Exam 11: Corporations: Organization, Share Transactions, Dividends,and Retained Earnings

Exam 1: Accounting in Action222 Questions

Exam 2: The Recording Process170 Questions

Exam 3: Adjusting the Accounts207 Questions

Exam 4: Completing the Accounting Cycle167 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventories156 Questions

Exam 7: Fraud, Internal Control, and Cash176 Questions

Exam 8: Accounting for Receivables206 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets261 Questions

Exam 10: Liabilities141 Questions

Exam 12: Investments119 Questions

Exam 13: Statement of Cash Flows130 Questions

Exam 14: Financial Statement Analysis120 Questions

Exam 15: Payroll Accounting27 Questions

Exam 16: Other Significant Liabilities31 Questions

Select questions type

Preference shares have contractual preference over ordinary shares in certain areas.

(True/False)

4.9/5  (35)

(35)

La Vida Corporation issued 18,000 shares of no-par value ordinary shares for €29.50 per share.Which of the following statements is true?

(Multiple Choice)

4.8/5  (28)

(28)

As soon as a corporation is authorized to issue shares, an accounting journal entry should be made recording the total value of the shares authorized.

(True/False)

4.8/5  (35)

(35)

When preference shares is cumulative, preference dividends not declared in a period are

(Multiple Choice)

5.0/5  (32)

(32)

When no-par ordinary shares that have a stated value are issued, the stated value is credited to Share Capital-Ordinary.

(True/False)

4.8/5  (32)

(32)

Manner, Inc.has 5,000 shares of 5%, ₤100 par value, noncumulative preference shares and 20,000 ordinary shares with a ₤1 par value outstanding at December 31, 2011.There were no dividends declared in 2010.The board of directors declares and pays a ₤45,000 dividend in 2011.What is the amount of dividends received by the ordinary shareholders in 2011?

(Multiple Choice)

4.8/5  (39)

(39)

If ordinary shares are issued for an amount greater than par value, the excess should be credited to

(Multiple Choice)

4.7/5  (38)

(38)

The number of ordinary shares outstanding can never be greater than the number of shares issued.

(True/False)

4.9/5  (37)

(37)

Beckham Company has 1,000 shares of 6%, $100 par cumulative preference shares outstanding at December 31, 2011.No dividends have been paid on these shares for 2010 or 2011.Dividends in arrears at December 31, 2011 total

(Multiple Choice)

4.8/5  (25)

(25)

Slaton Company originally issued 3,000 ordinary shares with a $10 par value for $90,000 ($30 per share).Slaton subsequently purchases 300 treasury shares for $27 per share and resells the 300 treasury shares for $29 per share.In the entry to record the sale of the treasury shares, there will be a

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following is not a right of an ordinary shareholder?

(Multiple Choice)

4.7/5  (36)

(36)

Ownership rights in a corporation are evidenced by ordinary shares.

(True/False)

4.9/5  (37)

(37)

Retained earnings that are restricted are unavailable for dividends.

(True/False)

4.7/5  (41)

(41)

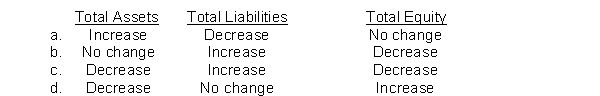

Indicate the respective effects of the declaration of a cash dividend on the following statement of financial position sections:

(Short Answer)

4.9/5  (47)

(47)

Looper, Inc.has 25,000 shares of 6%, ₤100 par value, noncumulative preference shares and 50,000 ordinary shares with a ₤1 par value outstanding at December 31, 2011.There were no dividends declared in 2010.The board of directors declares and pays a ₤250,000 dividend in 2011.What is the amount of dividends received by the common shareholders in 2011?

(Multiple Choice)

5.0/5  (33)

(33)

Showing 21 - 40 of 205

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)