Exam 14: Capital Structure Management in Practice

Exam 1: The Role and Objective of Financial Management81 Questions

Exam 2: The Domestic and International Financial Marketplace78 Questions

Exam 3: Evaluation of Financial Performance104 Questions

Exam 4: Financial Planning and Forecasting67 Questions

Exam 5: The Time Value of Money113 Questions

Exam 6: Fixed Income Securities: Characteristics and Valuation126 Questions

Exam 7: Common Stock: Characteristics, Valuation, and Issuance114 Questions

Exam 8: Analysis of Risk and Return114 Questions

Exam 9: Capital Budgeting and Cash Flow Analysis92 Questions

Exam 10: Capital Budgeting: Decision Criteria and Real Option Considerations106 Questions

Exam 11: Capital Budgeting and Risk78 Questions

Exam 12: The Cost of Capital104 Questions

Exam 13: Capital Structure Concepts75 Questions

Exam 14: Capital Structure Management in Practice85 Questions

Exam 15: Dividend Policy96 Questions

Exam 16: Working Capital Policy and Short-term Financing81 Questions

Exam 17: The Management of Cash and Marketable Securities80 Questions

Exam 18: Management of Accounts Receivable and Inventories80 Questions

Exam 19: Lease and Intermediate-term Financing52 Questions

Exam 20: Financing With Derivatives80 Questions

Exam 21: Risk Management49 Questions

Exam 22: International Financial Management51 Questions

Exam 23: Corporate Restructuring75 Questions

Exam 24: Continuous Compounding and Discounting28 Questions

Exam 25: Mutually Exclusive Investments Having Unequal Lives21 Questions

Exam 26: Breakeven Analysis23 Questions

Exam 27: Bond Refunding Analysis19 Questions

Exam 28: Taxes19 Questions

Select questions type

The degree of combined leverage is defined as the percentage change in earnings per share resulting from a given percentage change in

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

D

A firm is considering the purchase of assets that will increase its fixed operating costs. The firm should decrease the proportion of ____ it employs in its capital structure if it wants to maintain its existing degree of combined leverage.

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

A

The Albany Corporation has a present capital structure consisting of common stock ($200 million, 10 million shares) and debt ($150 million, 8%). The company is planning a major expansion and is undecided between two financing plans. Plan A: Equity financing. Under this plan, an additional 2.5 million shares of common stock will be sold at $ 15 each.

Plan B: Debt financing. Under this plan, $ 37.5 million of 10% long-term debt will be sold.

What happens to the EBIT indifference point if the interest rate on the new debt decreases and the common stock price remains constant?

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

B

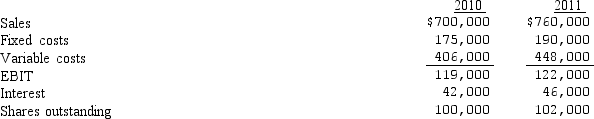

Given the following financial data for Boston Technology, compute the firm's degree of combined leverage. Assume a marginal tax rate of 40%.

(Multiple Choice)

4.9/5  (41)

(41)

Ipsy Dipsy Preschools, Inc. has a capital structure that consists of 60% common equity (2.0 million shares), 30% long-term debt ($10 million with 12% coupon), and 10% preferred stock ($50 par value with $4.75 dividend). The company is planning a major plant expansion and is undecided between the following two financing plans:

1) Equity financing: Sale of 400,000 shares of common at $10 each.

2) Debt financing: Sale of $4 million of 12.5 percent long-term bonds.

Calculate the EBIT-EPS indifference point. Assume the marginal tax rate is 40%.

(Multiple Choice)

4.8/5  (38)

(38)

The Albany Corporation has a present capital structure consisting of common stock ($200 million, 10 million shares) and debt ($150 million, 8%). The company is planning a major expansion and is undecided between two financing plans. Plan A: Equity financing. Under this plan, an additional 2.5 million shares of common stock will be sold at $ 15 each.

