Exam 13: Appendix: Managerial Analysis of Financial Statements

Exam 1: Managerial Accounting: Tools for Decision Making81 Questions

Exam 2: Cost Behavior, Activity Analysis, and Cost Estimation111 Questions

Exam 3: Cost-Volume-Profit Analysis and Planning111 Questions

Exam 4: Relevant Costs and Benefits for Decision Making60 Questions

Exam 5: Product Costing: Job and Process Operations106 Questions

Exam 6: Activity-Based Costing, Customer Profitability, and Activity-Based Management50 Questions

Exam 7: Additional Topics in Product Costing57 Questions

Exam 8: Pricing and Other Product Management Decisions71 Questions

Exam 9: Operational Budgeting and Profit Planning81 Questions

Exam 10: Standard Costs and Performance Reports85 Questions

Exam 11: Segment Reporting, Transfer Pricing, and Balanced Scorecard76 Questions

Exam 12: Capital Budgeting Decisions108 Questions

Exam 13: Appendix: Managerial Analysis of Financial Statements91 Questions

Select questions type

Alternative accounting procedures such as methods of depreciation and inventory cost flow methods affect both the income statement and the balance sheet.

(True/False)

4.8/5  (38)

(38)

-Which of the following would result from a vertical analysis of Robbins Corporation's income statement?

-Which of the following would result from a vertical analysis of Robbins Corporation's income statement?

(Multiple Choice)

4.7/5  (36)

(36)

Factors that influence the financial statements and evaluation methods include:

(Multiple Choice)

4.8/5  (30)

(30)

Ratios useful in assessing long term solvency are the current ratio, acid test ratio, inventory turnover, and days sales in receivables.

(True/False)

4.8/5  (38)

(38)

-Which of the following results would be found through a vertical analysis of the balance sheet or the income statement of Robbins Corporation?

-Which of the following results would be found through a vertical analysis of the balance sheet or the income statement of Robbins Corporation?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following is considered a solvency analysis measure?

(Multiple Choice)

4.9/5  (38)

(38)

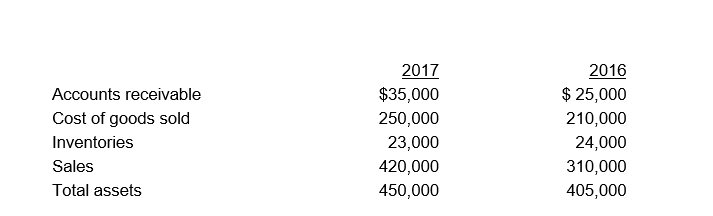

-In the judgment of the credit analysts of Joshua Company, what issue would be of most concern or source of optimism?

-In the judgment of the credit analysts of Joshua Company, what issue would be of most concern or source of optimism?

(Multiple Choice)

4.8/5  (28)

(28)

