Exam 5: Depreciation and Amortization

Exam 1: The Role of Accounting in Business15 Questions

Exam 2: The Statement of Financial Position30 Questions

Exam 3: The Statement of Profit or Loss30 Questions

Exam 4: Applying Accounting Conventions30 Questions

Exam 5: Depreciation and Amortization29 Questions

Exam 6: The Statement of Cash Flows24 Questions

Exam 7: Financial Reporting by Limited Companies30 Questions

Exam 8: Understanding Financial Reports: Trend Analysis30 Questions

Exam 9: Understanding Financial Reports: Using Accounting Ratios39 Questions

Exam 10: Management and Cost Accounting Information10 Questions

Exam 11: Costing: Overview and Basic Techniques15 Questions

Exam 12: Costing14 Questions

Exam 13: Pricing15 Questions

Exam 14: Marginal Costing and Decision Making30 Questions

Exam 15: Capital Investment Decisions30 Questions

Exam 16: Budgeting29 Questions

Exam 17: Accounting for Control30 Questions

Exam 18: Performance Measurement15 Questions

Exam 19: The Management of Working Capital25 Questions

Exam 20: Financing the Business25 Questions

Select questions type

When a business charges depreciation on its non-current assets, what are the effects on its assets, capital and liabilities?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

Keanu disposed of a motor vehicle on 31 December 20X7 for £7700.He bought the vehicle on 1 January 20X6 for £12 580 and depreciated it on the reducing balance basis at 20% each year.His year end is 31 October. What was the profit or loss on the sale of this asset (to the nearest £)?

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

B

Sohail runs a delivery business which charges a premium compared with its competitors because it offers a very fast and efficient service.He keeps delivery vans for 2½ years only, in order to ensure high levels of reliability.He estimates, on the basis of past experience, that the residual value of his vans is 45% of their cost price.He depreciates each van over the 2½ year period of ownership on the straight-line basis, calculating depreciation for each full month of ownership. Sohail buys a new van on 17 July 20X1 for £17 260.What is the charge for depreciation in respect of this van for inclusion in Sohail's statement of profit or loss for the year ended 31 October 20X1 (to the nearest £)?

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

C

Grigor purchased a freehold building for use in his business on 1 February 20X1 for £235 000.He estimated a useful life of 100 years for the building, with no residual value.On 1 February 20X6 he sold the building for £247 000.What was his profit or loss on sale?

(Multiple Choice)

4.8/5  (43)

(43)

Abbas runs a wholesale confectionery business.During 20X5 he installed a new computerized inventory system at a cost of £320 000.He decided to depreciate the system at 15% each year on the reducing balance basis, but because it did not come online until mid-20X5 he charged only half of the first year's depreciation in his accounts for the year ended 31 December 20X5. What was the carrying amount of the computerized inventory system at 31 December 20X6?

(Multiple Choice)

4.8/5  (35)

(35)

Bill buys new shelving for his warehouse on 1 May 20X4 at a total cost of £23 000.He plans to depreciate this cost on the straight-line basis over 10 years, after which it will have no value.He charges depreciation for each full month of ownership.What is the carrying amount of the shelving at 31 December 20X8 (to the nearest £)?

(Multiple Choice)

4.9/5  (41)

(41)

Cy employs a sales representative who uses a car supplied by Cy's business.Cy's policy is to depreciate the car over its estimated useful life of four years on the straight-line basis, charging one month's depreciation in respect of every full month of ownership. During March 20X3, the sales rep hands in her notice, and says that she intends to leave at the end of April 20X3.She asks Cy if she can buy the car for its carrying amount at that date.The car was purchased on 10 June 20X1 for £23 600.Its residual value was estimated at £6600.What is the carrying amount of the car at 30 April 20X3 (to the nearest £)?

(Multiple Choice)

4.7/5  (26)

(26)

Pat replaces motor vehicles used in his business every four years.On 1 May 20X6 he bought a new vehicle for £16 200 to replace a four-year old car that was sold on the same day for £3600.The latter vehicle was purchased for £12 300 and was depreciated on the straight-line basis assuming a residual value of £4500. What was Pat's profit or loss on sale of the vehicle?

(Multiple Choice)

4.8/5  (24)

(24)

Doris buys a non-current asset for £35 000 on 1 February 20X1.She depreciates assets of this type on the reducing balance basis at a rate of 15% each year.What is the carrying amount of this asset at Doris's year end on 31 January 20X5 (to the nearest £)?

(Multiple Choice)

4.8/5  (50)

(50)

Gavin sold an item of machinery on 31 October 20X4 for £6750.He had bought the machine exactly five years previously for £15 500 and had decided to depreciate it at the rate of 15% each year on the reducing balance basis. What was Gavin's profit or loss on disposal of the machine (to the nearest £)?

