Exam 7: Applications of Simple Interest

Exam 1: Review and Applications of Basic Mathematics205 Questions

Exam 2: Review and Applications of Algebra379 Questions

Exam 3: Ratios and Proportions148 Questions

Exam 4: Mathematics of Merchandising130 Questions

Exam 5: Applications of Linear Equations91 Questions

Exam 6: Simple Interest159 Questions

Exam 7: Applications of Simple Interest90 Questions

Exam 8: Compound Interest: Future Value and Present Value155 Questions

Exam 9: Compound Interest: Further Topics and Applications168 Questions

Exam 10: Ordinary Annuities: Future Value and Present Value137 Questions

Exam 11: Ordinary Annuities: Periodic Payment, Number of Payments, and Interest Rate107 Questions

Exam 12: Annuities Due277 Questions

Exam 13: Annuities: Special Situations20 Questions

Exam 14: Loan Amortization: Mortgages88 Questions

Exam 15: Bonds and Sinking Funds177 Questions

Exam 16: Business Investment Decisions129 Questions

Select questions type

a) What will be the maturity value of $15,000 placed in a 120-day term deposit paying an interest rate of 2.25%?

b) If on the maturity date the combined principal and interest are "rolled over" into a 90-day term deposit paying 2.15%, what amount will the depositor receive when the second term deposit matures?

Free

(Short Answer)

4.9/5  (31)

(31)

Correct Answer:

a) $15,110.96

b) $15,191.07

A chartered bank offers a rate of 5.50% on investments of $25,000 to $59,999 and a rate of 5.75% on investments of $60,000 to $99,999 in 90 to 365-day GICs. How much more will an investor earn from a single $80,000, 180-day GIC than from two $40,000, 180-day GICs?

Free

(Short Answer)

4.9/5  (38)

(38)

Correct Answer:

$98.63

A contract requires payments of $1500, $2000, and $1000 in 100, 150, and 200 days, respectively, from today. What is the value of the contract today if the payments are discounted to yield a 10.5% rate of return?

Free

(Short Answer)

4.7/5  (39)

(39)

Correct Answer:

$4320.92

Calculate the price on its issue date of $100,000 face value, 90-day commercial paper issued by G E Capital Canada if the prevailing market rate of return is 3.932%.

(Short Answer)

4.8/5  (33)

(33)

What will be the maturity value of $25,000 placed in a 90-day term deposit paying an interest rate of 4.75%?

(Multiple Choice)

4.9/5  (44)

(44)

Doina borrowed $7000 from her credit union on a demand loan on July 20 to purchase a motorcycle. The terms of the loan require fixed monthly payments of $1400 on the first day of each month, beginning September 1. The floating rate on the loan is prime plus 3%. The prime rate started at 5.75%, but rose 0.5% on August 19, and another 0.25% effective November 2. Prepare a loan repayment schedule presenting the amount of each payment and the allocation of each payment to interest and principal.

(Essay)

4.8/5  (43)

(43)

Ms. Wadeson obtained a $15,000 demand loan from the Canadian Imperial Bank of Commerce on May 23 to purchase a car. The interest rate on the loan was prime plus 2%. The loan required payments of $700 on the 15th of each month, beginning June 15. The prime rate was 7.5% at the outset, dropped to 7.25% on July 26, and then jumped by 0.5% on September 14. Prepare a loan repayment schedule showing the details of the first five payments.

(Essay)

4.9/5  (47)

(47)

Calculate the maturity value of a 300-day, $6,000 term deposit earning 5.15%.

(Multiple Choice)

4.9/5  (37)

(37)

Calculate the simple rate of return on a $1,000,000 181-day Treasury Bill that was issued for $970,639.

(Multiple Choice)

4.8/5  (44)

(44)

Calculate the maturity value of a 120-day, $1000 face value note dated November 30, 2011, and earning interest at 10.75%.

(Short Answer)

4.9/5  (37)

(37)

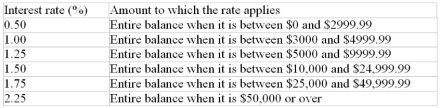

The Super Savings account offered by a trust company calculates interest daily based on the lesser of each day's opening or closing balance as follows:  September's opening balance was $8572. The transactions in the account for the month were a $9500 deposit on September 6, a deposit of $8600 on September 14, and a withdrawal of $25,000 on September 23. What interest will be credited to the account at the end of September?

September's opening balance was $8572. The transactions in the account for the month were a $9500 deposit on September 6, a deposit of $8600 on September 14, and a withdrawal of $25,000 on September 23. What interest will be credited to the account at the end of September?

(Short Answer)

4.7/5  (36)

(36)

A $100,000, 182-day Province of New Brunswick Treasury bill was issued 66 days ago. What will it sell at today to yield the purchaser 4.48%?

(Short Answer)

4.7/5  (38)

(38)

Monica finished her program at New Brunswick Community College on June 3 with Canada Student Loans totalling $6800. She decided to capitalize the interest that accrued (at prime plus 2.5%) during the grace period. In addition to regular end-of-month payments of $200, she made an extra $500 lump payment on March 25 that was applied entirely to principal. The prime rate dropped from 6% to 5.75% effective September 22, and declined another 0.5% effective March 2. Calculate the balance owed on the floating rate option after the regular March 31 payment. The relevant February had 28 days.

(Short Answer)

4.8/5  (31)

(31)

A 168-day, $100,000 T-bill was initially issued at a price that would yield the buyer 5.19%. If the yield required by the market remains at 5.19%, how many days before its maturity date will the T-bill's market price first exceed $99,000?

(Short Answer)

4.8/5  (37)

(37)

The payee on a 3-month $2700 note earning interest at 8% wishes to sell the note to raise some cash. What price should she be prepared to accept for the note (dated May 19) on June 5 in order to yield the purchaser an 11% rate of return?

(Short Answer)

4.7/5  (35)

(35)

Determine the legal due date for:

a) A 4-month note dated April 30, 2010.

b) A 120-day note issued April 30, 2010.

(Short Answer)

4.8/5  (31)

(31)

A money market mutual fund purchased $1 million face value of Honda Canada Finance Inc. 90-day commercial paper 28 days after its issue. What price was paid if the paper was discounted at 4.10%?

(Short Answer)

4.8/5  (40)

(40)

Showing 1 - 20 of 90

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)