Exam 10: Financial Markets and the Economy

Exam 1: Economics: the Study of Choice136 Questions

Exam 2: Confronting Scarcity: Choices in Production189 Questions

Exam 3: Demand and Supply243 Questions

Exam 4: Applications of Supply and Demand104 Questions

Exam 5: Macroeconomics: the Big Picture141 Questions

Exam 6: Measuring Total Output and Income156 Questions

Exam 7: Aggregate Demand and Aggregate Supply162 Questions

Exam 8: Economic Growth131 Questions

Exam 9: The Nature and Creation of Money219 Questions

Exam 10: Financial Markets and the Economy169 Questions

Exam 11: Monetary Policy and the Fed173 Questions

Exam 12: Government and Fiscal Policy170 Questions

Exam 13: Consumption and the Aggregate Expenditures Model214 Questions

Exam 14: Investment and Economic Activity135 Questions

Exam 15: Net Exports and International Finance194 Questions

Exam 16: Inflation and Unemployment128 Questions

Exam 17: A Brief History of Macroeconomic Thought and Policy120 Questions

Exam 18: Inequality, Poverty, and Discrimination135 Questions

Select questions type

When the Fed sells government bonds in the open market, the money supply will increase.

Free

(True/False)

4.8/5  (40)

(40)

Correct Answer:

False

Which of the following decreases the demand for money?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

Use the following to answer questions

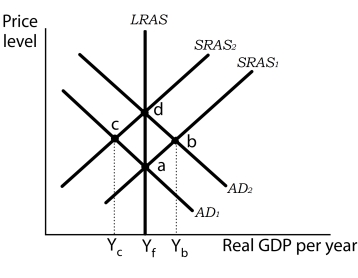

Exhibit: Economic Adjustments  -(Exhibit: Economic Adjustments)

If the economy is at point c,

-(Exhibit: Economic Adjustments)

If the economy is at point c,

(Multiple Choice)

4.8/5  (29)

(29)

When the money demand curve is drawn with interest rate on the vertical axis and the quantity of money on the horizontal axis, the slope of the demand curve for money is

(Multiple Choice)

5.0/5  (29)

(29)

If financial investors believe that the prices of bonds and other assets will fall,

(Multiple Choice)

4.8/5  (34)

(34)

Use the following to answer questions

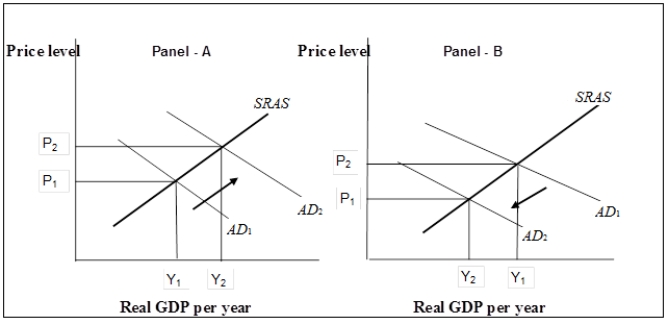

Exhibit: The Money Supply and Aggregate Demand  -(Exhibit The Money Supply and Aggregate Demand)

If the economy is experiencing a recessionary gap, the Fed would

-(Exhibit The Money Supply and Aggregate Demand)

If the economy is experiencing a recessionary gap, the Fed would

(Multiple Choice)

4.8/5  (32)

(32)

Suppose the United States experiences a rise in the U.S.dollar price of foreign exchange.

(Multiple Choice)

4.7/5  (36)

(36)

Consider Scenario 1 below:

Scenario 1

Consider two money management strategies.The first strategy is called the cash strategy in which an individual deposits her monthly earnings in a checking account and draws down equal amounts each day to finance her daily expenditures.Assume that she earns no interest on her checking accounts and funds are exhausted at the end of the month.The second strategy is called the bond fund strategy.Here the individual deposits one-quarter of her earnings in a checking account and the remaining three-quarters in a bond fund.The bond fund pays 1% interest per month.At the end of the week when the money in the checking account is exhausted, the individual replenishes it by withdrawing another one-quarter of her earnings from the bond fund for the next week.This process is repeated at the end of the second week and third week until the bond fund is exhausted.

In which strategy will the quantity of money demanded be greater?

(Multiple Choice)

4.8/5  (42)

(42)

Use the following to answer questions

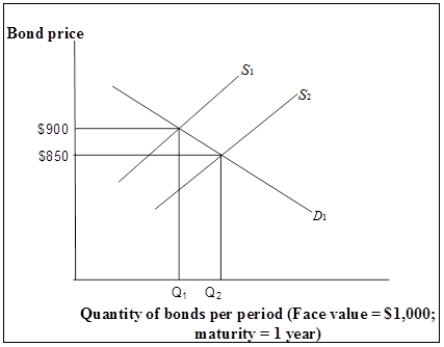

Exhibit: The Bond Market  -(Exhibit: The Bond Market)

A movement from S1 to S2, means there was

-(Exhibit: The Bond Market)

A movement from S1 to S2, means there was

(Multiple Choice)

4.9/5  (36)

(36)

Suppose the government issues bonds to finance an increase in government spending.In the bond market,

(Multiple Choice)

4.8/5  (38)

(38)

Holding $10 in your pocket to purchase a piping hot pizza illustrates the

(Multiple Choice)

4.8/5  (36)

(36)

A $100 bond, which matures in one year, has a price of $75.The interest rate on this bond is

(Multiple Choice)

4.9/5  (32)

(32)

If a British student pays her way to attend Harvard University, her action will:

(Multiple Choice)

4.9/5  (41)

(41)

Use the following to answer questions

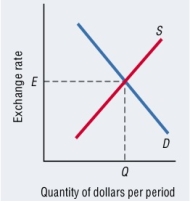

Exhibit: Foreign Exchange Market  -(Exhibit: Foreign Exchange Market)

Who generates a supply of dollars in the foreign exchange market?

-(Exhibit: Foreign Exchange Market)

Who generates a supply of dollars in the foreign exchange market?

(Multiple Choice)

4.7/5  (26)

(26)

Showing 1 - 20 of 169

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)