(Multiple Choice)

4.7/5  (41)

(41)

Randolph started business on 1 January 20X1, on which date he invested in machinery and motor vehicles.He made no further acquisitions or disposals of non-current assets during the rest of 20X1 and 20X2.His policy is to depreciate all classes of non-current asset on the reducing balance basis at a rate of 25% each year. Which two of the following statements are correct?

A. Randolph's depreciation charge would have been lower in 20X2 if he had adopted a policy of straight line depreciation over four years with assumed residual values of £nil.

B. Randolph's depreciation charge would have been higher in 20X2 if he had adopted a policy of straight line depreciation over four years with assumed residual values of £nil.

C. His net profit margin was higher in year 2 than it would have been if he had adopted a policy of straight line depreciation over four years with assumed residual values of £nil.

D. His net profit margin was lower in year 2 than it would have been if he had adopted a policy of straight line depreciation over four years with assumed residual values of £nil.

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following statements about depreciation are correct?

A.Depreciation is a way of allocating the cost of a non-current asset to the accounting periods that benefit from its use.

B. Depreciation helps to set aside sufficient cash to buy a replacement once the asset is worn out.

(Multiple Choice)

4.7/5  (32)

(32)

Oscar's business invests in a new lorry on 13 September20X3 at a cost of £42 350.On the same date he disposes of the old lorry for £4000.The estimated useful life of the new lorry is five years, with an expected residual value of £6500.Oscar charges a full year's depreciation in the year of acquisition and none in the year of disposal. What is Oscar's depreciation charge in respect of the lorry for the financial year ended 31 January 20X4?

(Multiple Choice)

4.8/5  (41)

(41)

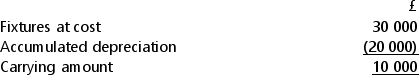

Daisy runs a small floristry business.She depreciates shop fixtures on the straight-line basis over four years, and assumes that the fixtures will have no value at the end of that period.The following balances were included in Daisy's statement of financial position in respect of shop fittings at 31 January 20X4:  On 1 February 20X1, when she started the business, she bought fixtures at a cost of £20 000.One year later, on 1 February 20X2, she spent a further £10 000.She charges 1/12th of the annual depreciation charge for each complete month of ownership.

On 1 August 20X4, Daisy disposed of all of her 20X1 purchase of shop fittings for £600.On the same day she bought replacement fittings for £25 000.

What is the total charge to Daisy's statement of profit or loss in respect of these transactions for the year ended 31 January 20X5?

On 1 February 20X1, when she started the business, she bought fixtures at a cost of £20 000.One year later, on 1 February 20X2, she spent a further £10 000.She charges 1/12th of the annual depreciation charge for each complete month of ownership.

On 1 August 20X4, Daisy disposed of all of her 20X1 purchase of shop fittings for £600.On the same day she bought replacement fittings for £25 000.

What is the total charge to Daisy's statement of profit or loss in respect of these transactions for the year ended 31 January 20X5?

(Multiple Choice)

4.8/5  (37)

(37)

Stan sells an item of machinery for £8000.The machine had cost £17 500 and accumulated depreciation up to the date of sale was £8600.Using the accounting equation, what was the effect of this transaction on Stan's business assets, capital and liabilities?

(Multiple Choice)

4.9/5  (30)

(30)

Dagmar spent £11 700 on 1 February 20X2 in acquiring a new car for use in her business.The basic price of the car was £11 000, but she spent an additional £700 on air conditioning for it.Dagmar's policy is to depreciate on the reducing balance basis at a rate of 25%. What was the charge to depreciation in respect of this car for Dagmar's financial year ended 31 January 20X4 (to the nearest £)?

(Multiple Choice)

4.8/5  (27)

(27)

Ruby buys a non-current asset on 1 January 20X2 for £18 000.She plans to depreciate it over a period of 10 years on the straight-line basis, and she estimates that its residual value at the end of the ten-year period will be £2000.What is the carrying amount of the non-current asset at her year end on 31 December 20X6?

(Multiple Choice)

4.8/5  (22)

(22)

Trish runs a boxing club.She installed a new boxing ring at a cost of £25 000 on 1 April 20X1, and decided to depreciate the new ring at a rate of 20% each year on the reducing balance basis.What is the depreciation charge in respect of the boxing ring for Trish's accounting year ended 31 March 20X4?

(Multiple Choice)

5.0/5  (35)

(35)

Ellie buys a new delivery vehicle on 1 January 20X4 for £15 000.She depreciates vans on a straight line basis over five years.She estimates that she will be able to sell this van on 31 December 20X8 for £750. What is the depreciation charge in respect of this vehicle for Ellie's financial year ended 31 December 20X4?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 1 - 20 of 29

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)