Exam 11: Overall audit plan and audit program

Exam 1: Demand for audit and assurance services74 Questions

Exam 2: Auditors’ legal environment89 Questions

Exam 3: Audit quality and ethics101 Questions

Exam 4: Audit responsibilities and objectives113 Questions

Exam 5: Audit evidence118 Questions

Exam 6: Audit planning and documentation105 Questions

Exam7: Materiality and risk105 Questions

Exam 8: Internal control and control risk119 Questions

Exam 9: Fraud auditing75 Questions

Exam 10: The impact of information technology on the audit process104 Questions

Exam 11: Overall audit plan and audit program105 Questions

Exam 12: Audit of the sales and collection cycle: Tests of controls and substantive tests of transactions120 Questions

Exam 13: Completing tests in the sales and collection cycle: Accounts receivable109 Questions

Exam 14: Audit sampling146 Questions

Exam 15: Audit of transaction cycles and financial statement balances I138 Questions

Exam 16: Audit of transaction cycles and financial statement balances II137 Questions

Exam 17: Completing the audit100 Questions

Exam 18: Audit reporting85 Questions

Exam 19: Other auditing and assurance engagements102 Questions

Select questions type

ASA 315 requires the auditor to assess the risk of material misstatement in the client's financial report.

(True/False)

4.8/5  (31)

(31)

Which of the following is NOT part of the methodology used in designing substantive tests of balances?

(Multiple Choice)

4.9/5  (30)

(30)

Which one of the following types of documentation is required for an audit in accordance with generally accepted auditing standards?

(Multiple Choice)

4.9/5  (41)

(41)

The actual operation of an internal control system may be most objectively evaluated by:

(Multiple Choice)

4.8/5  (33)

(33)

Which of the following tests determine whether accounting transactions have been properly authorised, correctly recorded and summarised in the journals, and correctly posted to subsidiary ledgers and the general ledgers?

(Multiple Choice)

4.8/5  (31)

(31)

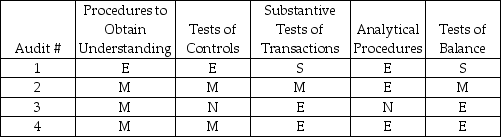

The evidence mix which the auditor chose in each of four different audits is shown below:

Amount of testing: E = extensive M = medium S = small N = none

In which audit did the client company have sophisticated internal controls and in which audit did the client have insufficient controls?

Amount of testing: E = extensive M = medium S = small N = none

In which audit did the client company have sophisticated internal controls and in which audit did the client have insufficient controls?

(Multiple Choice)

4.9/5  (41)

(41)

There are seven methods of obtaining audit evidence: physical examination, confirmation, documentation, observation, inquiries of the client, re-performance, and analytical procedures.For each of the following types of audit tests, indicate the type(s)of evidence-gathering procedures that can be used during the test: (1)tests of controls, (2)substantive tests of transactions, (3)analytical procedures and (4)tests of details of balances.

(Essay)

4.7/5  (31)

(31)

Why does an auditor evaluate the client's system of internal control?

(Multiple Choice)

4.8/5  (34)

(34)

The highest cost audit will be incurred when the auditor expected that the internal control system would:

(Multiple Choice)

4.9/5  (43)

(43)

List the nine balance-related audit objectives in the verification of the ending balance in accounts receivable and provide one specific useful audit procedure for each of the objectives.

(Essay)

4.8/5  (39)

(39)

Phase II of the audit primarily relies on which type(s)of audit evidence?

(Multiple Choice)

4.9/5  (39)

(39)

With respect to the auditor's planning of a year-end examination, which one of the following statements is ALWAYS true?

(Multiple Choice)

5.0/5  (43)

(43)

Substantive tests of transactions and tests of controls are often conducted simultaneously.

(True/False)

4.7/5  (33)

(33)

Substantive tests of balances are sometimes done before the year-end.This can only be done if:

(Multiple Choice)

4.9/5  (42)

(42)

Tests of controls and substantive tests of transactions are often conducted simultaneously on the same transactions.

(True/False)

4.8/5  (47)

(47)

Phase III of the audit primarily relies on which type(s)of audit evidence?

(Multiple Choice)

4.9/5  (41)

(41)

If tests of controls reveal that controls are sufficiently effective to justify reducing control risk, the auditor is justified in reducing substantive audit tests.

(True/False)

4.9/5  (37)

(37)

When are audit procedures regarding presentation and disclosure performed?

(Multiple Choice)

4.7/5  (36)

(36)

ASA 315 refers to the benefits and risks related to internal controls present in an IT system.What are the implications for the auditor in conducting tests of controls and substantive tests?

(Essay)

4.9/5  (38)

(38)

Showing 61 - 80 of 105

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)