Exam 7: Accounting for the Business-type Activities of State and Local Governments

Exam 1: Introduction to Accounting and Financial Reporting for Government and Not-for-Profit Entities62 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments73 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting91 Questions

Exam 4: Accounting for Governmental Operating Activities–Illustrative Transactions and Financial Statements91 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects83 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service75 Questions

Exam 7: Accounting for the Business-type Activities of State and Local Governments75 Questions

Exam 8: Accounting for Fiduciary Activities—Custodial and Trust Funds72 Questions

Exam 9: Financial Reporting of State and Local Governments66 Questions

Exam 10: Analysis of Government Financial Performance60 Questions

Exam 11: Auditing of Government and Not-for-Profit Organizations65 Questions

Exam 12: Budgeting and Performance Measurement60 Questions

Exam 13: Not-for-Profit Organizations—Regulatory, Taxation, and Performance Issues59 Questions

Exam 14: Accounting for Not-for-Profit Organizations77 Questions

Exam 15: Accounting for Colleges and Universities63 Questions

Exam 16: Accounting for Health Care Organizations63 Questions

Exam 17: Accounting and Reporting for the Federal Government66 Questions

Select questions type

The Central City Golf Course, an enterprise fund, purchased a new stove for use in the course's snack shop. The debit for the entry to record the purchase should be to:

Free

(Multiple Choice)

4.9/5  (29)

(29)

Correct Answer:

C

Under regulatory reporting, Utility Plant in Service is stated at original cost.

Free

(True/False)

4.8/5  (43)

(43)

Correct Answer:

True

If enterprise funds are the predominant participants in an internal service fund, the government should report the internal service fund's residual assets, deferred inflows and outflows of resources, and liabilities within the business-type activities column in the statement of net position.

Free

(True/False)

4.8/5  (43)

(43)

Correct Answer:

True

Which of the following would be reflected in the operating statement of a proprietary fund?

(Multiple Choice)

4.9/5  (39)

(39)

Interest and principal on enterprise fund revenue bonds should be recorded in a debt service fund until paid.

(True/False)

4.8/5  (44)

(44)

When utility customers are billed during the year, the enterprise fund journal entry will include:

(Multiple Choice)

4.8/5  (45)

(45)

Legislators often believe an internal service fund function will not be subjected to annual legislative budget review and the legislature will "lose control" of the fund. Do you agree with this line of reasoning? Why or why not?

(Essay)

4.7/5  (38)

(38)

The amount of expense and liability to be reported each period for the closure and postclosure costs of a municipal solid waste landfill (MSWLF) is proportional to the amount of landfill capacity used during the period.

(True/False)

4.7/5  (38)

(38)

Internal service funds account for operating expenses on the accrual basis of accounting.

(True/False)

4.8/5  (34)

(34)

Which of the following accounts would appropriately be included on an enterprise fund balance sheet?

(Multiple Choice)

4.8/5  (35)

(35)

Consistent with accounting in capital projects funds, interest capitalization for self-constructed assets of proprietary funds is prohibited.

(True/False)

4.9/5  (36)

(36)

Proprietary funds report using three net position categories: net investment in capital assets; restricted; and unrestricted.

(True/False)

4.7/5  (39)

(39)

In some local government financial reports you will find activities such as solid waste disposal and sewage disposal accounted for as a part of the General Fund. In other reports apparently identical activities are accounted for as enterprise funds. When is a government required to establish an enterprise fund?

(Essay)

4.9/5  (40)

(40)

Enterprise funds are reported as a part of the Governmental Activities column of the government-wide financial statements when they provide services to governmental funds.

(True/False)

4.7/5  (35)

(35)

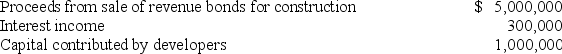

The following cash transactions were among those reported by Genesee County's Wastewater Enterprise Fund for the year:  In the Wastewater Enterprise Fund's statement of cash flows for the year ended December 31, what amount should be reported as cash flows from capital and related financing activities?

In the Wastewater Enterprise Fund's statement of cash flows for the year ended December 31, what amount should be reported as cash flows from capital and related financing activities?

(Multiple Choice)

4.8/5  (39)

(39)

Select the key term that relate to accounting for the business-type activities of state and local governments from the list that best matches with the following definition.

A. Allowance for Funds Used during Construction

B. Revenue bonds

C. Utility plant acquisition adjustment

D. Regulatory accounting principles

E. Original cost

F. Historical cost

G. General obligation bonds

________ 1. In utility accounting, the net cost for the period of construction of borrowed funds used for construction purposes and a reasonable rate on other funds so used.

________ 2. Accounting principles prescribed by federal or state regulatory commissions for investor-owned and some governmentally owned utilities.

________ 3. Bonds whose principal and interest are payable exclusively from earnings of a public enterprise.

________ 4. Bonds which carry the pledge of the government entity's full faith and credit, although the intent may be to service them from proprietary revenues rather than general taxes.

________ 5. The account that captures the premium paid on a utility plant purchased by a government.

(Essay)

4.9/5  (38)

(38)

Internal service funds are intended to operate on taxes or other financing sources authorized by the legally enacted revenue budget for each year; therefore, they are classified as governmental funds.

(True/False)

4.8/5  (37)

(37)

Under GASB standards, an internal service fund should prepare all of the following financial statements except a:

(Multiple Choice)

4.8/5  (31)

(31)

Showing 1 - 20 of 75

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)