Exam 4: The Accounting Cycle: Accruals and Deferrals

Exam 1: Accounting: Information for Decision Making23 Questions

Exam 2: Basic Financial Statements12 Questions

Exam 3: The Accounting Cycle: Capturing Economic Events11 Questions

Exam 4: The Accounting Cycle: Accruals and Deferrals16 Questions

Exam 5: The Accounting Cycle: Reporting Financial Results8 Questions

Exam 6: Merchandising Activities13 Questions

Exam 7: Financial Assets17 Questions

Exam 8: Inventories and the Cost of Goods Sold12 Questions

Exam 9: Plant and Intangible Assets11 Questions

Exam 10: Liabilities20 Questions

Exam 11: Stockholders Equity: Paid-In Capital16 Questions

Exam 12: Income and Changes in Retained Earnings16 Questions

Exam 13: Statement of Cash Flows11 Questions

Exam 14: Financial Statement Analysis12 Questions

Exam 15: Global Business and Accounting7 Questions

Exam 16: Management Accounting: A Business Partner11 Questions

Exam 17: Job Order Cost Systems and Overhead Allocations8 Questions

Exam 18: Process Costing14 Questions

Exam 19: Costing and the Value Chain16 Questions

Exam 20: Cost-Volume-Profit Analysis20 Questions

Exam 21: Incremental Analysis16 Questions

Exam 22: Responsibility Accounting and Transfer Pricing11 Questions

Exam 23: Operational Budgeting17 Questions

Exam 24: Standard Cost Systems14 Questions

Exam 25: Rewarding Business Performance3 Questions

Exam 26: Capital Budgeting16 Questions

Select questions type

Of the following adjusting entries, which one results in an increase in liabilities and the recognition of an expense at the end of an accounting period?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

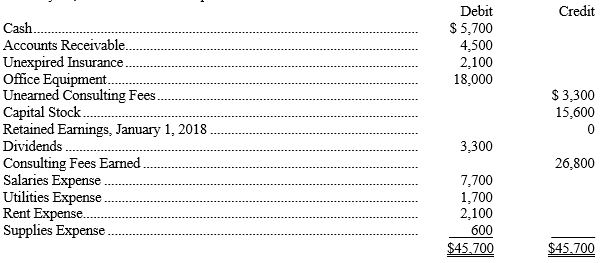

The accountant for Rose's Emporium, Inc. prepared the following trial balance at January 31, of the current year, after one month of operations:

Additional information items:

a) Consulting services rendered to a client in January, not yet billed or recorded, $2,400.

b) Portion of insurance expiring in January, $300.

c) Income taxes expense for January of $2,500.

d) The office equipment has a life of 5 years.

Instructions. Prepare adjusting entries for a through d.

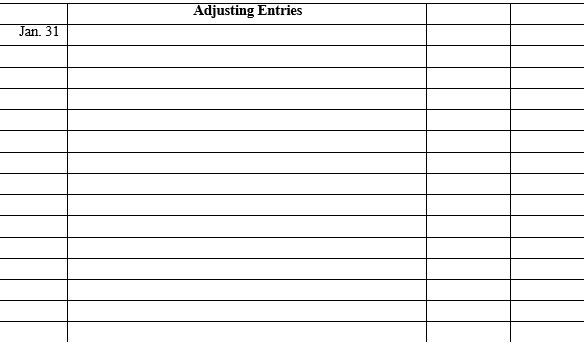

Additional information items:

a) Consulting services rendered to a client in January, not yet billed or recorded, $2,400.

b) Portion of insurance expiring in January, $300.

c) Income taxes expense for January of $2,500.

d) The office equipment has a life of 5 years.

Instructions. Prepare adjusting entries for a through d.

Free

(Essay)

4.8/5  (31)

(31)

Correct Answer:

