Exam 7: Trade Policies for the Developing Nations

Exam 1: The International Economy and Globalization48 Questions

Exam 2: Foundations of Modern Trade Theory: Comparative Advantage170 Questions

Exam 3: Sources of Comparative Advantage109 Questions

Exam 4: Tariffs124 Questions

Exam 5: Nontariff Trade Barriers133 Questions

Exam 6: Trade Regulations and Industrial Policies129 Questions

Exam 7: Trade Policies for the Developing Nations100 Questions

Exam 8: Regional Trading Arrangements130 Questions

Exam 9: International Factor Movements and Multinational Enterprises96 Questions

Exam 10: The Balance of Payments99 Questions

Exam 11: Foreign Exchange121 Questions

Exam 12: Exchange-Rate Determination133 Questions

Exam 13: Mechanisms of International Adjustment107 Questions

Exam 14: Exchange-Rate Adjustments and the Balance of Payments100 Questions

Exam 15: Exchange-Rate Systems and Currency Crises107 Questions

Exam 16: Macroeconomic Policy in an Open Economy72 Questions

Exam 17: International Banking: Reserves, Debt, and Risk96 Questions

Select questions type

Stabilizing commodity prices around long-term trends tends to benefit at the expense of exporters in markets characterized by:

(Multiple Choice)

4.9/5  (31)

(31)

Export-led growth industrialization suffers a major problem: it depends on the willingness and ability of foreign nations to absorb the goods exported by the country pursuing such a policy.

(True/False)

4.8/5  (29)

(29)

To promote stability in commodity markets, International Commodity Agreements have utilized production and export controls, buffer stocks, and multilateral contracts.

(True/False)

4.9/5  (43)

(43)

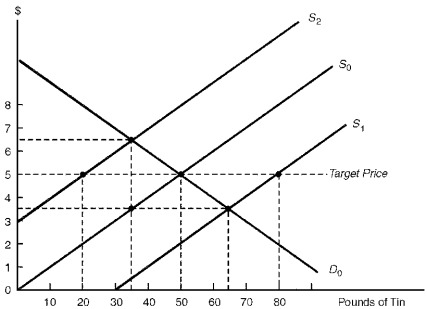

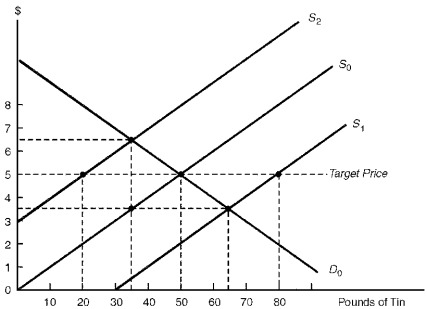

The diagram below illustrates the international tin market. Assume that the producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.2. Defending the Target Price in Face of Changing Supply Conditions

-Consider Figure 7.2. Suppose the supply of tin decreases from S0 to S2. Under a buffer stock system, the buffer-stock manager could maintain the target price by:

-Consider Figure 7.2. Suppose the supply of tin decreases from S0 to S2. Under a buffer stock system, the buffer-stock manager could maintain the target price by:

(Multiple Choice)

4.9/5  (37)

(37)

Under the Generalized System of Preferences program, the major industrial countries agree to temporarily reduce tariffs on designated imports from other industrial countries.

(True/False)

4.9/5  (37)

(37)

A widely used indicator to differentiate developed countries from developing countries is:

(Multiple Choice)

4.9/5  (30)

(30)

The diagram below illustrates the international tin market. Assume that the producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.2. Defending the Target Price in Face of Changing Supply Conditions

-Consider Figure 7.2. Suppose the supply of tin increases from S0 to S1. Under a buffer stock system, the buffer-stock manager could maintain the target price by:

-Consider Figure 7.2. Suppose the supply of tin increases from S0 to S1. Under a buffer stock system, the buffer-stock manager could maintain the target price by:

(Multiple Choice)

5.0/5  (38)

(38)

A reason why it is difficult for producers to maintain a cartel is that:

(Multiple Choice)

4.8/5  (35)

(35)

Prior to the formation of the Organization of Petroleum Exporting Countries, individual oil producing nations,

(Multiple Choice)

4.9/5  (44)

(44)

As a profit-maximizing cartel, the Organization of Petroleum Exporting Countries would produce a greater output and charge a lower price than what would occur in a competitive market.

(True/False)

4.8/5  (43)

(43)

The so-called Four Tigers include Australia, South Korea, Taiwan, and Hong Kong.

(True/False)

4.7/5  (37)

(37)

Which device has the International Tin Agreement utilized as a way of stabilizing tin prices?

(Multiple Choice)

4.8/5  (35)

(35)

The OPEC nations during the 1970s manifested their market power by utilizing:

(Multiple Choice)

4.9/5  (41)

(41)

To be considered a good candidate for an export cartel, a commodity should:

(Multiple Choice)

4.8/5  (35)

(35)

Which nation accounts for the largest amount of OPEC's oil reserves and production?

(Multiple Choice)

4.8/5  (39)

(39)

All of the following nations except ____ have recently utilized export-led (outward oriented) growth policies.

(Multiple Choice)

4.9/5  (27)

(27)

A multilateral contract stipulates the maximum price at which importing nations will purchase guaranteed quantities from producing nations and the minimum price at which producing nations will sell guaranteed amounts to importing nations.

(True/False)

4.9/5  (47)

(47)

The diagram below illustrates the international tin market. Assume that producing and consuming countries establish an international commodity agreement under which the target price of tin is $5 per pound.

Figure 7.1. Defending the Target Price in Face of Changing Demand Conditions

-Consider Figure 7.1. Suppose the demand for tin increases from D0 to D1. Under a buffer stock system, the buffer-stock manager could maintain the target price by:

-Consider Figure 7.1. Suppose the demand for tin increases from D0 to D1. Under a buffer stock system, the buffer-stock manager could maintain the target price by:

(Multiple Choice)

4.7/5  (38)

(38)

Which device has been used by the International Wheat Agreement to stipulate the minimum prices at which importers will buy stipulated quantities from producers and the maximum prices at which producers will sell stipulated quantities to importers?

(Multiple Choice)

4.8/5  (36)

(36)

Showing 61 - 80 of 100

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)