Exam 9: Current Liabilities and Long-Term Debt

Exam 1: Business, Accounting, and You121 Questions

Exam 2: Analyzing and Recording Business Transactions133 Questions

Exam 3: Adjusting and Closing Entries127 Questions

Exam 4: Ethics, Internal Control, and Cash134 Questions

Exam 5: Accounting for a Merchandising Business139 Questions

Exam 6: Inventory138 Questions

Exam 7: Sales and Receivables86 Questions

Exam 8: Long-Term Assets161 Questions

Exam 9: Current Liabilities and Long-Term Debt90 Questions

Exam 11: The Cash Flow Statement111 Questions

Exam 12: Financial Statement Analysis112 Questions

Select questions type

Disclosure is required under IFRS when the likelihood of the outcome (measurement) is:

(Multiple Choice)

4.8/5  (43)

(43)

If a liability is not properly classified, it will have an effect on the:

(Multiple Choice)

4.8/5  (40)

(40)

A person or business who pays another party for the use of an asset is a lessee.

(True/False)

4.9/5  (38)

(38)

Journalize the following transactions for Alpha Company:

May 13 Purchased inventory on account from ABC for $4,000.

May 22 Purchased inventory on account from Sara for $2,500.

May 27 Paid off the account from ABC.

(Essay)

4.9/5  (39)

(39)

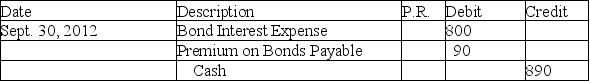

The September 30, 2012 semi-annual interest entry for Casey Company's bond interest expense was:

Journalize the December 31, 2012 adjusting entry.

Journalize the December 31, 2012 adjusting entry.

(Essay)

4.8/5  (32)

(32)

Amanda Industries had total assets of $600,000; total liabilities of $175,000; and total shareholders' equity of $425,000. Calculate Amanda Industries' debt ratio.

(Short Answer)

4.8/5  (34)

(34)

Journalize the following annual bond interest payments on Apr 30:

April 30 a. 10-year 7% $250,000 bond that sold for $250,000.

April 30 b. 8-year 9% $450,000 bond that sold for $426,000.

April 30 c. 15-year 10% $500,000 bond that sold for $410,000.

(Essay)

4.9/5  (41)

(41)

If a bond's stated rate of interest is equal to the market rate of interest, the bond will be issued at __________.

(Short Answer)

4.8/5  (46)

(46)

A $300,000 issue of bonds that sold at 105 will cost __________.

(Short Answer)

4.7/5  (34)

(34)

When the likelihood of an obligation occurring is possible, under Canadian ASPE what is the accounting treatment?

(Short Answer)

4.9/5  (32)

(32)

ABC Co. has a $100,000 pending lawsuit which is expected to be settled in the next 18 months. The company's lawyers are virtually certain that ABC Co. will lose the case. Identify the category of the liability and explain how it should be classified.

(Essay)

4.8/5  (39)

(39)

Journalize the following bond issues:

Dec. 17 $175,000 at 100.

Dec. 28 $425,000 at 96.7.

Dec. 30 $710,000 at 103.4.

(Essay)

4.9/5  (30)

(30)

On October 31, 2011, Isaiah Industries recorded its semi-annual bond interest expense, which contained a credit to discount on bonds payable of $1,200. The adjusting entry on December 31, 2011 will show a credit to discount on bonds payable of:

(Multiple Choice)

4.8/5  (35)

(35)

The percentage of total assets of a company that it would take to pay off all of the company's liabilities is called the debt ratio.

(True/False)

4.8/5  (37)

(37)

Which of the following would be considered an estimated liability?

(Multiple Choice)

4.7/5  (28)

(28)

When the likelihood of an obligation occurring is virtually certain, what is the accounting treatment under IFRS and Canadian ASPE?

(Short Answer)

4.9/5  (31)

(31)

Casey Company purchases inventory for $100,000, paying $40,000 in cash and signing a 3-year, 5% note payable for the remainder. The company has $90,000 sales in the month of March and estimates that 5% of product sales will require warranty repairs. Journalize the transactions below and identify which accounts are known liabilities and which are estimated liabilities.

Inventory purchase

Sales for March (25% on account, 75% in cash).

Estimated dollars for warranties.

(Essay)

4.8/5  (34)

(34)

Amanda Industries, a private company, has a contingent liability estimated at $125,000 with a 70%-95% likelihood of the obligation occurring What is the appropriate accounting treatment for the company?

(Essay)

4.8/5  (34)

(34)

Showing 41 - 60 of 90

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)