Exam 8: Operating Activities

Exam 1: Overview of Financial Reporting, Financial Statement Analysis, and Valuation91 Questions

Exam 2: Asset and Liability Valuation and Income Recognition70 Questions

Exam 3: Income Flows Versus Cash Flows: Understanding the Statement of Cash Flows74 Questions

Exam 4: Profitability Analysis86 Questions

Exam 5: Risk Analysis69 Questions

Exam 6: Financing Activities70 Questions

Exam 7: Investing Activities60 Questions

Exam 8: Operating Activities92 Questions

Exam 9: Accounting Quality68 Questions

Exam 10: Forecasting Financial Statements51 Questions

Exam 11: Risk-Adjusted Expected Rates of Return and the Dividends Valuation Approach44 Questions

Exam 12: Valuation: Cash-Flow Based Approaches52 Questions

Exam 13: Valuation: Earnings-Based Approaches49 Questions

Exam 14: Valuation: Market-Based Approaches55 Questions

Select questions type

Using the information below, calculate the average total depreciable life of the assets:

Information from the Balance Sheet:

(Multiple Choice)

4.8/5  (47)

(47)

Under IFRS, when an asset is revalued upwards, subsequent depreciation is based on:

(Multiple Choice)

4.7/5  (40)

(40)

Olivia Co. owns 5,600 of the 14,000 outstanding shares of Hobbitt Corp. common stock and exercises significant influence over the company. During 2011, Hobbitt earns $90,000 and pays cash dividends of $25,000. If the beginning balance in the investment account was $190,000, the balance at December 31, 2011 should be:

(Multiple Choice)

4.9/5  (39)

(39)

The three types of costs incurred in coal production are acquisition costs (costs to acquire the coal rich lands plus the present value of future cash flows necessary to restore the sites minus the cost of the land), exploration costs (costs of mining), and development costs (pipes, roads, and so on, to extract and transport the coal to customers).

Required :

Should each of these costs be capitalized or expensed? Explain.

(Essay)

4.8/5  (39)

(39)

Olivia Co. owns 4,000 of the 10,000 outstanding shares of Hobbitt Corp. common stock and exercises significant influence over the company. During 2011, Hobbitt earns $80,000 and pays cash dividends of $30,000. For the year ended December 31, 2011, Olivia should report income related to the investment equal to:

(Multiple Choice)

4.8/5  (41)

(41)

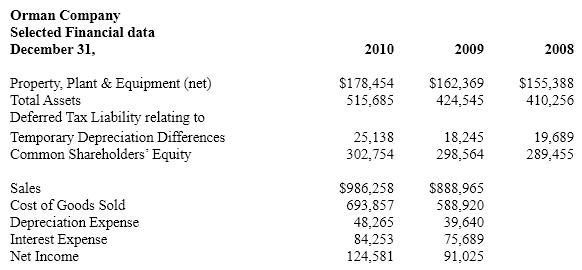

Orman Company is a large international canning company. Orman uses straight-line depreciation for financial reporting purposes and accelerated depreciation for tax reporting. The company's tax rate is 35%. Selected financial information about Orman appears below.

Required:

a. Compute the amount of depreciation expense that Orman recognized for income tax purposes for year 2010 and 2009. The amount reported as the deferred tax liability relating to temporary depreciation differences represents the cumulative income tax delayed as of each balance sheet date because Orman uses accelerated depreciation for tax purposes and straight-line depreciation for financial statement reporting.

b. Compute the fixed asset turnover ratio for years 2010 and 2009 using the amounts reported for financial statement purposes.

c. Compute the fixed asset turnover ratio for years 2010 and 2009 using the amounts reported for tax purposes.

Required:

a. Compute the amount of depreciation expense that Orman recognized for income tax purposes for year 2010 and 2009. The amount reported as the deferred tax liability relating to temporary depreciation differences represents the cumulative income tax delayed as of each balance sheet date because Orman uses accelerated depreciation for tax purposes and straight-line depreciation for financial statement reporting.

b. Compute the fixed asset turnover ratio for years 2010 and 2009 using the amounts reported for financial statement purposes.

c. Compute the fixed asset turnover ratio for years 2010 and 2009 using the amounts reported for tax purposes.

(Essay)

4.9/5  (40)

(40)

Most publicly traded firms in the United States use the _________________________ method of depreciation for ______________ statement purposes.

(Short Answer)

4.8/5  (36)

(36)

All of the following statements are true regarding accounting for software development costs except :

(Multiple Choice)

4.9/5  (30)

(30)

Interpretation No. 46R relates to the issue of whether an investing firm is the primary beneficiary in a variable-interest entity. When is an entity classified as a variable interest entity?

(Essay)

4.9/5  (39)

(39)

If Ashley Company accounts for the investment as a minority, active investment and uses the equity method to account for the investment, then the investment will appear in the December 31, 2010 balance sheet at what amount?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following items would be charged to the cost of the building?

(Multiple Choice)

4.8/5  (42)

(42)

Harbour Company purchased a new piece of equipment with a list price of $200,000 and subject to a 6 percent discount if paid within 45 days. Harbour paid within the discount period. The company also paid $1,650 to obtain title to the equipment and $650 as the license fee for the first year of operation. It paid $2,475 to level the area in which the equipment would be located and $11,750 to relocate other equipment that would have interfered with the proper operation of the new equipment. Harbour paid $500 for property and liability insurance for the first year of operation. What is the acquisition cost of this equipment that Harbour should record in its accounting records? Indicate the treatment of any amount not included in acquisition cost.

(Essay)

4.8/5  (30)

(30)

Showing 81 - 92 of 92

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)