Exam 4: Systems Design: Process Costing

Exam 1: An Introduction to Managerial Accounting and Cost Concepts50 Questions

Exam 2: Systems Design: Job-Order Costing112 Questions

Exam 3: Systems Design: Activity-Based Costing114 Questions

Exam 4: Systems Design: Process Costing126 Questions

Exam 5: Cost Behavior: Analysis and Use103 Questions

Exam 6: Cost-Volume-Profit Relationships98 Questions

Exam 7: Profit Planning117 Questions

Exam 8: Standard Costs160 Questions

Exam 9: Flexible Budgets and Overhead Analysis145 Questions

Exam 10: Decentralization113 Questions

Exam 11: Relevant Costs for Decision Making163 Questions

Exam 12: Capital Budgeting Decisions96 Questions

Exam 13: How Well Am I Doing Statement of Cash Flows223 Questions

Exam 14: How Well Am I Doing Financial Statement Analysis34 Questions

Select questions type

For the current year,Paxman Company incurred $150,000 in actual manufacturing overhead cost.The Manufacturing Overhead account showed that overhead was overapplied in the amount of $6,000 for the year.If the predetermined overhead rate was $8.00 per direct labour hour,how many hours were worked during the year?

(Multiple Choice)

4.9/5  (38)

(38)

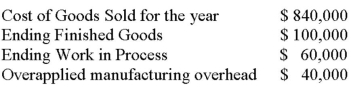

Using the following information:  Assuming overapplied overhead is considered material,using the preferred method,what would be the adjustment to Cost of Goods Sold to close the overapplied overhead?

Assuming overapplied overhead is considered material,using the preferred method,what would be the adjustment to Cost of Goods Sold to close the overapplied overhead?

(Multiple Choice)

4.8/5  (38)

(38)

The cost of goods sold (after adjustment for underapplied or overapplied overhead)is:

(Multiple Choice)

4.7/5  (40)

(40)

Sweet Company applies overhead to jobs on the basis of 125% of direct labour cost.If Job 107 shows $10,000 of manufacturing overhead applied,how much was the direct labour cost on the job:

(Multiple Choice)

4.8/5  (41)

(41)

In a normal costing system actual overhead costs are allocated to jobs.

(True/False)

4.8/5  (30)

(30)

The ending balance of which of the following accounts can be calculated by summing the totals of the open job-order cost sheets:

(Multiple Choice)

4.9/5  (44)

(44)

The actual direct labour hours worked during April totalled:

(Multiple Choice)

4.9/5  (44)

(44)

Compton Company uses a predetermined overhead rate in applying overhead to production orders on a labour cost basis in Department A and on a machine hours basis in DepartmentB.At the beginning of the most recently completed year,the company made the following estimates:  What predetermined overhead rate would be used in Department A and Department B,respectively?

What predetermined overhead rate would be used in Department A and Department B,respectively?

(Multiple Choice)

4.8/5  (42)

(42)

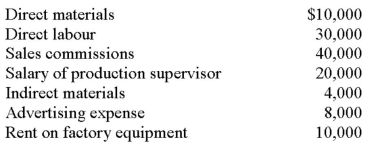

Simplex Company has the following estimated costs for next year:  Simplex estimates that 10,000 direct labour and 16,000 machine hours will be worked during the year.If overhead is applied on the basis of machine hours,the overhead rate per hour will be:

Simplex estimates that 10,000 direct labour and 16,000 machine hours will be worked during the year.If overhead is applied on the basis of machine hours,the overhead rate per hour will be:

(Multiple Choice)

4.8/5  (38)

(38)

Knowlton Company applies overhead to completed jobs on the basis of 70% of direct labour cost.If Job 501 shows $21,000 of manufacturing overhead applied,the direct labour cost on the job was:

(Multiple Choice)

4.7/5  (34)

(34)

If the estimated manufacturing overhead for the year was $24,000,and the applied overhead was $26,500,the actual manufacturing overhead cost for the year was:

(Multiple Choice)

4.8/5  (34)

(34)

CR Company has the following estimated costs for the next year:  CR Company estimates that 20,000 labour hours will be worked during the year.If overhead is applied on the basis of direct labour hours,the overhead rate per hour will be?

CR Company estimates that 20,000 labour hours will be worked during the year.If overhead is applied on the basis of direct labour hours,the overhead rate per hour will be?

(Multiple Choice)

4.9/5  (36)

(36)

Carlo Company uses a predetermined overhead rate based on direct labour hours to apply manufacturing overhead to jobs.The company estimated manufacturing overhead at $255,000 for the year and direct labour-hours at 100,000 hours.Actual manufacturing overhead costs incurred during the year totalled $270,000.Actual direct labour hours were 105,000.What was the overapplied or underapplied overhead for the year?

(Multiple Choice)

4.9/5  (33)

(33)

Kelsh Company uses a predetermined overhead rate based on machine hours to apply manufacturing overhead to jobs.The company has provided the following estimated costs for next year:  Kelsh estimates that 5,000 direct labour hours and 10,000 machine hours will be worked during the year.The predetermined overhead rate per hour will be:

Kelsh estimates that 5,000 direct labour hours and 10,000 machine hours will be worked during the year.The predetermined overhead rate per hour will be:

(Multiple Choice)

4.7/5  (34)

(34)

In job-order costing,the Work in Process inventory account contains the actual costs of direct labour,direct materials,and manufacturing overhead incurred on partially completed jobs.

(True/False)

4.9/5  (34)

(34)

Allenton Company is a manufacturing firm that uses job-order costing.At the beginning of the year,the company's inventory balances were as follows:

(Essay)

4.7/5  (35)

(35)

Showing 41 - 60 of 126

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)