Exam 5: Elasticity and Its Application

Exam 1: Ten Principles of Economics51 Questions

Exam 2: Thinking Like an Economist9 Questions

Exam 3: Interdependence and the Gains From Trade159 Questions

Exam 4: The Market Forces of Supply and Demand94 Questions

Exam 5: Elasticity and Its Application55 Questions

Exam 6: Supply, Demand, and Government Policies35 Questions

Exam 7: Consumers, Producers, and the Efficiency of Markets35 Questions

Exam 8: Application: The Costs of Taxation35 Questions

Exam 9: Application: International Trade46 Questions

Exam 10: Measuring a Nations Income43 Questions

Exam 11: Measuring the Cost of Living45 Questions

Exam 12: Production and Growth37 Questions

Exam 13: Saving, Investment, and the Financial System53 Questions

Exam 14: The Basic Tools of Finance33 Questions

Exam 15: Unemployment and Its Natural Rate42 Questions

Exam 16: The Monetary System52 Questions

Exam 17: Money Growth and Inflation54 Questions

Exam 18: Open-Economy Macroeconomics: Basic Concepts81 Questions

Exam 19: A Macroeconomic Theory of the Open Economy81 Questions

Select questions type

In a small open economy, if exports equal $15 billion and imports equal $8 billion, then there is a trade and net capital outflow.

(Multiple Choice)

4.8/5  (32)

(32)

In the 2008 global financial crisis, many investors considered the U.S. economy a safe place to move their assets. What is the predicted impact of this inflow of financial capital to the United States, which is a large open economy, on the U.S. interest rate and the U.S. exchange rate, holding other factors constant? Illustrate your answer graphically and explain in words.

(Essay)

4.7/5  (31)

(31)

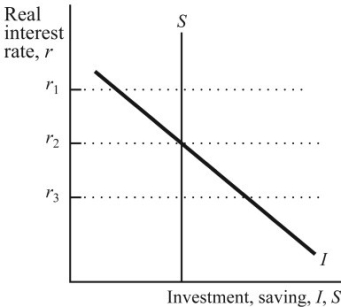

Exhibit: Saving and Investment in a Small Open Economy

Reference: Ref 5-1

(Exhibit: Saving and Investment in a Small Open Economy) In a small open economy, if the world interest rate is r ,

Then the economy has:

Reference: Ref 5-1

(Exhibit: Saving and Investment in a Small Open Economy) In a small open economy, if the world interest rate is r ,

Then the economy has:

(Multiple Choice)

4.9/5  (42)

(42)

If the government of a small open economy wishes to reduce a trade deficit, which policy action will be successful in achieving this goal?

(Multiple Choice)

4.8/5  (43)

(43)

A small open economy with perfect capital mobility is characterized by all of the following except that:

(Multiple Choice)

4.8/5  (29)

(29)

The adoption of an investment tax credit in a small open economy is likely to lead to:

(Multiple Choice)

4.8/5  (43)

(43)

Holding other factors constant, legislation to cut taxes in an open economy will:

(Multiple Choice)

4.9/5  (40)

(40)

In a small open economy, if domestic investment exceeds domestic saving, then the extra investment will be financed by:

(Multiple Choice)

4.8/5  (42)

(42)

Starting from a small open economy with balanced trade, if large foreign countries increase their domestic government purchases, this policy will tend to increase:

(Multiple Choice)

4.9/5  (40)

(40)

In a small open economy, if exports equal $20 billion, imports equal $30 billion, and domestic national saving equals

$25 billion, then net capital outflow equals:

(Multiple Choice)

4.8/5  (39)

(39)

Suppose that the International Monetary Fund (IMF) is concerned about currency depreciation in a small open economy.

a. What type of fiscal policy should the IMF propose to the government of the small open economy to generate a currency appreciation?

b. Illustrate graphically the impact of the IMF proposal on the exchange rate of the small open economy.

c. What will happen to the trade balance of the small open economy, assuming that it started from a position of balanced trade?

(Essay)

4.8/5  (38)

(38)

Assume that in a small open economy where full employment always prevails, national saving is 300.

a. If domestic investment is given by I = 400 - 20r, where r is the real interest rate in percent, what would the equilibrium interest rate be if the economy were closed?

b. If the economy is open and the world interest rate is 10 percent, what will investment be?

c. What will the current account surplus or deficit be? What will net capital outflow be?

(Essay)

4.7/5  (42)

(42)

If domestic saving is less than domestic investment, then net exports are and net capital outflows are

)

(Multiple Choice)

4.8/5  (37)

(37)

a. Suppose that governments around the world begin to engage in expansionary fiscal policy (run large budget deficits) in order to stimulate economic activity in their countries. Use the long-run model of a small open economy to illustrate graphically the impact of this expansionary fiscal policy by foreigners on the U.S. exchange rate and the trade balance. Assume that the country starts from a position of trade balance, i.e., exports equal imports. Be sure to label: i. the axes; ii. the curves; iii. the initial equilibrium values; iv. the direction the curves shift; and v. the new

long-run equilibrium values.

b. Based on your graphical analysis, explain the predicted impact of the foreign expansionary fiscal policy on the

U.S. exchange rate and the U.S. trade balance.

(Essay)

4.9/5  (42)

(42)

In a small open economy, if domestic saving equals $50 billion and domestic investment equals $50 billion, then

There is and net capital outflow equals .

(Multiple Choice)

4.9/5  (36)

(36)

Showing 21 - 40 of 55

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)