Exam 18: Measuring the Price Level and Inflation

Exam 1: Thinking Like an Economist142 Questions

Exam 2: Comparative Advantage163 Questions

Exam 3: Supply and Demand181 Questions

Exam 4: Elasticity154 Questions

Exam 5: Demand144 Questions

Exam 6: Perfectly Competitive Supply159 Questions

Exam 7: Efficiency, Exchange, and the Invisible Hand in Action159 Questions

Exam 8: Monopoly, Oligopoly, and Monopolistic Competition147 Questions

Exam 9: Games and Strategic Behavior150 Questions

Exam 10: An Introduction to Behavioral Economics111 Questions

Exam 11: Externalities, Property Rights, and the Environment184 Questions

Exam 12: The Economics of Information127 Questions

Exam 13: Labor Markets, Poverty, and Income Distribution138 Questions

Exam 14: Public Goods and Tax Policy142 Questions

Exam 15: International Trade and Trade Policy164 Questions

Exam 16: Macroeconomics: The Birds Eye View of the Economy154 Questions

Exam 17: Measuring Economic Activity: GDP and Unemployment210 Questions

Exam 18: Measuring the Price Level and Inflation160 Questions

Exam 19: Economic Growth, Productivity, and Living Standards158 Questions

Exam 20: The Labor Market: Workers, Wages, and Unemployment121 Questions

Exam 21: Saving and Capital Formation144 Questions

Exam 22: Money Prices and the Federal Reserve107 Questions

Exam 23: Financial Markets and International Capital Flows104 Questions

Exam 24: Short-Term Economic Fluctuations: An Introduction124 Questions

Exam 25: Spending and Output in the Short Run146 Questions

Exam 26: Stabilizing the Economy: The Role of the Fed162 Questions

Exam 27: Aggregate Demand, Aggregate Supply, and Inflation159 Questions

Exam 28: Exchange Rates and the Open Economy157 Questions

Select questions type

Suppose that the total expenditures for a typical household in 2015 equaled $2,500 per month, while the cost of purchasing exactly the same items in 2017 was $3,000. If 2015 is the base year, the CPI for 2017 equals:

(Multiple Choice)

4.8/5  (35)

(35)

When inflation turns out to be different from what was expected, purchasing power is ________.

(Multiple Choice)

4.9/5  (45)

(45)

On January 1, 2015, Anna invested $5,000 at 5 percent interest for one year. The CPI on January 1, 2015 stood at 2.37. On January 1, 2016, the CPI was 2.40. The real rate of interest earned by Anna was ________ percent.

(Multiple Choice)

4.8/5  (35)

(35)

Because the minimum wage is not indexed to inflation, when there is inflation the nominal minimum wage ________, and the real minimum wage ________.

(Multiple Choice)

4.9/5  (36)

(36)

The process of converting current dollar values into real terms is called ________, while the process of adjusting nominal quantities to maintain their purchasing power is called ________.

(Multiple Choice)

4.8/5  (32)

(32)

If the annual real rate on a 10-year inflation-protected bond equals 1.9 percent and the annual nominal rate of return on a 10-year bond without inflation protection is 4.4 percent, what average rate of inflation over the ten years would make holders of inflation-protected bonds and holders of bonds without inflation protection equally well off?

(Multiple Choice)

4.9/5  (34)

(34)

The price of a gallon of gasoline at the pump increased by 10 percent at the same time that the inflation rate was 5 percent. The nominal price of gasoline ________, and the real price of gasoline ________.

(Multiple Choice)

4.7/5  (37)

(37)

The consumer price index for Planet Econ consists of only two items: books and hamburgers. In 2015, the base year, the typical consumer purchased 10 books for $20 each and 200 hamburgers for $1 each. In 2017, the typical consumer purchased 12 books for $23 each and 300 hamburgers for $1.15 each. The consumer price index for 2017 on Planet Econ equals:

(Multiple Choice)

4.9/5  (35)

(35)

The price of a gallon of gasoline at the pump increased by 5 percent at the same time that the inflation rate was also 5 percent. The nominal price of gasoline ________, and the real price of gasoline ________.

(Multiple Choice)

4.9/5  (34)

(34)

Suppose a borrower and lender agree to an interest rate on a loan when inflation is expected to be 6 percent. The borrower would benefit the most if which of the following inflation rates actually occurred?

(Multiple Choice)

5.0/5  (40)

(40)

If both the lender and borrower agree on an 8 percent interest rate, both expect a 4 percent inflation rate, and inflation turns out to be 4 percent, then ________ by the inflation.

(Multiple Choice)

4.8/5  (33)

(33)

Suppose that the total expenditures for a typical household in 2015 equaled $2,500 per month, while the cost of purchasing exactly the same items in 2017 was $3,000. If 2015 is the base year, the CPI for 2015 equals:

(Multiple Choice)

4.8/5  (30)

(30)

The market interest rate in Alpha is 7 percent, and the market interest rate in Beta is 10 percent; the inflation rate in Alpha is 3 percent, and inflation rate in Beta is 8 percent. Which of the following statements is true?

(Multiple Choice)

5.0/5  (25)

(25)

Assume one investor bought a 10-year inflation-protected bond with a fixed annual real rate of 1.5 percent and another investor bought a 10-year bond without inflation protection with a nominal annual return of 4.2 percent. If inflation over the 10-year period averaged 2 percent, which investor earned a higher real return?

(Multiple Choice)

4.8/5  (31)

(31)

The wage paid to workers measured in terms of real purchasing power is called the:

(Multiple Choice)

4.8/5  (38)

(38)

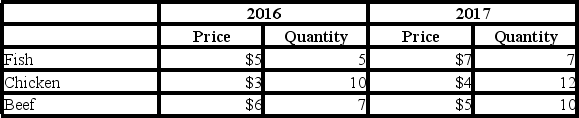

A consumer expenditure survey reports the following information on consumer protein spending:

Using 2016 as the base year, by how much does a "cost of protein" index increase between 2016 and 2017?

Using 2016 as the base year, by how much does a "cost of protein" index increase between 2016 and 2017?

(Multiple Choice)

4.8/5  (36)

(36)

The CPI in 1930 equaled 0.17. The CPI in 1931 equaled 0.15. The rate of inflation between 1930 and 1931 was ________ percent.

(Multiple Choice)

4.9/5  (38)

(38)

Showing 61 - 80 of 160

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)