Exam 3: The Recording Process: Debits and Credits

Exam 1: Welcome to Accounting158 Questions

Exam 2: The Accounting Equation and Transaction Analysis155 Questions

Exam 3: The Recording Process: Debits and Credits222 Questions

Exam 4: The Recording Process: the Journal, the Ledger, and the Trial Balance176 Questions

Exam 5: Adjusting the Accounts and Preparing an Adjusted Trial Balance180 Questions

Exam 6: Completing a Worksheet and Completing the Accounting Cycle186 Questions

Exam 7: Merchandising Companies: Purchases Perpetual153 Questions

Exam 8: Merchandising Companies: Sales Perpetual122 Questions

Exam 9: Merchandising Companies: Worksheets and Financial Statements Perpetual163 Questions

Exam 10: Special Journals153 Questions

Exam 11: Inventory205 Questions

Exam 12: Cash, Banking, and Internal Controls268 Questions

Exam 13: Payroll Accounting: Employee Taxes and Records101 Questions

Exam 14: Payroll Accounting: Employer Taxes and Records79 Questions

Select questions type

Sara Bernheat withdraws $700 cash from her business for personal use. Recording this transaction will include a debit of $700 to

(Multiple Choice)

4.7/5  (37)

(37)

During an accounting period, a business has numerous transactions affecting each of the following accounts. State for each account whether it is likely to have (a) debit entries only, (b) credit entries only, or (c) both debit and credit entries.

(Essay)

4.9/5  (32)

(32)

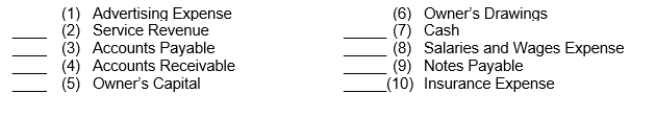

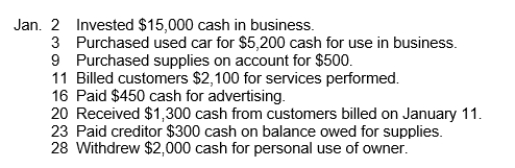

Selected transactions for A. Byrjun, a property manager, in her first month of business,

are as follows.  Instructions

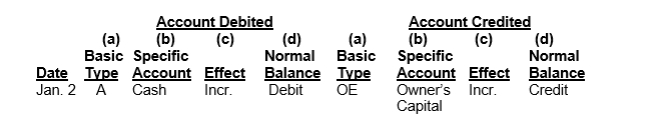

For each transaction indicate the following.

(a) The basic type of account debited and credited (asset (A), liability (L), owner's equity (OE)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

Instructions

For each transaction indicate the following.

(a) The basic type of account debited and credited (asset (A), liability (L), owner's equity (OE)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

(Essay)

4.9/5  (38)

(38)

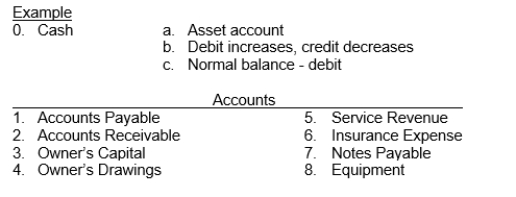

For each of the following accounts indicate (a) the type of account (Asset, Liability, Owner's Equity, Revenue, Expense), (b) the debit and credit effects, and (c) the normal account balance.

(Essay)

4.9/5  (38)

(38)

Both services performed on account and services performed in exchange for Cash are recorded with a credit to Revenues.

(True/False)

4.9/5  (44)

(44)

In the first month of operations, the total of the debit entries to the cash account amounted to $1,400 and the total of the credit entries to the cash account amounted to $800. The cash account has a(n)

(Multiple Choice)

4.8/5  (31)

(31)

Ben's Discorama received $1,000 for services in designing a disc golf course. It is recorded with a

(Multiple Choice)

4.9/5  (41)

(41)

Under the double-entry system, revenues must always equal expenses.

(True/False)

4.8/5  (44)

(44)

Knowledge of the normal balances of accounts would help identify which of the following as an error in the recording process?

(Multiple Choice)

5.0/5  (38)

(38)

Agworth Company debited an asset account for $1,300 and credited a liability account for $600. Which of the following would be an incorrect way to complete the recording of the transaction?

(Multiple Choice)

4.7/5  (39)

(39)

Which of the following correctly identifies the normal balances of accounts?

(Multiple Choice)

4.9/5  (41)

(41)

Services performed on account requires a credit to Accounts Receivable.

(True/False)

4.8/5  (42)

(42)

On June 1, 2020, Barcelona Inc. reported a cash balance of $11,000. During June, Barcelona made deposits of $3,000 and made disbursements totalling $9,000. What is the cash balance at the end of June?

(Multiple Choice)

4.8/5  (25)

(25)

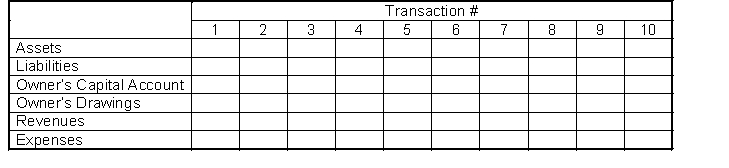

For each transaction given, enter in the tabulation given below a "D" for debit and a "C" for credit to reflect the increases and decreases of the assets, liabilities, and owner's equity accounts. In some cases there may Transactions:

1. Owner invests cash in the business.

2. Pays cash for equipment.

3. Pays administrative assistant's salary.

4. Purchases office supplies on account.

5. Pays electricity bill.

6. Borrows money from local bank.

7. Makes payment on account.

8. Receives cash due from customers.

9. Provides services on account.

10. Owner withdraws assets from the business.

(Essay)

4.7/5  (27)

(27)

Showing 21 - 40 of 222

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)