Exam 12: Financial Statement Analysis and Decision Making

Exam 1: An Introduction to Accounting91 Questions

Exam 2: The Recording Process98 Questions

Exam 3: Accrual Accounting Concepts81 Questions

Exam 4: Inventories35 Questions

Exam 5: Reporting and Analysing Inventory45 Questions

Exam 6: Accounting Information Systems142 Questions

Exam 7: Reporting and Analysing Cash and Receivables61 Questions

Exam 8: Reporting and Analysing Non-Current Assets131 Questions

Exam 9: Reporting and Analysing Liabilities81 Questions

Exam 10: Reporting and Analysing Equity75 Questions

Exam 11: Statement of Cash Flows47 Questions

Exam 12: Financial Statement Analysis and Decision Making32 Questions

Exam 13: Analysing and Integrating Gaap66 Questions

Exam 14: Technology Concepts43 Questions

Exam 15: Introduction to Management Accounting80 Questions

Exam 16: Cost Accounting Systems52 Questions

Exam 17: Costvolumeprofit Relationships51 Questions

Exam 18: Budgeting57 Questions

Select questions type

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Debt to total assets ratio

(Multiple Choice)

4.9/5  (28)

(28)

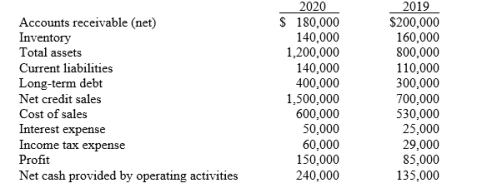

Selected information from the comparative financial statements of Dryman Ltd for the year ended 31 December appears below:

Required: Answer the following questions relating to the year ended 31 December 2020. Show computations.

1. Inventory turnover for 2020 is __________.

2. The number of times interest earned ratio in 2020 is __________.

3. The debt to total assets ratio for 2020 is __________.

4. Receivables turnover for 2020 is __________.

5. Return on assets for 2020 is __________.

6. The cash return on sales ratio for 2020 is __________.

7. Current cash debt coverage for 2020 is __________.

Required: Answer the following questions relating to the year ended 31 December 2020. Show computations.

1. Inventory turnover for 2020 is __________.

2. The number of times interest earned ratio in 2020 is __________.

3. The debt to total assets ratio for 2020 is __________.

4. Receivables turnover for 2020 is __________.

5. Return on assets for 2020 is __________.

6. The cash return on sales ratio for 2020 is __________.

7. Current cash debt coverage for 2020 is __________.

(Short Answer)

4.8/5  (36)

(36)

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Acid-test ratio (Quick ratio)

(Multiple Choice)

4.8/5  (34)

(34)

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Inventory turnover

(Multiple Choice)

4.9/5  (33)

(33)

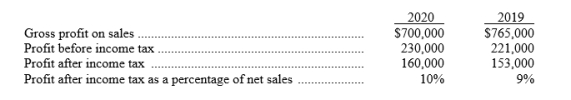

The following information was taken from the financial statements of Genesis Ltd:

Required:

(a) Compute the net sales for each year.

(b) Compute the cost of sales in dollars and as a percentage of net sales for each year.

(c) Compute operating expenses in dollars and as a percentage of net sales for each year. (Income taxes are not operating expenses).

Required:

(a) Compute the net sales for each year.

(b) Compute the cost of sales in dollars and as a percentage of net sales for each year.

(c) Compute operating expenses in dollars and as a percentage of net sales for each year. (Income taxes are not operating expenses).

(Short Answer)

4.8/5  (31)

(31)

Communication: Fast Express specialises in the transportation of medical equipment and laboratory specimens overnight. The company has selected the following information from its most recent annual report to be the subject of an immediate press release.

• The financial statements are being released.

• Profit this year was $2.1 million. Last year's profit had been $1.8 million.

• The current ratio has changed to 2:1 from last year's 1.5:1.

• The debt/total assets ratio has changed to 4:5 from last year's 3:5.

• The company expanded its truck fleet substantially by purchasing ten new delivery vans.

• The company already had twelve delivery vans. The company is now the largest medical courier on the Eastern seaboard.

Required: Prepare a brief press release incorporating the information above. Include all information. Think carefully which information (if any) is good news for the company, and which (if any) is bad news.

(Essay)

4.9/5  (41)

(41)

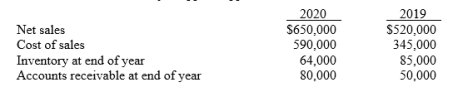

Selected data for Marcy's Apparel appear below.

Compute the following for 2020:

(a) Gross profit percentage

(b) Inventory turnover

(c) Receivables turnover

Compute the following for 2020:

(a) Gross profit percentage

(b) Inventory turnover

(c) Receivables turnover

(Short Answer)

4.8/5  (28)

(28)

In a traditional set of financial statements, the values of items found in a statement of financial position will be:

(Multiple Choice)

4.7/5  (37)

(37)

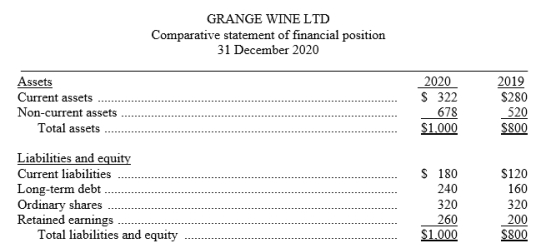

The comparative statement of financial position of Grange Wine Ltd appears below:

Instructions:

(a) Using horizontal analysis, show the percentage change for each statement of financial position item using 2019 as a base year.

(b) Using vertical analysis, prepare a common-size comparative statement of financial position.

Instructions:

(a) Using horizontal analysis, show the percentage change for each statement of financial position item using 2019 as a base year.

(b) Using vertical analysis, prepare a common-size comparative statement of financial position.

(Short Answer)

4.7/5  (31)

(31)

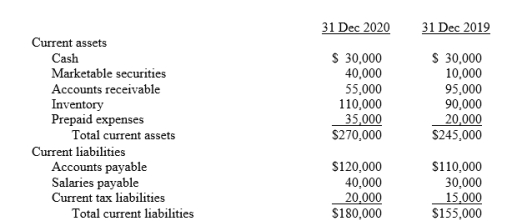

Birch Ltd had the following comparative current assets and current liabilities:

During 2020, credit sales and cost of sales were $450,000 and $250,000, respectively. Net cash provided by operating activities for 2020 was $134,000.

Compute the following liquidity measures for 2020:

1. Current ratio

2. Quick ratio

3. Current cash debt coverage

4. Receivables turnover

5. Inventory turnover

During 2020, credit sales and cost of sales were $450,000 and $250,000, respectively. Net cash provided by operating activities for 2020 was $134,000.

Compute the following liquidity measures for 2020:

1. Current ratio

2. Quick ratio

3. Current cash debt coverage

4. Receivables turnover

5. Inventory turnover

(Short Answer)

4.7/5  (33)

(33)

Showing 21 - 32 of 32

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)