Exam 22: Appendix E: Accounting for Natural Resources

Exam 1: Financial Accounting and Accounting Standards20 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting35 Questions

Exam 3: The Accounting Information System34 Questions

Exam 4: Balance Sheet32 Questions

Exam 5: Income Statement and Related Information50 Questions

Exam 6: Statement of Cash Flows49 Questions

Exam 7: Revenue Recognition52 Questions

Exam 8: Cash and Receivables58 Questions

Exam 9: Accounting for Inventories51 Questions

Exam 10: Accounting for Property, Plant, and Equipment64 Questions

Exam 11: Intangible Assets48 Questions

Exam 12: Accounting for Liabilities63 Questions

Exam 13: Stockholders Equity74 Questions

Exam 14: Investments48 Questions

Exam 15: Accounting for Income Taxes69 Questions

Exam 16: Accounting for Compensation42 Questions

Exam 17: Accounting for Leases59 Questions

Exam 18: Additional Reporting Issues70 Questions

Exam 19: Appendix A: Accounting and the Time Value of Money31 Questions

Exam 20: Appendix B: Reporting Cash Flows18 Questions

Exam 21: Appendix D: Retail Inventory Method6 Questions

Exam 22: Appendix E: Accounting for Natural Resources6 Questions

Exam 23: Appendix G: Accounting for Troubled Debt3 Questions

Exam 24: Appendix H: Accounting for Derivative Instruments1 Questions

Exam 25: Appendix I: Error Analysis6 Questions

Select questions type

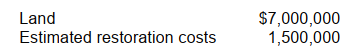

Lane Company acquired a tract of land containing an extractable natural resource. Lane is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 5,000,000 tons, and that the land will have a value of $1,000,000 after restoration. Relevant cost information follows:

If Lane maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

If Lane maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

Free

(Multiple Choice)

4.7/5  (32)

(32)

Correct Answer:

B

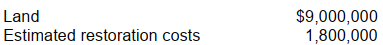

Seymor Resources Company acquired a tract of land containing an extractable natural resource. Seymor is required by its purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource. Geological surveys estimate that the recoverable reserves will be 2,000,000 tons, and that the land will have a value of $1,200,000 after restoration. Relevant cost information follows:

If Seymor maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

If Seymor maintains no inventories of extracted material, what should be the charge to depletion expense per ton of extracted material?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

C

During 2008, Bolton Corporation acquired a mineral mine for $1,500,000 of which $200,000 was ascribed to land value after the mineral has been removed. Geological surveys have indicated that 10 million units of the mineral could be extracted. During 2008, 1,500,000 units were extracted and 1,200,000 units were sold. What is the amount of depletion expensed for 2008?

Free

(Multiple Choice)

4.9/5  (44)

(44)

Correct Answer:

B

In January 2008, Jenks Mining Corporation purchased a mineral mine for $4,200,000 with removable ore estimated by geological surveys at 2,500,000 tons. The property has an estimated value of $400,000 after the ore has been extracted. Jenks incurred $1,150,000 of development costs preparing the property for the extraction of ore. During 2008, 340,000 tons were removed and 300,000 tons were sold. For the year ended December 31, 2008, Jenks should include what amount of depletion in its cost of goods sold?

(Multiple Choice)

4.9/5  (35)

(35)

In March, 2008, Sauder Mines Co. purchased a coal mine for $6,000,000. Removable coal is estimated at 1,500,000 tons. Sauder is required to restore the land at an estimated cost of $720,000, and the land should have a value of $630,000. The company incurred $1,500,000 of development costs preparing the mine for production. During 2008, 450,000 tons were removed and 300,000 tons were sold. The total amount of depletion that Sauder should record for 2008 is

(Multiple Choice)

4.9/5  (40)

(40)

In January, 2008, Pratt Corporation purchased a mineral mine for $3,400,000 with removable ore estimated by geological surveys at 2,000,000 tons. The property has an estimated value of $200,000 after the ore has been extracted. The company incurred $1,000,000 of development costs preparing the mine for production. During 2008, 500,000 tons were removed and 400,000 tons were sold. What is the amount of depletion that Pratt should expense for 2008?

(Multiple Choice)

4.9/5  (36)

(36)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)