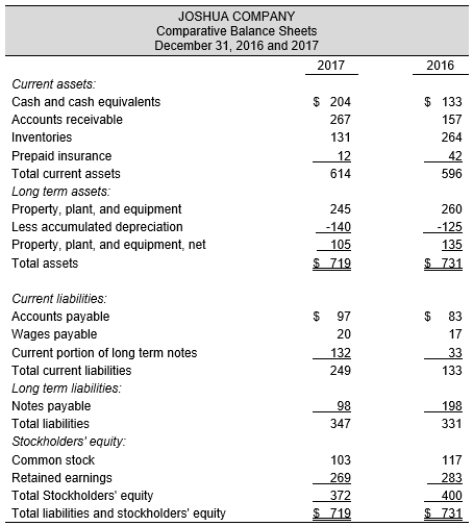

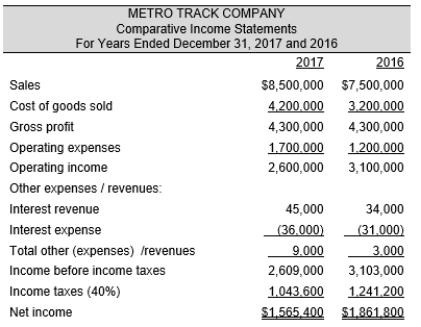

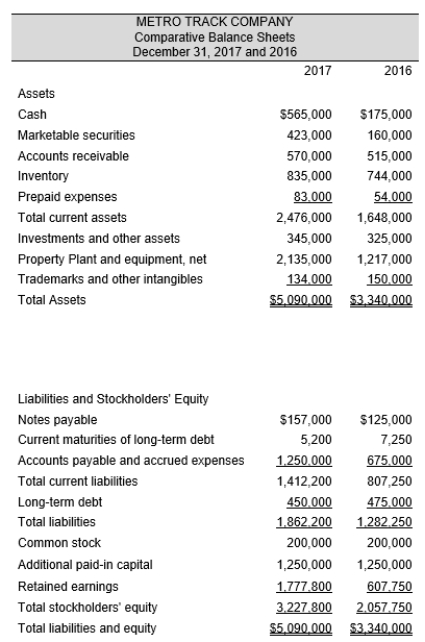

Comparative income statements and balance sheets for Metro Track Company follow for 2017 and 2016.

Required:

a. Prepare a comprehensive analysis of Metro Track for 2017 including the following measures (round all calculations to three decimal places.

1. Short-term solvency ratios (current ratio, acid test, inventory turnover, and days sales in receivables ratios)

2. Long-term solvency ratios (debt-to-equity and times-interest-earned ratios)

3. Performance measurement ratios (asset turnover, return on sales, return on assets, and return on equity ratios)

b. Comment on the financial condition of Metro Track with respect to short-term solvency, long-term solvency, and performance.

c. Using the data for Metro Track Company, prepare common size statements. For the balance sheets, use total assets as the base; for the income statements, make one set using sales of each year as the base and another set using the year 2016 as the base for both years.

d. Comment on the condition of Metro Track drawing on the common size statements.

Required:

a. Prepare a comprehensive analysis of Metro Track for 2017 including the following measures (round all calculations to three decimal places.

1. Short-term solvency ratios (current ratio, acid test, inventory turnover, and days sales in receivables ratios)

2. Long-term solvency ratios (debt-to-equity and times-interest-earned ratios)

3. Performance measurement ratios (asset turnover, return on sales, return on assets, and return on equity ratios)

b. Comment on the financial condition of Metro Track with respect to short-term solvency, long-term solvency, and performance.

c. Using the data for Metro Track Company, prepare common size statements. For the balance sheets, use total assets as the base; for the income statements, make one set using sales of each year as the base and another set using the year 2016 as the base for both years.

d. Comment on the condition of Metro Track drawing on the common size statements.

(Essay)

4.8/5  (35)

(35)

List and describe briefly the factors that influence analysis of a firm's financial statements.

(Essay)

5.0/5  (38)

(38)

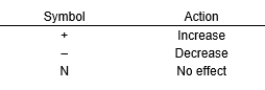

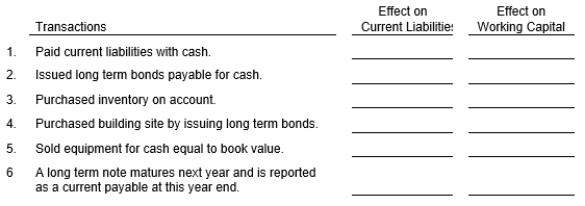

Show the effect of each of the transactions below on total liabilities and working capital by using one of the following symbols in each box to complete the table.

(Essay)

4.8/5  (39)

(39)

A solvency measure used also to assist in performance evaluation is:

(Multiple Choice)

4.8/5  (25)

(25)

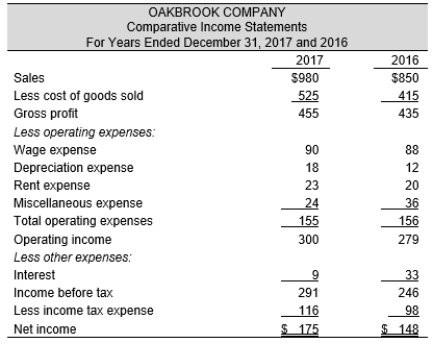

-In the judgment of the credit analysts of Oakbrook Company, what issue would be of most concern or source of optimism?

-In the judgment of the credit analysts of Oakbrook Company, what issue would be of most concern or source of optimism?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following is used to analyze a company's solvency?

(Multiple Choice)

4.7/5  (38)

(38)

In order to determine the meaning of common size percentages, some kind of comparison, such as an industry average, trend analysis, or a firm's own history, is helpful.

(True/False)

4.9/5  (39)

(39)

Showing 21 - 40 of 91

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)