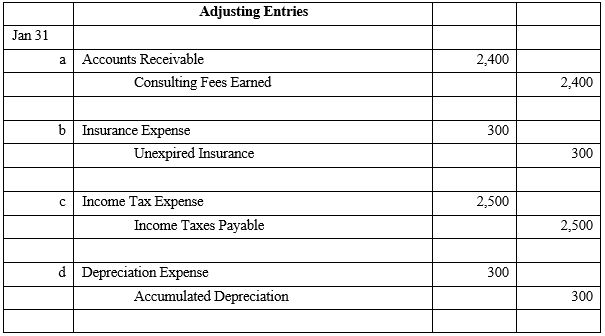

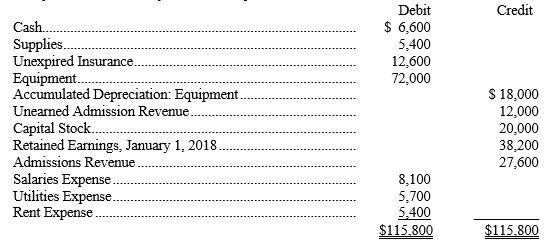

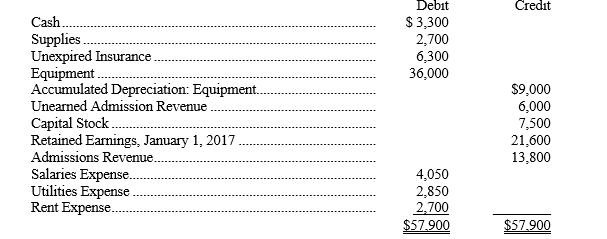

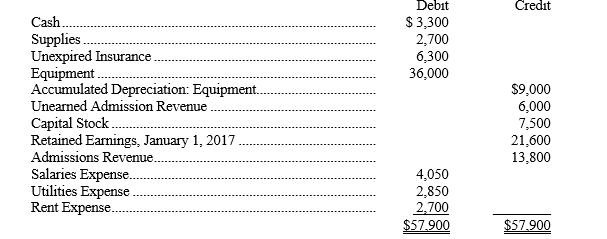

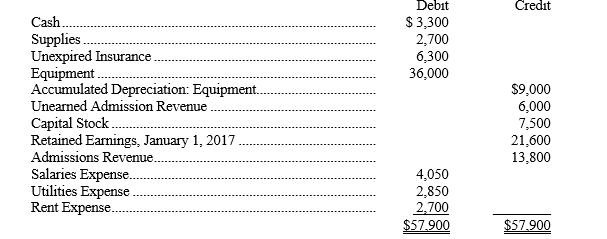

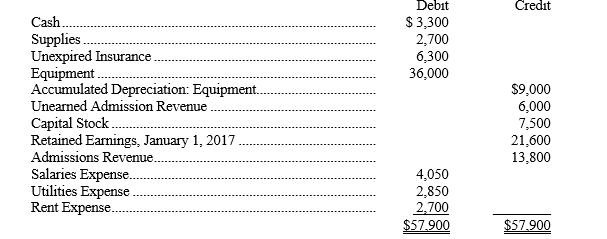

Scorpio Travel adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. According to attendance records, $4,800 of the Unearned Admission Revenue has been earned in January. Compute the balance in the following accounts after the proper adjustment is made.

Unearned Admission Revenue account balance $__________

Admission Revenue account balance $__________

-Refer to the above data. According to attendance records, $4,800 of the Unearned Admission Revenue has been earned in January. Compute the balance in the following accounts after the proper adjustment is made.

Unearned Admission Revenue account balance $__________

Admission Revenue account balance $__________

Free

(Essay)

4.9/5  (37)

(37)

Correct Answer:

Unearned Admission Revenue: $6,000 - $4,800 = $1,200 credit

Admission Revenue: $13,800 + $4,800 = $18,600 credit

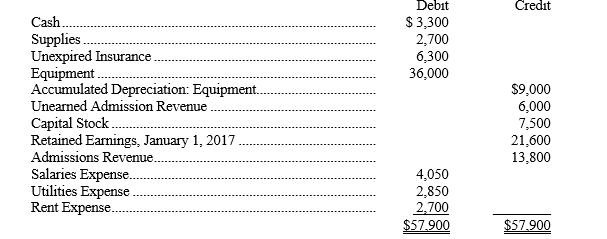

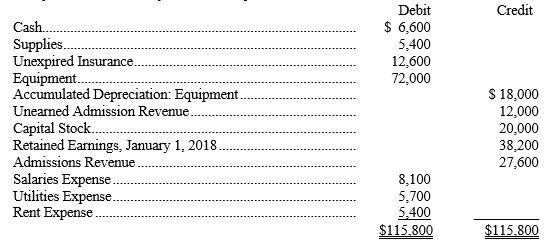

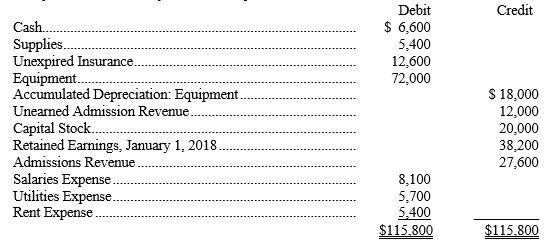

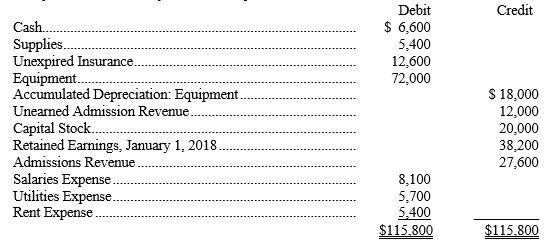

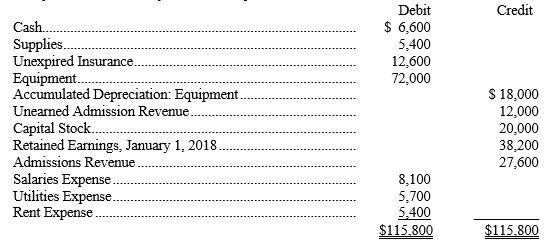

Manhattan Park adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. On August 1, of the previous year, the park purchased a 12-month insurance policy. The necessary adjusting entry at January 31 of the current year, includes which of the following entries? (Hint: The company has adjusted its books on a monthly basis.)

