Exam 12: Return, Risk and the Security Market

Exam 1: Introduction to Corporate Finance71 Questions

Exam 2: Corporate Governance99 Questions

Exam 3: Financial Statement Analysis112 Questions

Exam 4: Introduction to Valuation: the Time Value of Money101 Questions

Exam 5: Discounted Cash Flow Valuation68 Questions

Exam 6: Bond Valuation128 Questions

Exam 7: Equity Valuation128 Questions

Exam 8: Net Present Value and Other Investment Criteria119 Questions

Exam 9: Making Capital Investment Decisions112 Questions

Exam 10: Project Analysis and Evaluation108 Questions

Exam 11: Some Lessons From Recent Capital Market History105 Questions

Exam 12: Return, Risk and the Security Market97 Questions

Exam 13: Cost of Capital100 Questions

Exam 14: Raising Capital100 Questions

Exam 15: Financial Leverage and Capital Structure Policy89 Questions

Exam 16: Dividends and Payout Policy97 Questions

Exam 17: Short-Term Financial Planning and Management103 Questions

Exam 18: International Corporate Finance109 Questions

Exam 19: Behavioural Finance101 Questions

Exam 20: Financial Risk Management97 Questions

Exam 21: Options and Corporate Finance98 Questions

Select questions type

The U.S.Securities and Exchange Commission periodically charges individuals with insider trading and claims those individuals have made unfair profits.Given this, you would be most apt to argue that the markets are less than _____ form efficient.

(Multiple Choice)

4.8/5  (42)

(42)

The average compound return earned per year over a multi-year period is called the _____ average return.

(Multiple Choice)

4.7/5  (43)

(43)

A stock had returns of 15 percent, 8 percent, 12 percent, -15 percent, and -4 percent for the past five years.Based on these returns, what is the approximate probability that this stock will return at least 20 percent in any one given year?

(Multiple Choice)

4.8/5  (38)

(38)

You are aware that your neighbor trades stocks based on confidential information he overhears at his workplace.This information is not available to the general public.This neighbor continually brags to you about the profits he earns on these trades.Given this, you would tend to argue that the financial markets are at best _____ form efficient.

(Multiple Choice)

5.0/5  (38)

(38)

What was the highest annual rate of inflation during the period 1926-2010?

(Multiple Choice)

4.9/5  (45)

(45)

Which two of the following are the most likely reasons why a stock price might not react at all on the day that new information related to the stock issuer is released?

I.insiders knew the information prior to the announcement

II.investors need time to digest the information prior to reacting

III.the information has no bearing on the value of the firm

IV.the information was anticipated

(Multiple Choice)

4.8/5  (44)

(44)

Six months ago, you purchased 100 shares of stock in Global Trading at a price of $38.70 a share.The stock pays a quarterly dividend of $0.15 a share.Today, you sold all of your shares for $40.10 per share.What is the total amount of your dividend income on this investment?

(Multiple Choice)

4.8/5  (28)

(28)

Which one of the following categories of securities has had the most volatile returns over the period 1926-2010?

(Multiple Choice)

4.8/5  (38)

(38)

If you excel in analyzing the future outlook of firms, you would prefer the financial markets be ____ form efficient so that you can have an advantage in the marketplace.

(Multiple Choice)

4.8/5  (33)

(33)

Individuals who continually monitor the financial markets seeking mispriced securities:

(Multiple Choice)

4.8/5  (35)

(35)

Your friend is the owner of a stock which had returns of 25 percent, -36 percent, 1 percent, and 16 percent for the past four years.Your friend thinks the stock may be able to achieve a return of 50 percent or more in a single year.Based on these returns, what is the probability that your friend is correct?

(Multiple Choice)

4.9/5  (46)

(46)

Which one of the following statements is correct concerning market efficiency?

(Multiple Choice)

4.8/5  (38)

(38)

What is the amount of the risk premium on a U.S.Treasury bill if the risk-free rate is 2.8 percent and the market rate of return is 8.35 percent?

(Multiple Choice)

4.8/5  (36)

(36)

Which one of the following is a correct ranking of securities based on their volatility over the period of 1926-2010? Rank from highest to lowest.

(Multiple Choice)

4.7/5  (34)

(34)

One year ago, you purchased 150 shares of a stock at a price of $54.18 a share.Today, you sold those shares for $40.25 a share.During the past year, you received total dividends of $182 while inflation averaged 4.2 percent.What is your approximate real rate of return on this investment?

(Multiple Choice)

4.9/5  (33)

(33)

Bayside Marina just announced it is decreasing its annual dividend from $1.64 per share to $1.50 per share effective immediately.If the dividend yield remains at its pre-announcement level, then you know the stock price:

(Multiple Choice)

4.8/5  (36)

(36)

Inside information has the least value when financial markets are:

(Multiple Choice)

4.8/5  (35)

(35)

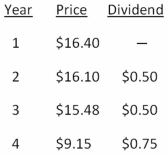

A stock had the following prices and dividends.What is the geometric average return on this stock?

(Multiple Choice)

4.8/5  (44)

(44)

A stock has annual returns of 5 percent, 21 percent, -12 percent, 7 percent, and -6 percent for the past five years.The arithmetic average of these returns is _____ percent while the geometric average return for the period is _____ percent.

(Multiple Choice)

4.9/5  (36)

(36)

How can an investor lose money on a stock while making money on a bond investment if there is a reward for bearing risk? Aren't stocks riskier than bonds?

(Essay)

4.7/5  (38)

(38)

Showing 61 - 80 of 97

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)