50 for each of the 6 million shares sold.The initial offering price was $23.65 per share, and the stock rose to $31.42 per share in the first few minutes of trading.Huff paid $1,260,000 in direct legal and other costs, and $390,000 in indirect costs.The flotation costs were what percentage of the funds raised?

(Multiple Choice)

4.9/5  (38)

(38)

Nelson Paints recently went public by offering 65,000 shares of common stock to the public.The underwriters provided their services in a best efforts underwriting.The offering price was set at $16 a share and the gross spread was $2.After completing their sales efforts, the underwriters determined that they sold a total of 57,500 shares.How much cash did Nelson Paints receive from its IPO?

(Multiple Choice)

4.9/5  (40)

(40)

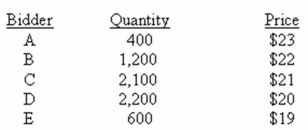

Webster Electrics is offering 1,500 shares of stock in a Dutch auction.The bids include:  How much cash will Webster Electrics receive from selling these shares? Ignore all transaction and flotation costs.

How much cash will Webster Electrics receive from selling these shares? Ignore all transaction and flotation costs.

(Multiple Choice)

4.8/5  (39)

(39)

The 40-day period following an IPO during which the SEC places restrictions on the public communications of the issuer is known as the _____ period.

(Multiple Choice)

4.9/5  (43)

(43)

To purchase shares in a rights offering, a shareholder generally just needs to:

(Multiple Choice)

4.9/5  (42)

(42)

Roy owns 200 shares of R.T.F., Inc.He has opted not to participate in the current rights offering by this firm.As a result, Roy will most likely be subject to:

(Multiple Choice)

4.9/5  (32)

(32)

Showing 61 - 80 of 89

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)