Exam 13: Strategies Over Time

Exam 1: Introduction40 Questions

Exam 2: Supply and Demand131 Questions

Exam 3: Empirical Methods for Demand Analysis84 Questions

Exam 4: Consumer Choice67 Questions

Exam 5: Production128 Questions

Exam 6: Costs117 Questions

Exam 7: Firm Organization and Market Structure78 Questions

Exam 8: Competitive Firms and Markets97 Questions

Exam 9: Monopoly82 Questions

Exam 10: Pricing With Market Power138 Questions

Exam 11: Oligopoly and Monopolistic Competition84 Questions

Exam 12: Game Theory and Business Strategy90 Questions

Exam 13: Strategies Over Time67 Questions

Exam 14: Managerial Decision-Making Under Uncertainty116 Questions

Exam 15: Asymmetric Information112 Questions

Exam 16: Government and Business106 Questions

Exam 17: Global Business72 Questions

Select questions type

An incumbent's threat to retaliate after a potential competitor enters the market will be taken seriously by potential competitors if

(Multiple Choice)

4.9/5  (40)

(40)

An incumbent announces it will significantly increase output in the next period, but only has contracts for the amount produced this period. The announcement is a

(Multiple Choice)

4.8/5  (39)

(39)

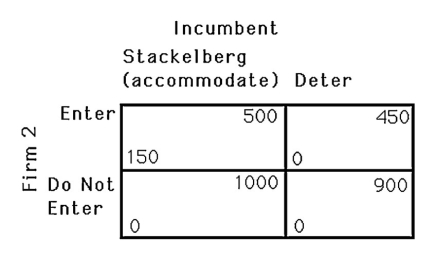

-The above figure shows the payoff matrix facing an incumbent firm and a potential entrant. Assuming a fixed cost of entry, the incumbent will deter entry because

-The above figure shows the payoff matrix facing an incumbent firm and a potential entrant. Assuming a fixed cost of entry, the incumbent will deter entry because

(Multiple Choice)

4.9/5  (45)

(45)

An incumbent monopolist producing more output than necessary might be able to keep potential rivals from entering

(Multiple Choice)

4.7/5  (32)

(32)

In an ultimatum game where the payoff totals $100 and is split in $1 increments, the rational amount for the proposer to offer and the responder to take is

(Multiple Choice)

4.8/5  (38)

(38)

The Cournot and Stackelberg models are similar, EXCEPT Cournot ________ and Stackelberg ________.

(Multiple Choice)

4.8/5  (38)

(38)

The trench warfare case during World War I is an example of a(n)

(Multiple Choice)

4.8/5  (35)

(35)

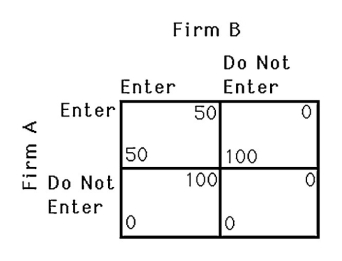

-The above figure shows the payoff to two gasoline stations, A and B, deciding to operate in an isolated town. Suppose a $60 fee is required to enter the market. If firm A chooses its strategy first, then

-The above figure shows the payoff to two gasoline stations, A and B, deciding to operate in an isolated town. Suppose a $60 fee is required to enter the market. If firm A chooses its strategy first, then

(Multiple Choice)

5.0/5  (39)

(39)

Assume a firm is a monopoly and enjoys $10 million in profits per year. The firm lobbies to have a moratorium passed by Congress on new firms in its market for the next 25 years. If there is no discount rate, how much would the firm be willing to pay to deter entry?

(Multiple Choice)

4.8/5  (41)

(41)

Showing 21 - 40 of 67

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)