Exam 28: Exchange Rates and the Open Economy

Exam 1: Thinking Like an Economist142 Questions

Exam 2: Comparative Advantage163 Questions

Exam 3: Supply and Demand181 Questions

Exam 4: Elasticity154 Questions

Exam 5: Demand144 Questions

Exam 6: Perfectly Competitive Supply159 Questions

Exam 7: Efficiency, Exchange, and the Invisible Hand in Action159 Questions

Exam 8: Monopoly, Oligopoly, and Monopolistic Competition147 Questions

Exam 9: Games and Strategic Behavior150 Questions

Exam 10: An Introduction to Behavioral Economics111 Questions

Exam 11: Externalities, Property Rights, and the Environment184 Questions

Exam 12: The Economics of Information127 Questions

Exam 13: Labor Markets, Poverty, and Income Distribution138 Questions

Exam 14: Public Goods and Tax Policy142 Questions

Exam 15: International Trade and Trade Policy164 Questions

Exam 16: Macroeconomics: The Birds Eye View of the Economy154 Questions

Exam 17: Measuring Economic Activity: GDP and Unemployment210 Questions

Exam 18: Measuring the Price Level and Inflation160 Questions

Exam 19: Economic Growth, Productivity, and Living Standards158 Questions

Exam 20: The Labor Market: Workers, Wages, and Unemployment121 Questions

Exam 21: Saving and Capital Formation144 Questions

Exam 22: Money Prices and the Federal Reserve107 Questions

Exam 23: Financial Markets and International Capital Flows104 Questions

Exam 24: Short-Term Economic Fluctuations: An Introduction124 Questions

Exam 25: Spending and Output in the Short Run146 Questions

Exam 26: Stabilizing the Economy: The Role of the Fed162 Questions

Exam 27: Aggregate Demand, Aggregate Supply, and Inflation159 Questions

Exam 28: Exchange Rates and the Open Economy157 Questions

Select questions type

According to the theory of purchasing power parity, the real exchange rate between two currencies will equal ________ in the long run.

(Multiple Choice)

4.9/5  (39)

(39)

Tight monetary policy will ________ net exports as a result of a ________ currency.

(Multiple Choice)

4.8/5  (40)

(40)

When the nominal exchange rate changes from 4 francs per dollar to 6 francs per dollar, the dollar has:

(Multiple Choice)

4.9/5  (49)

(49)

All else being equal, if European firms switch from U.S. produced software to software produced in India, the equilibrium value of the U.S. dollar will:

(Multiple Choice)

4.8/5  (33)

(33)

European firms wishing to purchase American goods and services are ________ the foreign exchange market.

(Multiple Choice)

4.9/5  (34)

(34)

If a certain automotive part can be purchased in Mexico for 32 pesos or in the United States for $5.25, and if the nominal exchange rate is 8 pesos per U.S. dollar, then the automotive part:

(Multiple Choice)

4.8/5  (41)

(41)

The price of gold is $300 per ounce in New York and 2,550 pesos per ounce in Mexico City. If the law of one price holds for gold, the nominal exchange rate is ________ pesos per U.S. dollar.

(Multiple Choice)

4.8/5  (37)

(37)

If one euro nation is experiencing rapid growth and inflation while another is facing sluggish growth and recession:

(Multiple Choice)

4.9/5  (31)

(31)

The demand for the Franconian franc in the foreign exchange market equals 14,000 - 3,000e and the supply of francs in the foreign exchange market equals 2,000 + 2,000e, where e is the nominal exchange rate expressed in U.S. dollars per franc. If the franc is fixed at 3 U.S. dollars per franc, then to maintain this fixed rate Franconia's international reserves must:

(Multiple Choice)

4.9/5  (35)

(35)

An increase in the real exchange rate will tend to ________ exports and to ________ imports.

(Multiple Choice)

4.9/5  (35)

(35)

When the Fed tightens U.S. monetary policy, domestic interest rates ________, making U.S. assets relatively more attractive to foreign investors, and ________ the equilibrium exchange rate.

(Multiple Choice)

4.9/5  (35)

(35)

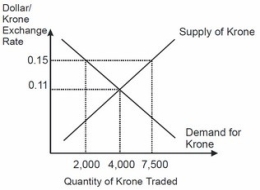

Based on this figure, if the krone exchange rate is fixed at $0.15 dollars per krone, then the krone is:

(Multiple Choice)

4.8/5  (34)

(34)

If the fundamental value of the nominal exchange rate equals 0.20 U.S. dollars per franc, but the franc is officially fixed at 0.15 U.S. dollars per franc, then the franc exchange rate is ________ and to maintain this exchange rate there will be ________ in the government's stock of international reserves.

(Multiple Choice)

4.8/5  (31)

(31)

The demand for the Franconian franc in the foreign exchange market equals 11,000 - 25,000e and the supply of francs in the foreign exchange market equals 9,000 + 25,000 e, where e is the nominal exchange rate expressed in U.S. dollars per franc. If the franc is fixed at 0.25 U.S. dollars per franc, then the franc is ________ and Franconia has a balance-of-payments ________.

(Multiple Choice)

4.8/5  (45)

(45)

Showing 141 - 157 of 157

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)