Exam 7: Fraud, Internal Control and Cash

Exam 1: Accounting in Action202 Questions

Exam 2: The Recording Process162 Questions

Exam 3: Adjusting the Accounts204 Questions

Exam 4: Completing the Accounting Cycle180 Questions

Exam 5: Accounting for Merchandising Operations202 Questions

Exam 6: Inventories176 Questions

Exam 7: Fraud, Internal Control and Cash166 Questions

Exam 8: Accounting for Receivables193 Questions

Exam 9: Plant Assets, Natural Resources and Intangible Assets236 Questions

Exam 10: Liabilities250 Questions

Exam 11: Corporations: Organisations, Stock Transactions and Stockholders Equity222 Questions

Exam 12: Statement of Cash Flows117 Questions

Exam 13: Financial Analysis: the Big Picture193 Questions

Exam 14: Time Value of Money52 Questions

Exam 15: Payroll Accounting27 Questions

Exam 16: Other Significant Liabilities21 Questions

Select questions type

All reconciling items in determining the adjusted cash balance per books require the depositor to make adjusting journal entries to the Cash account.

Free

(True/False)

4.9/5  (36)

(36)

Correct Answer:

True

Companies that are subject to, but fail to comply with, the Sarbanes-Oxley Act

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

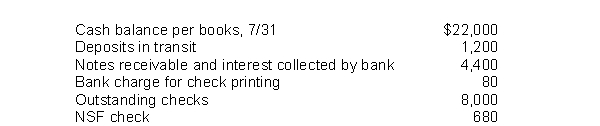

Electric Sunset Company gathered the following reconciling information in preparing its July bank reconciliation:  The adjusted cash balance per books on July 31 is

The adjusted cash balance per books on July 31 is

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

C

Controls that enhance the accuracy and reliability of the accounting records are

(Multiple Choice)

4.8/5  (35)

(35)

The custodian of the petty cash fund has the responsibility for recording a journal entry every time cash is used from the fund.

(True/False)

4.9/5  (43)

(43)

The cash account shows a balance of $90,000 before reconciliation.The bank statement does not include a deposit of $5,000 made on the last day of the month.The bank statement shows a collection by the bank of $2,400 and a customer's check for $640 was returned because it was NSF.A customer's check for $900 was recorded on the books as $1,080, and a check written for $138 was recorded as $192.The correct balance in the cash account was

(Multiple Choice)

4.8/5  (41)

(41)

Control over cash disbursements is generally more effective when

(Multiple Choice)

5.0/5  (33)

(33)

In the month of November, Kinsey Company Inc.wrote checks in the amount of $27,750. In December, checks in the amount of $37,974 were written.In November, $25,404 of

These checks were presented to the bank for payment, and $32,649 were presented in

December.What is the amount of outstanding checks at the end of December?

(Multiple Choice)

5.0/5  (38)

(38)

At April 30, Yaddof Company has the following bank information: cash balance per bank $2,300; outstanding checks $390; deposits in transit $275; credit memo for interest $50; bank service charge $10.What is Yaddof's adjusted cash balance on April 30?

(Multiple Choice)

4.8/5  (34)

(34)

Fitzgerald Company wrote checks totaling $34,160 during October and $37,300 during November.$32,480 of these checks cleared the bank in October, and $36,440 cleared the bank in November.What was the amount of outstanding checks on November 30?

(Multiple Choice)

4.8/5  (37)

(37)

Allowing only the treasurer to sign checks is an example of

(Multiple Choice)

4.8/5  (34)

(34)

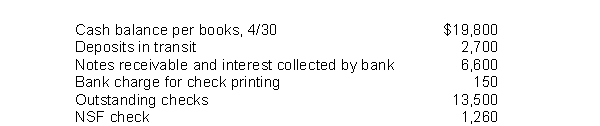

Shane Company gathered the following reconciling information in preparing its April bank reconciliation:  The adjusted cash balance per books on April 30 is

The adjusted cash balance per books on April 30 is

(Multiple Choice)

4.8/5  (30)

(30)

Carothers Company assembled the following information in completing its March bank reconciliation: balance per bank $7,640; outstanding checks $1,550; deposits in transit $2,500; NSF check $160; bank service charge $50; cash balance per books $8,800.As a result of this reconciliation, Carothers will

(Multiple Choice)

4.8/5  (32)

(32)

Which one of the following is not an objective of a system of internal control?

(Multiple Choice)

4.8/5  (40)

(40)

The duties of approving an item for payment and paying the item should be done by different departments or individuals.

(True/False)

4.9/5  (32)

(32)

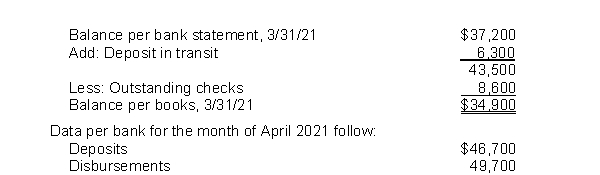

Trudy, Inc.had the following bank reconciliation at March 31, 2021:  All reconciling items at March 31, 2021 cleared the bank in April.Outstanding checks at April 30, 2021 totaled $6,000.There were no deposits in transit at April 30, 2021.What is the cash balance per books at April 30, 2021?

All reconciling items at March 31, 2021 cleared the bank in April.Outstanding checks at April 30, 2021 totaled $6,000.There were no deposits in transit at April 30, 2021.What is the cash balance per books at April 30, 2021?

(Multiple Choice)

4.9/5  (37)

(37)

For efficiency of operations and better control over cash, a company should maintain only one bank account.

(True/False)

4.9/5  (38)

(38)

Showing 1 - 20 of 166

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)