-Refer to the above data. On August 1, of the previous year, the park purchased a 12-month insurance policy. The necessary adjusting entry at January 31 of the current year, includes which of the following entries? (Hint: The company has adjusted its books on a monthly basis.)

(Multiple Choice)

4.7/5  (38)

(38)

The CPA firm auditing Indian Company found that net income had been overstated. Which of the following errors could be the cause?

(Multiple Choice)

4.9/5  (42)

(42)

The adjusting entry to recognize an unrecorded expense is necessary:

(Multiple Choice)

4.9/5  (47)

(47)

Manhattan Park adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. At January 31, the amount of supplies on hand is $2,300. What amount is shown on the January income statement for supplies expense?

-Refer to the above data. At January 31, the amount of supplies on hand is $2,300. What amount is shown on the January income statement for supplies expense?

(Multiple Choice)

4.9/5  (34)

(34)

Scorpio Travel adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. The equipment has an original useful life of eight years. Compute the book value of the equipment at January 31 after the proper January adjustment is recorded. $__________

-Refer to the above data. The equipment has an original useful life of eight years. Compute the book value of the equipment at January 31 after the proper January adjustment is recorded. $__________

(Essay)

4.9/5  (35)

(35)

Manhattan Park adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. According to attendance records, $8,200 of the Unearned Admission Revenue has been earned in January. Compute the amount of admissions revenue to be shown in the January income statement:

-Refer to the above data. According to attendance records, $8,200 of the Unearned Admission Revenue has been earned in January. Compute the amount of admissions revenue to be shown in the January income statement:

(Multiple Choice)

4.9/5  (30)

(30)

Scorpio Travel adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. $900 is owed to employees for work since the last payday in January, to be paid the first week of February. What is the effect on January net income if the accountant fails to make any January 31 adjustment for this item? $__________

-Refer to the above data. $900 is owed to employees for work since the last payday in January, to be paid the first week of February. What is the effect on January net income if the accountant fails to make any January 31 adjustment for this item? $__________

(Short Answer)

4.9/5  (31)

(31)

Scorpio Travel adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. On June 1, of the previous year, the park purchased a 12-month insurance policy. Give the adjusting entry to record insurance coverage expiring in January of the current year. (Hint: The company adjusts its books on a monthly basis.)

-Refer to the above data. On June 1, of the previous year, the park purchased a 12-month insurance policy. Give the adjusting entry to record insurance coverage expiring in January of the current year. (Hint: The company adjusts its books on a monthly basis.)

(Essay)

5.0/5  (30)

(30)

Manhattan Park adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. The equipment has an original estimated useful life of six years. Compute the book value of the equipment at January 31 after the proper January adjustment is recorded:

-Refer to the above data. The equipment has an original estimated useful life of six years. Compute the book value of the equipment at January 31 after the proper January adjustment is recorded:

(Multiple Choice)

4.8/5  (38)

(38)

Before any month-end adjustments are made, the net income of Lawrence Company is $550,000. However, the following adjustments are necessary: office supplies used, $35,000; services performed for clients but not yet recorded or collected, $12,300; interest accrued on note payable to bank, $14,100. After adjusting entries are made for the items listed above, Lawrence Company's net income would be:

(Multiple Choice)

4.9/5  (37)

(37)

Manhattan Park adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. Employees are owed $1,200 for services since the last payday in January to be paid the first week of February. No adjustment was made for this item. As a result of this error:

-Refer to the above data. Employees are owed $1,200 for services since the last payday in January to be paid the first week of February. No adjustment was made for this item. As a result of this error:

(Multiple Choice)

4.8/5  (35)

(35)

Joseph Jewelers purchased display shelves on March 1 for $36,000. If this asset has an estimated useful life of five years, what is the book value of the display shelves on April 30?

(Multiple Choice)

4.8/5  (35)

(35)

Scorpio Travel adjusts its books each month and closes its books on December 31 each year. The trial balance at January 31, of the current year, before adjustments, follows:

-Refer to the above data. At January 31, the amount of supplies still on hand was determined to be $675. What amount should be reported in the January income statement for supplies expense? $__________

-Refer to the above data. At January 31, the amount of supplies still on hand was determined to be $675. What amount should be reported in the January income statement for supplies expense? $__________

(Short Answer)

4.7/5  (37)

(37)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)