Exam 5: Inventory

Exam 1: Business, Accounting, and You159 Questions

Exam 2: Analyzing and Recording Business Transactions152 Questions

Exam 3: Adjusting and Closing Entries155 Questions

Exam 4: Accounting for a Merchandising Business158 Questions

Exam 5: Inventory155 Questions

Exam 6: The Challenges of Accounting: Standards, Internal Control, Audits, Fraud, and Ethics145 Questions

Exam 7: Cash and Receivables165 Questions

Exam 8: Long-Term and Other Assets171 Questions

Exam 9: Current Liabilities and Long-Term Debt171 Questions

Exam 10: Corporations: Paid-In Capital and Retained Earnings165 Questions

Exam 11: The Statement of Cash Flows135 Questions

Exam 12: Financial Statement Analysis162 Questions

Select questions type

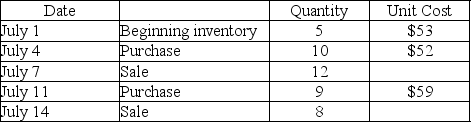

Lionworks Enterprises had the following inventory data:  Assuming LIFO, what is the cost of goods sold for the July 14 sale?

Assuming LIFO, what is the cost of goods sold for the July 14 sale?

(Multiple Choice)

4.9/5  (34)

(34)

Under the average cost method, the flow of costs through the accounting records will:

(Multiple Choice)

4.9/5  (43)

(43)

According to the consistency principle, companies may change inventory costing methods depending on circumstances.

(True/False)

4.8/5  (32)

(32)

The average cost method generates gross profit, net income, and income tax amounts that fall between the extremes of FIFO and LIFO.

(True/False)

4.8/5  (38)

(38)

The Betta Corp's inventory account balance was $1,450 at the end of the year. A physical inventory count revealed that inventory on hand was $1,150. What amount should Betta report on the balance sheet for inventory?

(Multiple Choice)

4.8/5  (41)

(41)

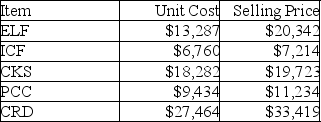

Lionworks Enterprises had the following inventory data:  Assuming average cost, what is the ending inventory after the July 14 sale? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

Assuming average cost, what is the ending inventory after the July 14 sale? (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.)

(Multiple Choice)

4.8/5  (35)

(35)

Companies that want a "middle ground" solution to net income and the amount of income taxes that the company will pay will value their inventory at:

(Multiple Choice)

4.8/5  (34)

(34)

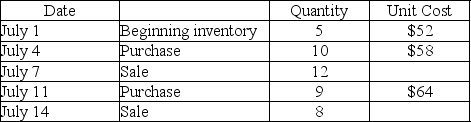

Liberty, Inc. has the following list of inventory:  Under specific-identification, what is Liberty's cost of goods sold if ICF and CRD were not sold during the current period?

Under specific-identification, what is Liberty's cost of goods sold if ICF and CRD were not sold during the current period?

(Multiple Choice)

4.8/5  (41)

(41)

Cascade Supply Company's income statement includes sales revenue $122,000, cost of goods sold $80,000, and gross profit $42,000. If ending inventory was accidentally overstated by $5,000, what is the correct amount for gross profit?

(Multiple Choice)

4.9/5  (41)

(41)

Inventory is probably the retailer's smallest (by value)current asset.

(True/False)

4.7/5  (42)

(42)

If a misstatement of inventory occurs, the net income for ________ periods will be misstated.

(Multiple Choice)

4.7/5  (38)

(38)

Part of the journal entry to record the cost of an item for $28 that sold for $42 cash under the perpetual inventory system is:

(Multiple Choice)

4.8/5  (29)

(29)

Under the LIFO method, the flow of costs through the accounting records will:

(Multiple Choice)

4.7/5  (40)

(40)

If the replacement cost of inventory is less than its historical cost, the company will write down the inventory by:

(Multiple Choice)

4.8/5  (38)

(38)

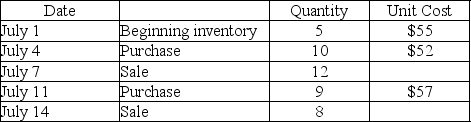

Lionworks Enterprises had the following inventory data:  Assuming average cost, what is the cost of goods sold for the July 14 sale?

Assuming average cost, what is the cost of goods sold for the July 14 sale?

(Multiple Choice)

4.8/5  (40)

(40)

One lot of merchandise was counted at $566.34. A second count of the same merchandise showed $566.82. The difference could be ignored due to:

(Multiple Choice)

4.9/5  (32)

(32)

Which inventory costing method results in the oldest costs in ending inventory?

(Multiple Choice)

4.8/5  (39)

(39)

If shrinkage is found for $400, an adjusting entry would be made as follows:

(Multiple Choice)

4.8/5  (46)

(46)

Showing 121 - 140 of 155

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)