Plan B: Debt financing. Under this plan, $37.5 million of 10% long-term debt will be sold.

What is the EBIT-EPS indifference point? Assume a 40 percent marginal tax rate.

(Multiple Choice)

4.7/5  (34)

(34)

Given the following financial data for Cosmos, compute the firm's degree of financial leverage.

(Multiple Choice)

4.8/5  (36)

(36)

Twin City Printing is considering two financial alternatives for financing a major expansion program. Under either alternative EBIT is expected to be $15.6 million. Currently the firm's capital structure consists of 4 million shares of common stock and $35 million in 11% long-term bonds. Under the debt financing alternative $10 million in 12% long-term bonds will be sold and under the equity financing alternative the firm would sell 500,000 shares of common stock. The P/E under the debt alternative would be 15 and the P/E under the equity alternative would be 16. The firm's marginal tax rate is 40%. Which alternative would produce the higher stock price?

(Multiple Choice)

4.8/5  (36)

(36)

Cash insolvency analysis evaluates the adequacy of a firm's cash position in a

(Multiple Choice)

4.8/5  (39)

(39)

What is the degree of operating leverage for Flippin' Out Company, a maker of scuba flippers, f the firm sells its finished product for $50 per unit with variable costs per unit of $15? The company has fixed operating costs of $2,000,000 and sells 200,000 units (the answer is rounded).

(Multiple Choice)

4.7/5  (34)

(34)

The percentage change in a firm's EBIT that results in a 1% change in sales or output is known as the

(Multiple Choice)

4.8/5  (35)

(35)

Last year Alpine Growers experienced a 34% increase in earnings per share on 11% increase in sales. If management knows that Alpine's DOL is 1.5, what is its DFL?

(Multiple Choice)

4.8/5  (40)

(40)

When fixed capital costs are incurred by the firm, a change in ____ is magnified into a larger change in earnings per share.

(Multiple Choice)

4.8/5  (29)

(29)

Suppose that ITC's degree of combined leverage (DCL) is 3.00 at a sales volume of $9 million. Determine ITC's percentage change in earnings per share (EPS) if forecasted sales increase by 20 percent to $10,800,000.

(Multiple Choice)

4.8/5  (35)

(35)

Onyx expects to have an EBIT of $240,000 with a standard deviation of $110,000. The distribution of operating income is approximately normal. If Onyx has interest expenses of $50,000, what is the probability that it will have an operating income that is below $0?

(Multiple Choice)

4.7/5  (33)

(33)

Kenzel has an EPS of $4.20 and sales are $9 million. If the firm has a degree of operating leverage of 4.0 and a degree of financial leverage of 5.2, forecast EPS if the firm expects a 4% sales decline.

(Multiple Choice)

4.9/5  (43)

(43)

Dagger Company has a current capital structure consisting of $60 million in long-term debt with an interest rate of 9% and $60 million in common equity (12 million shares). The firm is considering an expansion plan costing $23 million. The expansion plan can be financed with additional long-term debt at a 12% interest rate or the sale of new common stock at $8 per share. The firm's marginal tax rate is 40%. Determine the indifference level of EBIT for the two financing plans.

(Multiple Choice)

5.0/5  (39)

(39)

The use of increasing amounts of combined leverage ____ the risk of financial distress.

(Multiple Choice)

4.7/5  (48)

(48)

A firm that employs relatively large amounts of labor- saving equipment in its operations will have a relatively ____ degree of operating leverage.

(Multiple Choice)

4.8/5  (41)

(41)

Crown Data(CD) has a current capital structure that consists of $120 million in common equity (15 million shares) and $80 million in long-term debt with an average interest rate of 11 percent. CD is considering an expansion project that will cost $22 million. The project will be financed either by issuing long-term debt at a cost of 12.5 percent, or the sale of new common stock at $35 per share. The firm's marginal tax rate is 40%. What is the EBIT indifference point between the two financing options.

(Multiple Choice)

5.0/5  (44)

(44)

Showing 1 - 20 of 85

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)