Exam 9: Long-Lived Tangible and Intangible Assets

Exam 1: Business Decisions and Financial Accounting228 Questions

Exam 2: The Balance Sheet223 Questions

Exam 3: The Income Statement233 Questions

Exam 4: Adjustments,Financial Statements,and Financial Results252 Questions

Exam 5: Fraud,Internal Control,and Cash187 Questions

Exam 6: Merchandising Operations and the Multistep Income Statement209 Questions

Exam 7: Inventory and Cost of Goods Sold218 Questions

Exam 8: Receivables,Bad Debt Expense,and Interest Revenue240 Questions

Exam 9: Long-Lived Tangible and Intangible Assets299 Questions

Exam 10: Liabilities260 Questions

Exam 11: Stockholders Equity278 Questions

Exam 12: Statement of Cash Flows222 Questions

Exam 13: Measuring and Evaluating Financial Performance183 Questions

Select questions type

On January 1,2018,Orangewood Industries bought a new cash register for $7,500.Orangewood plans to use the cash register for 4 years and then sell it for $600.If Orangewood uses straight-line depreciation,depreciation expense for the year ended December 31,2018 equals:

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

A

The carrying value of a long-lived asset is referred to as its:

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

B

Company A uses an accelerated depreciation method while Company B uses the straight-line method for an asset of the same cost and useful life.Other things being equal,which of the following is correct?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

C

MacKenzie Manufacturing purchased equipment for $160,000.In addition,shipping charges of $2,000 were incurred to obtain the equipment.The company paid $12,500 to construct a foundation and install the equipment.The equipment is estimated to have a residual value of $15,000 at the end of its 5-year useful life. Using the straight-line method,what is the amount of depreciation expense each year?

(Multiple Choice)

4.9/5  (37)

(37)

Tidy Limited purchased a new van on January 1,2018.The van cost $20,000.It has an estimated life of five years and the estimated residual value is $5,000.Tidy uses the double-declining-balance method to compute depreciation. What is the depreciation expense for 2018?

(Multiple Choice)

4.9/5  (38)

(38)

If a company wants exclusive rights to artistic material,it should obtain:

(Multiple Choice)

4.8/5  (38)

(38)

If Company A has a contractual right to sell certain products or services,use certain trademarks,or perform activities in a certain geographical regions,then Company A has:

(Multiple Choice)

5.0/5  (42)

(42)

Match each term with the appropriate explanation.Not all explanations will be used.

-Carrying value

(Multiple Choice)

4.8/5  (41)

(41)

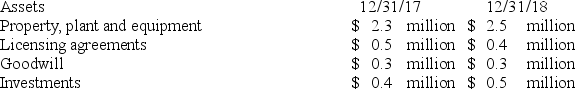

The company has net sales revenue of $3.6 million during 2018.The company's records also included the following information:  What is the company's fixed asset turnover ratio for 2018?

What is the company's fixed asset turnover ratio for 2018?

(Multiple Choice)

4.8/5  (31)

(31)

Sierra Nevada Corp.reported Sales Revenue of $500,000,000 and Sales Discounts of $4,000,000 for the year.The beginning balance of Net Plant and Equipment was $23,000,000,and the ending balance was $27,000,000.What is the fixed asset turnover ratio?

(Multiple Choice)

4.8/5  (35)

(35)

Match each term with the appropriate definition.Not all definitions will be used.

-Licensing right

(Multiple Choice)

4.8/5  (35)

(35)

Once the depreciation expense for a long-lived asset is calculated:

(Multiple Choice)

4.9/5  (41)

(41)

On December 31,2018,Far Niente Winery sold a wine press for $545,000;the wine press had originally cost $900,000.Cash was paid by the buyer of the press.Accumulated Depreciation on the press,updated to the date of disposal,was $450,000. What is the effect of the sale on the balance sheet and income statement of Far Niente reported as of and for the year ended December 31,2018?

(Multiple Choice)

4.8/5  (38)

(38)

Match each term with the appropriate definition.Not all definitions will be used.

-Fixed asset turnover ratio

(Multiple Choice)

4.9/5  (42)

(42)

Morris Lest,Inc.sold its truck and received less cash than the truck's book value.The net effect of this sale on the accounting equation is a(n):

(Multiple Choice)

4.9/5  (29)

(29)

Which of McGraw-Hill's intangible assets gives it the legal right to prevent you from borrowing a textbook from a friend and photocopying several chapters from the book?

(Multiple Choice)

4.8/5  (34)

(34)

What is the effect of an impairment loss on the accounting equation?

(Multiple Choice)

4.8/5  (46)

(46)

Showing 1 - 20 of 299

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)