Exam 10: Differential Analysis and Product Pricing

Exam 1: Introduction to Managerial Accounting191 Questions

Exam 2: Job Order Costing178 Questions

Exam 3: Process Cost Systems182 Questions

Exam 4: Activity Based Costing110 Questions

Exam 5: Cost Volume Profit Analysis210 Questions

Exam 6: Variable Costing for Management Analysis153 Questions

Exam 7: Budgeting182 Questions

Exam 8: Evaluating Variances From Standard Costs166 Questions

Exam 9: Evaluating Decentralized Operations204 Questions

Exam 10: Differential Analysis and Product Pricing165 Questions

Exam 11: Capital Investment Analysis177 Questions

Exam 12: Lean Manufacturing and Activity Analysis123 Questions

Exam 13: Statement of Cash Flows171 Questions

Exam 14: Financial Statement Analysis183 Questions

Select questions type

A cost that will not be affected by later decisions is termed a sunk cost.

(True/False)

4.9/5  (34)

(34)

In addition to the differential costs in an equipment-replacement decision, the remaining useful life of the old equipment and the estimated life of the new equipment are important considerations.

(True/False)

5.0/5  (46)

(46)

Jarrett Company is considering a cash outlay of $300,000 for the purchase of land, which it could lease out for $36,000 per year. If alternative investments are available that yield a 9% return, the opportunity cost of the purchase of the land is

(Multiple Choice)

4.8/5  (23)

(23)

In using the variable cost concept of applying the cost-plus approach to product pricing, fixed manufacturing costs and fixed selling and administrative expenses must be covered by the markup.

(True/False)

4.8/5  (36)

(36)

Sparrow Co. is currently operating at 80% of capacity and is currently purchasing a part used in its manufacturing operations for $8.00 a unit. The unit cost for Sparrow Co. to make the part is $9.00, which includes $0.60 of fixed costs. If 4,000 units of the part are normally purchased each year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease for making the part rather than purchasing it?

(Multiple Choice)

5.0/5  (49)

(49)

Since the costs of producing an intermediate product do not change regardless of whether the intermediate product is sold or processed further, these costs are not considered in deciding whether to further process a product.

(True/False)

4.8/5  (52)

(52)

Using the variable cost concept, determine the selling price for 30,000 units using the following data: variable cost per unit, $15.00; total fixed costs, $90,000; and desired profit, $150,000.

(Short Answer)

4.9/5  (36)

(36)

The Swan Company produces its product at a total cost of $43 per unit. Of this amount, $8 per unit is selling and administrative costs. The total variable cost is $30 per unit and the desired profit is $20 per unit.

Determine the markup percentage on product cost.

(Multiple Choice)

4.9/5  (35)

(35)

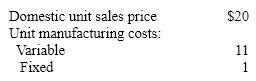

Stryker Industries received an offer from an exporter for 15,000 units of product at $17.50 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data is available:  What is the amount of income or loss from acceptance of the offer?

What is the amount of income or loss from acceptance of the offer?

(Multiple Choice)

4.9/5  (44)

(44)

Sensational Soft Drinks makes three products: iced tea, soda, and lemonade. The following data are available:

(a) Using a theory of constraints (TOC) approach, rank the products in terms of profitability.

(b) What price for lemonade would equate its profitability (contribution margin per bottleneck hour) to that of soda?

(a) Using a theory of constraints (TOC) approach, rank the products in terms of profitability.

(b) What price for lemonade would equate its profitability (contribution margin per bottleneck hour) to that of soda?

(Short Answer)

4.8/5  (30)

(30)

Widgeon Co. manufactures three products: Bales, Tales, and Wales. The selling prices are $55, $78, and $32, respectively. The variable costs for each product are $20, $50, and $15, respectively. Each product must go through the same processing in a machine that is limited to 2,000 hours per month. Bales take 5 hours to process; Tales, 7 hours; and Wales 1 hour.

What is the contribution margin per machine hour for Bales?

(Multiple Choice)

4.9/5  (41)

(41)

Diamond Boot Factory normally sells their specialty boots for $375 a pair. An offer to buy 100 boots for $275 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $250 and special stitching will add another $20 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organization.

(Short Answer)

4.9/5  (30)

(30)

Yasmin Co. can further process Product B to produce Product C. Product B is currently selling for $30 per pound and costs $28 per pound to produce. Product C would sell for $55 per pound and would require an additional cost of $31 per pound to produce. What is the differential cost of producing Product C?

(Multiple Choice)

4.8/5  (38)

(38)

Differential analysis can aid management in making decisions on a variety of alternatives, including whether to discontinue an unprofitable segment and whether to replace usable plant assets.

(True/False)

4.8/5  (43)

(43)

Manufacturers must conform to the Robinson-Patman Act, which prohibits price discrimination within the United States unless differences in prices can be justified by different costs of serving different customers.

(True/False)

4.9/5  (36)

(36)

Yakking Co. manufactures mobile cellular equipment and develops a price for the product by using the variable cost concept. Yakking incurs variable costs of $1,900,000 in the production of 100,000 units while fixed costs total $50,000. The company employs $4,725,000 of assets and wishes to earn a profit equal to a 10% rate of return on assets.

(a) Compute a markup percentage based on variable cost.

(b) Determine a selling price.

Round your markup percentage to one decimal place, and other intermediate calculations and final answer to two decimal places.

(Short Answer)

4.9/5  (34)

(34)

Crane Company Division B recorded sales of $360,000, variable cost of goods sold of $315,000, variable selling expenses of $13,000, and fixed costs of $61,000; creating a loss from operations of $29,000. Determine the differential income or loss from the sales of Division B. Should this division be discontinued?

(Short Answer)

4.9/5  (45)

(45)

Which of the following is not a cost concept commonly used in applying the cost-plus approach to product pricing?

(Multiple Choice)

5.0/5  (38)

(38)

Finch, Inc. has bought a new server and must decide what to do with the old one. The cost of the old server was originally $60,000 and has been depreciated $45,000. The company has received two offers. One offer was made to purchase the equipment outright for $18,500 less a 5% sales commission. The other offer was to lease the equipment for $7,000 for the next five years but the company will be required to provide maintenance and insurance totaling $3,000 per year. What offer should Finch, Inc. accept?

(Short Answer)

4.7/5  (39)

(39)

Showing 21 - 40 of 165

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)