Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold

Exam 1: Business Decisions and Financial Accounting211 Questions

Exam 2: Reporting Investing and Financing Results on the Balance Sheet193 Questions

Exam 3: Reporting Operating Results on the Income Statement235 Questions

Exam 4: Adjustments,financial Statements,and Financial Results246 Questions

Exam 5: Fraud, Internal Control, and Cash188 Questions

Exam 6: Internal Control and Financial Reporting for Cash and Merchandising Operations210 Questions

Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold214 Questions

Exam 8: Reporting and Interpreting Receivables,bad Debt Expense,and Interest Revenue230 Questions

Exam 9: Reporting and Interpreting Long-Lived Tangible and Intangible Assets266 Questions

Exam 10: Reporting and Interpreting Liabilities235 Questions

Exam 11: Reporting and Interpreting Stockholders Equity253 Questions

Exam 12: Reporting and Interpreting the Statement of Cash Flows208 Questions

Exam 13: Measuring and Evaluating Financial Performance170 Questions

Select questions type

Delta Diamonds uses a periodic inventory system.The company had five one-carat diamonds available for sale this year: one was purchased on June 1 for $500,two were purchased on July 9 for $550 each,and two were purchased on September 23 for $600 each.On December 24,it sold one of the diamonds that was purchased on July 9.Using the specific identification method,its ending inventory (after the December 24 sale)equals:

(Multiple Choice)

4.8/5  (36)

(36)

The assignment of costs to cost of goods sold and to inventory using the weighted average method usually yields different results depending on whether a perpetual or a periodic system is used.

(True/False)

4.9/5  (39)

(39)

Eaton Electronics uses a periodic inventory system.On March 31, Eaton has two plasma TVs on hand at a cost of $1,500 each (serial numbers 11534892 and 11534894).In April, the company purchases four more identical TVs from Toshiba for $1,450 each (serial numbers 11542631 through 11542634).In May, the company purchases five more identical TVs for $1,600 each (serial numbers 11550964 through 11550968).In June, Eaton sells two of these TVs (serial numbers 11534894 and 11542631).There were no additional purchases or sales during the remainder of the year.

-Use the information above to answer the following question.Eaton Electronics reports $3,000 as the cost of goods sold.Eaton Electronics is using the:

(Multiple Choice)

4.8/5  (37)

(37)

Alphabet Company, which uses the periodic inventory method, purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February, it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A, D, E, H, J and N in October.There were no additional purchases or sales during the remainder of the year.

-Use the information above to answer the following question.If Alphabet Company uses the specific identification method,what is the cost of its ending inventory?

(Multiple Choice)

4.8/5  (41)

(41)

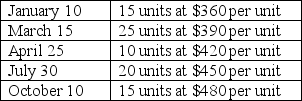

Friedman Company made the following purchases during the year:

On December 31,there were 28 units in ending inventory.These 28 units consisted of 1 from the January 10 purchase,2 from the March 15 purchase,5 from the April 25 purchase,15 from the July 30 purchase,and 5 from the October 10 purchase.Using specific identification,calculate the cost of the ending inventory.

On December 31,there were 28 units in ending inventory.These 28 units consisted of 1 from the January 10 purchase,2 from the March 15 purchase,5 from the April 25 purchase,15 from the July 30 purchase,and 5 from the October 10 purchase.Using specific identification,calculate the cost of the ending inventory.

(Essay)

4.9/5  (42)

(42)

Which of the following statements about inventory measures is not correct?

(Multiple Choice)

4.7/5  (35)

(35)

A company can use different methods for inventories that differ in nature or use.

(True/False)

4.9/5  (37)

(37)

During its first year of operations,Energy Inc.is experiencing increasing inventory costs.

Required:

Part a.Explain how each of the inventory costing methods will affect the amount reported for inventory at the end of the year.(Ignore the specific identification method.)

Part b.Explain how each of those three inventory costing methods will affect the amount reported for cost of goods sold.

Part c.Identify the inventory costing methods that will produce the highest and lowest inventory turnover ratios.

(Essay)

4.7/5  (25)

(25)

Goods on consignment are goods shipped by the owner to another company that holds the goods and sells them on behalf of the owner.

(True/False)

4.7/5  (46)

(46)

Mountain Made uses a periodic inventory system.The company started the month with 3 quilts in its beginning inventory that cost $200 each.During the month,Mountain Made purchased 20 additional quilts for $210 each.At the end of the month,Mountain Made counted its inventory and found that 5 quilts remained unsold.If Mountain Made uses LIFO periodic,its cost of goods sold for the month is:

(Multiple Choice)

4.9/5  (42)

(42)

Alphabet Company, which uses the periodic inventory method, purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February, it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A, D, E, H, J and N in October.There were no additional purchases or sales during the remainder of the year.

-Use the information above to answer the following question.If Alphabet Company uses the FIFO method,what is the cost of its ending inventory?

(Multiple Choice)

4.9/5  (31)

(31)

If inventory is sold with terms of FOB shipping point,the goods belong to the customer while in transit.

(True/False)

5.0/5  (35)

(35)

When costs to purchase inventory are rising,using LIFO leads to reporting ______ cost of goods sold and ______ net income than FIFO.

(Multiple Choice)

4.8/5  (36)

(36)

One of the most common sources of misstatement in financial statements is the:

(Multiple Choice)

4.9/5  (41)

(41)

Manufacturers have three types of inventory,which include raw materials,work in process,and finished goods,whereas merchandisers have only raw materials inventory.

(True/False)

5.0/5  (37)

(37)

Which of the following statements about an auto manufacturer's inventory is not correct?

(Multiple Choice)

4.9/5  (33)

(33)

When costs to purchase inventory are rising,using LIFO leads to reporting a ______ than FIFO.

(Multiple Choice)

4.8/5  (29)

(29)

Axle Inc.updates its inventory perpetually.Its beginning inventory is $35,000,goods purchased during the period cost $120,000,and the cost of goods sold for the period is $140,000.What is the amount of the ending inventory?

(Multiple Choice)

4.8/5  (35)

(35)

The primary goals of inventory managers are to maintain a sufficient quantity of inventory to meet customers' needs,ensure inventory quality meets customers' expectations and company standards,and minimize the cost of acquiring and carrying inventory.

(True/False)

4.8/5  (35)

(35)

FIFO uses the ______ cost for cost of goods sold on the income statement and the ______ cost for inventory on the balance sheet.

(Multiple Choice)

4.7/5  (35)

(35)

Showing 21 - 40 of 214

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)