Exam 12: Exchange-Rate Determination

Exam 1: The International Economy and Globalization48 Questions

Exam 2: Foundations of Modern Trade Theory: Comparative Advantage170 Questions

Exam 3: Sources of Comparative Advantage109 Questions

Exam 4: Tariffs124 Questions

Exam 5: Nontariff Trade Barriers133 Questions

Exam 6: Trade Regulations and Industrial Policies129 Questions

Exam 7: Trade Policies for the Developing Nations100 Questions

Exam 8: Regional Trading Arrangements130 Questions

Exam 9: International Factor Movements and Multinational Enterprises96 Questions

Exam 10: The Balance of Payments99 Questions

Exam 11: Foreign Exchange121 Questions

Exam 12: Exchange-Rate Determination133 Questions

Exam 13: Mechanisms of International Adjustment107 Questions

Exam 14: Exchange-Rate Adjustments and the Balance of Payments100 Questions

Exam 15: Exchange-Rate Systems and Currency Crises107 Questions

Exam 16: Macroeconomic Policy in an Open Economy72 Questions

Exam 17: International Banking: Reserves, Debt, and Risk96 Questions

Select questions type

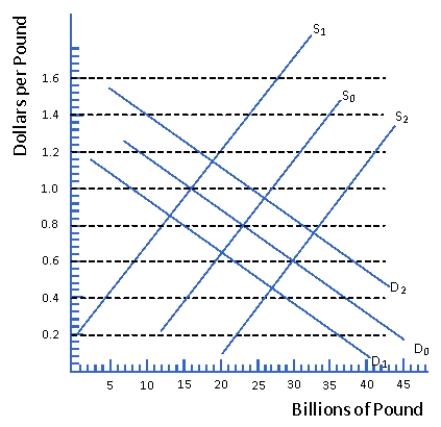

Figure 12.3 Market for British Pounds

-Consider Figure 12.3. The market is initially governed by demand curve D0 and supply curve S0. Suppose the domestic price level rises rapidly in the United States but stays relatively constant in the United Kingdom, which supply and demand curves depict the new situation?

-Consider Figure 12.3. The market is initially governed by demand curve D0 and supply curve S0. Suppose the domestic price level rises rapidly in the United States but stays relatively constant in the United Kingdom, which supply and demand curves depict the new situation?

(Multiple Choice)

4.8/5  (37)

(37)

What is the purchasing power parity approach to exchange rate determination?

(Essay)

4.8/5  (36)

(36)

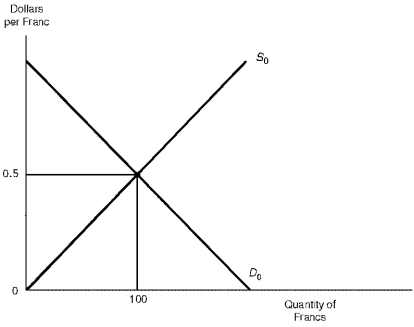

The figure below illustrates the supply and demand schedules of Swiss francs under a system of floating exchange rates.

Figure 12.2. The Market for Swiss Francs

-Refer to Figure 12.2. If Swiss manufacturing costs increase relative to those of the United States, there would occur an increase in the supply of francs and an appreciation in the dollar's exchange value.

-Refer to Figure 12.2. If Swiss manufacturing costs increase relative to those of the United States, there would occur an increase in the supply of francs and an appreciation in the dollar's exchange value.

(True/False)

4.9/5  (33)

(33)

Lower tariffs on U.S. agricultural imports cause the dollar to ____ in the ____.

(Multiple Choice)

4.8/5  (33)

(33)

When deciding between U.S. and British government securities, an American investor typically considers:

(Multiple Choice)

4.8/5  (30)

(30)

According to the "Big Mac" index, if a Big Mac costs $2.28 in the United States and 25.75 krone in Denmark (equivalent to $4.25), the Danish krone is an undervalued currency.

(True/False)

4.8/5  (37)

(37)

For an American investor, the expected rate of return on European securities depends on all of the following factors except the:

(Multiple Choice)

4.8/5  (38)

(38)

According to the asset-markets approach, adjustments among financial assets are a key determinant of long-run movements in exchange rates.

(True/False)

4.8/5  (34)

(34)

If real interest rates decline in the United States relative to real interest rates abroad, the dollar's exchange value will appreciate under a floating exchange-rate system.

(True/False)

4.9/5  (44)

(44)

Assume that interest rates in the United States and Britain are the same. If a U.S. resident anticipates that the exchange value of the dollar is going to appreciate against the pound, she should:

(Multiple Choice)

4.8/5  (25)

(25)

The high foreign exchange value of the U.S. dollar in the early 1980s can best be explained by:

(Multiple Choice)

4.7/5  (36)

(36)

In a free market, the equilibrium exchange rate occurs at the point where the quantity demanded of a foreign currency equals the quantity of that currency supplied.

(True/False)

4.9/5  (36)

(36)

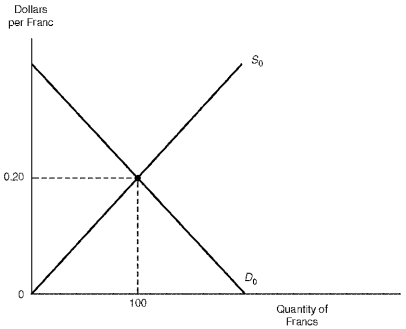

The figure below illustrates the supply and demand schedules of Swiss francs in a market of freely-floating exchange rates.

Figure 12.1 The Market for Francs

-Refer to Figure 12.1. Should Swiss labor productivity rise, leading to a decrease in Swiss manufacturing costs, there would occur a (an):

-Refer to Figure 12.1. Should Swiss labor productivity rise, leading to a decrease in Swiss manufacturing costs, there would occur a (an):

(Multiple Choice)

4.8/5  (40)

(40)

Assume that labor productivity growth is slower in the United States than in its trading partners. Given a system of floating exchange rates, the impact of this growth differential for the United States will be:

(Multiple Choice)

4.8/5  (33)

(33)

Assume that the United States faces an 8 percent inflation rate while no (zero) inflation exists in Japan. According to the purchasing-power parity theory, the dollar would be expected to:

(Multiple Choice)

5.0/5  (37)

(37)

In 1985 and 1986 U.S. interest rates fell relative to interest rates in Japan. Under floating exchange rates, this would lead to the dollar's exchange value depreciating against the yen.

(True/False)

4.7/5  (32)

(32)

Exchange-rate overshooting is based on the notion that the supply schedule of a currency is more elastic in the short run than in the long run.

(True/False)

4.7/5  (37)

(37)

According to the "Big Mac" index, if a Big Mac costs $2.28 in the United States and 48 baht in Thailand (equivalent to $1.91), the baht is an undervalued currency.

(True/False)

4.8/5  (35)

(35)

Changes in market expectations have their greatest impact on exchange-rate changes over the long run as opposed to the short run.

(True/False)

4.9/5  (45)

(45)

Given a system of floating exchange rates, U.S. preferences for imports would trigger:

(Multiple Choice)

4.8/5  (42)

(42)

Showing 81 - 100 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)