Exam 16: The Management of Working Capital

Exam 1: Foundations127 Questions

Exam 2: Financial Background: a Review of Accounting Financial Statements and Taxes157 Questions

Exam 3: Cash Flows and Financial Analysis123 Questions

Exam 4: Financial Planning119 Questions

Exam 5: The Financial System Corporate Governance and Interest218 Questions

Exam 6: Time Value of Money251 Questions

Exam 7: The Valuation and Characteristics of Bonds and Leasing180 Questions

Exam 8: The Valuation and Characteristics of Stock189 Questions

Exam 9: Risk and Return195 Questions

Exam 10: Capital Budgeting166 Questions

Exam 11: Cash Flow Estimation205 Questions

Exam 12: Risk Topics and Real Options in Capital Budgeting118 Questions

Exam 13: Cost of Capital188 Questions

Exam 14: Capital Structure and Leverage198 Questions

Exam 15: Dividends and Repurchases178 Questions

Exam 16: The Management of Working Capital285 Questions

Exam 17: Corporate Restructuring186 Questions

Exam 18: International Finance171 Questions

Select questions type

Because of the short-term nature of working capital assets and liabilities, it is always necessary to support working capital with short-term borrowing. To do otherwise would violate the matching principle, which is of paramount importance in financial management.

(True/False)

4.8/5  (35)

(35)

Most spontaneous financing comes from trade payables created when vendors sell on credit allowing deferred payment.

(True/False)

4.9/5  (40)

(40)

Working capital represents assets that support day-to-day operating activities. Funding working capital requires:

(Multiple Choice)

4.8/5  (47)

(47)

The ____ says the term of financing should match the duration of the item or project supported.

(Multiple Choice)

4.8/5  (46)

(46)

Which is the most appropriate form of funding for temporary working capital?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following account changes would reduce a firm's net working capital if all other account balances are held constant?

(Multiple Choice)

4.7/5  (41)

(41)

If a company decides to factor its receivables without recourse, it will:

(Multiple Choice)

4.7/5  (45)

(45)

We say a working capital financing policy is conservative if short-term funding is used to support working capital.

(True/False)

4.7/5  (33)

(33)

Haverly, Inc. has borrowed $100,000. The loan is subject to a 10% compensating balance and has an effective interest rate of 13.33%. Calculate the quoted interest rate on the loan. (Round to nearest whole percent)

(Multiple Choice)

4.8/5  (44)

(44)

The ____ measures the promptness with which customers pay their credit obligations.

(Multiple Choice)

4.7/5  (42)

(42)

Float, or money tied up in the process of check clearing, consists of transit float arising from the administrative functions of the payee that delay the actual deposit of the check and processing float created in the Federal Reserve's check clearing system.

(True/False)

4.9/5  (43)

(43)

In most companies, the level of working capital needed to operate efficiently varies with sales.

(True/False)

4.8/5  (35)

(35)

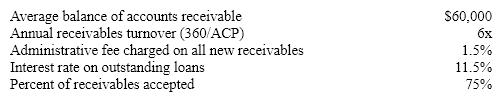

Assume the following facts about a firm that borrows by pledging its receivables:  What is the effective cost of financing stated as an annual rate?

What is the effective cost of financing stated as an annual rate?

(Multiple Choice)

4.9/5  (41)

(41)

Childers, Inc. operates primarily in the Southeast but has a number of customers in Phoenix who remit about 8,000 checks a year. The average check is $2,400. It currently takes the Phoenix checks an average of seven days after mailing to clear into Childers' account. A Phoenix bank has offered Childers a lock box system for $2,400 a year plus $.22 per check. This will reduce the clearing time for the checks to four days. How much will the lock box system save Childers if it borrows at 11%?

(Multiple Choice)

4.8/5  (34)

(34)

What is the effective interest rate on a 12% loan that requires a 10 percent minimum compensating balance?

(Multiple Choice)

4.9/5  (34)

(34)

Carrying excess cash is convenient but expensive because cash earns little or no return.

(True/False)

4.9/5  (37)

(37)

Which of the following is an incorrect statement of an issue involved in receivables management?

(Multiple Choice)

4.9/5  (39)

(39)

A firm's cash includes currency, coins, demand deposit accounts in banks, and may include marketable securities.

(True/False)

4.8/5  (37)

(37)

Showing 121 - 140 of 285

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)