Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities 46 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments 50 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting 76 Questions

Exam 4: Accounting for Governmental Operating Activities-Illustrative Transactions and Financial Statements 87 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects 88 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service81 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments94 Questions

Exam 8: Accounting for Fiduciary Activities-Agency and Trust Funds61 Questions

Exam 9: Financial Reporting of State and Local Governments58 Questions

Exam 10: Analysis of Governmental Financial Performance46 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations66 Questions

Exam 12: Budgeting and Performance Measurement62 Questions

Exam 13: Accounting for Not-For-Profit Organizations57 Questions

Exam 14: Not-For-Profit Organizations-Regulatory, Taxation, and Performance Issues43 Questions

Exam 15: Accounting for Colleges and Universities45 Questions

Exam 16: Accounting for Health Care Organizations52 Questions

Exam 17: Accounting and Reporting for the Federal Government49 Questions

Select questions type

Which of the following accounts of a government is credited when a purchase order is approved?

(Multiple Choice)

4.8/5  (33)

(33)

If a state law requires that local governments prepare General Fund and special revenue fund budgets on a basis that differs from the basis of accounting required by generally accepted accounting principles (GAAP)

(Multiple Choice)

5.0/5  (37)

(37)

When the budget of a government is recorded and Appropriations exceeds Estimated Revenues,the Budgetary Fund Balance account is

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following fund types uses the current financial resources measurement focus and modified accrual basis of accounting?

(Multiple Choice)

5.0/5  (35)

(35)

The Estimated Revenues control account of a government is credited when

(Multiple Choice)

4.9/5  (33)

(33)

Under which basis of accounting for a government should revenues be recognized in the period when they are measurable and available?

(Multiple Choice)

4.8/5  (34)

(34)

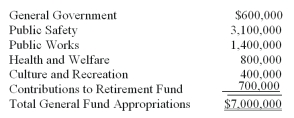

The Board of Aldermen of Fitchburg approved the appropriations budget for its General Fund for the year ending December 31,as shown below.

1)Explain the legal significance of an appropriation and why auditors engaged for a financial and compliance audit need to know the meaning of the term.

2)It is illegal for a government to spend money for any purpose unless a valid appropriation for that purpose exists.Does this legal rule assure good financial management for each government? Why or why not?

1)Explain the legal significance of an appropriation and why auditors engaged for a financial and compliance audit need to know the meaning of the term.

2)It is illegal for a government to spend money for any purpose unless a valid appropriation for that purpose exists.Does this legal rule assure good financial management for each government? Why or why not?

(Essay)

4.9/5  (42)

(42)

Fund balance may be classified as all of the following except

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following accounts is a budgetary account of a governmental fund?

(Multiple Choice)

4.8/5  (41)

(41)

Available means that a revenue or other financing source is expected to be collected during the current fiscal period or within one month of the fiscal year end.

(True/False)

4.8/5  (44)

(44)

Which of the following statements is true regarding the required disclosure of budgetary information?

(Multiple Choice)

5.0/5  (41)

(41)

Which of the following would be classified as a general revenue?

(Multiple Choice)

4.8/5  (38)

(38)

Under the modified accrual basis of accounting used by the General Fund,financial resources are considered available if they will be received in the current period or within

(Multiple Choice)

4.7/5  (35)

(35)

Which of the following terms refers to an actual cost rather than an estimate?

(Multiple Choice)

4.8/5  (41)

(41)

GASB standards require that all state and local governments present a statement of revenues,expenditures,and changes in fund balances-budget and actual for the General Fund,and major special revenue funds for which annual budgets have been legally adopted.

(True/False)

4.8/5  (40)

(40)

For what funds do budgetary comparisons need to be presented in connection with the basic financial statements?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 61 - 76 of 76

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)