Exam 7: The Risk and Term Structure of Interest Rates

Exam 1: An Introduction to Money and the Financial System31 Questions

Exam 2: Money and the Payments System109 Questions

Exam 3: Financial Instruments, Financial Markets, and Financial Institutions119 Questions

Exam 4: Future Value, Present Value and Interest Rates118 Questions

Exam 5: Understanding Risk108 Questions

Exam 6: Bonds, Bond Prices, and the Determination of Interest Rates128 Questions

Exam 7: The Risk and Term Structure of Interest Rates130 Questions

Exam 8: Stocks, Stock Markets and Market Efficiency123 Questions

Exam 9: Derivatives: Futures, Options, and Swaps120 Questions

Exam 10: Foreign Exchange114 Questions

Exam 11: The Economics of Financial Intermediation113 Questions

Exam 12:Depository Institutions: Banks and Bank Management116 Questions

Exam 13:Financial Industry Structure125 Questions

Exam 14: Regulating the Financial System120 Questions

Exam 15: Central Banks in the World Today113 Questions

Exam 16: The Structure of Central Banks: The Federal Reserve and the European Central Bank116 Questions

Exam 17: The Central Bank Balance Sheet and the Money Supply Process108 Questions

Exam 18:Monetary Policy: Stabilizing the Domestic Economy103 Questions

Exam 19:Exchange Rate Policy and the Central Bank120 Questions

Exam 20:Money Growth, Money Demand and Modern Monetary Policy108 Questions

Exam 21:Output, Inflation, and Monetary Policy104 Questions

Exam 22:Understanding Business Cycle Fluctuations103 Questions

Exam 23: Modern Monetary Policy and the Challenges Facing Central Bankers98 Questions

Select questions type

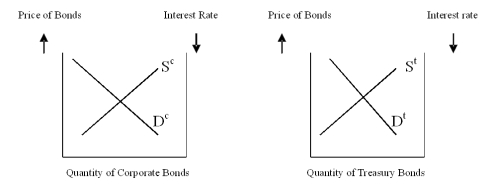

Please use the graphs to show what happens to the risk (yield) differential in each situation and why.

Assume the corporate and Treasury bonds have the same maturity;

a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?

b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?

c) If the corporate bonds are granted tax-exempt status, what happens in each market?

d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

Assume the corporate and Treasury bonds have the same maturity;

a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?

b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?

c) If the corporate bonds are granted tax-exempt status, what happens in each market?

d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

(Essay)

4.8/5  (40)

(40)

Suppose the tax rate is 25% and the taxable bond yield is 8%. What is the equivalent tax-exempt bond yield?

(Multiple Choice)

4.8/5  (40)

(40)

Assume an investor has a choice of 3 consecutive one-year bonds or one 3-year bond. Assuming the expectations hypothesis of the term structure of interest rates is correct the:

(Multiple Choice)

4.9/5  (36)

(36)

A company that continues to have strong profit performance during an economic downturn when many other companies are suffering losses or failing should see:

(Multiple Choice)

4.8/5  (43)

(43)

Assume the Expectation Hypothesis regarding the term structure of interest rates is correct. Then, if the current one-year interest rate is 4% and the two-year interest rate is 6%, then investors are expecting the future one-year rate to be:

(Multiple Choice)

4.9/5  (36)

(36)

The risk premium that investors associate with a bond increases with all of the following except:

(Multiple Choice)

4.9/5  (38)

(38)

Why might we expect to see a high correlation between increases in the risk structure of interest rates and the yield curve becoming inverted?

(Essay)

4.7/5  (47)

(47)

What impact should an economic slowdown have on the risk structure of interest rates?

(Essay)

4.8/5  (41)

(41)

As technology allows information regarding the financial health of corporations to become easier to obtain, we should expect:

(Multiple Choice)

5.0/5  (41)

(41)

Under the liquidity premium theory a flat yield curve implies:

(Multiple Choice)

4.8/5  (44)

(44)

An investor sees the current twelve-month rate at 4% and expects the following future twelve-month rate for each of the subsequent years; 4.5%, 5.5% and 6.0%. If this investor views a four-year maturity at 5.65% as equal to four consecutive one-year securities, what is his/her risk premium?

(Short Answer)

4.9/5  (36)

(36)

The addition of the liquidity premium theory to the expectations hypothesis allows us to explain why:

(Multiple Choice)

4.8/5  (42)

(42)

The presence of a term spread that is usually positive indicates that:

(Multiple Choice)

4.9/5  (38)

(38)

We have heard the predictions regarding the large number of people that will be retiring over the next 25-50 years and the strain this is going to place on the federal budget. Assuming that federal borrowing will have to increase, what is the likely impact going to be on the risk and term structure (if any) of interest rates and why?

(Essay)

4.8/5  (31)

(31)

The slope of the yield curve seems to predict the performance of the economy usually:

(Multiple Choice)

4.9/5  (42)

(42)

Showing 21 - 40 of 130

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)