Exam 21: Capital Budgeting and Cost Analysis

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

Which of the following is an advantage of internal rate of return method?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

B

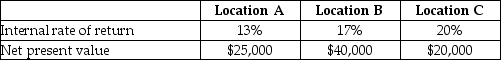

Retail Outlet is looking for a new location near a shopping mall. It is considering purchasing a building rather than leasing, as it has done in the past. Three retail buildings near a new mall are available but each has its own advantages and disadvantages. The owner of the company has completed an analysis of each location that includes considerations for the time value of money. The information is as follows:

The owner does not understand how the location with the highest percentage return has the lowest net present value.

Required:

Explain to the owner what is (are) the probable cause(s) of the comparable differences.

The owner does not understand how the location with the highest percentage return has the lowest net present value.

Required:

Explain to the owner what is (are) the probable cause(s) of the comparable differences.

Free

(Essay)

4.8/5  (42)

(42)

Correct Answer:

The highest probability is that location C has a much lower initial investment than the other two. Therefore, it can show a higher rate of return with fewer dollars of inflow. Unfortunately, this may cause it to have the lowest net present value since this model is presented in dollar terms. Location C could also have a shorter life which could give it a higher percentage return during its life but fewer dollars overall.

Which of the following is a stage of the capital-budgeting process that tracks realized cash flows and compares those against estimated numbers?

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

A

Which of the following is a stage of the capital budgeting process during which a plant manager is queried for assembly time?

(Multiple Choice)

4.9/5  (43)

(43)

Ambinu Flower Company provides flowers and other nursery products for decorative purposes in medium to large sized restaurants and businesses. The company has been investigating the purchase of a new specially equipped van for deliveries. The van has a value of $133,750 with a six-year life. The expected additional cash inflows are $52,500 per year. What is the payback period for this investment?

(Multiple Choice)

4.9/5  (38)

(38)

The nominal approach to incorporating inflation into the net present value method predicts cash inflows in real monetary units and uses a real rate as the required rate of return.

(True/False)

4.8/5  (40)

(40)

Unlike the net present value method and the internal rate-of-return method, the payback method does NOT distinguish between the origins of the cash flows.

(True/False)

4.8/5  (33)

(33)

As a discounted cash flow method does not report good operating income results in the project's early years, managers are tempted to not use discounted cash flow methods even though the decisions based on them would be in the best interests of the company as a whole over the long run.

(True/False)

4.8/5  (40)

(40)

Malive Park Department is considering a new capital investment. The following information is available on the investment. The cost of the machine will be $179,000. The annual cost savings if the new machine is acquired will be $35,000. The machine will have a 10-year life, at which time the terminal disposal value is expected to be zero. Malive Park is assuming no tax consequences. Malive Park has a 14% required rate of return. What is the payback period for the investment?

(Multiple Choice)

4.8/5  (24)

(24)

The capital budgeting method that calculates the discount rate at which the present value of expected cash inflows from a project equals the present value of expected cash outflows is the ________.

(Multiple Choice)

4.8/5  (30)

(30)

Capital budgeting is both a decision making and control tool. Which of the following is an example of capital budgeting as a control tool?

(Multiple Choice)

4.9/5  (34)

(34)

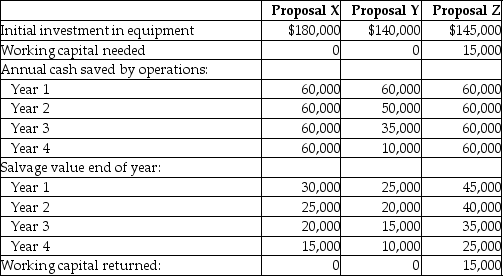

Cedile Trailer Supply has received three proposals for its new trailer assembly line. Information on each proposal is as follows:

Required:

Determine each proposal's payback.

Required:

Determine each proposal's payback.

(Essay)

4.9/5  (29)

(29)

Which of the following is another term for required rate of return?

(Multiple Choice)

4.8/5  (43)

(43)

In nominal rate of return, the inflation element is the premium above the real rate.

(True/False)

4.9/5  (39)

(39)

Which of the following is the first stage to the capital budgeting process?

(Multiple Choice)

4.8/5  (31)

(31)

In determining whether to keep a machine or replace it, the original cost of the machine is a sunk cost and is NOT a relevant factor.

(True/False)

4.9/5  (44)

(44)

The use of an accelerated method of depreciation for tax purposes would usually decrease the present value of the investment.

(True/False)

4.8/5  (30)

(30)

Showing 1 - 20 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)