Exam 13: Weighing Net Present Value and Other Capital Budgeting Criteria

Exam 1: Introduction to Financial Management65 Questions

Exam 2: Reviewing Financial Statements115 Questions

Exam 3: Analyzing Financial Statements131 Questions

Exam 4: Time Value of Money 1: Analyzing Single Cash Flows143 Questions

Exam 5: Time Value of Money 2: Analyzing Annuity Cash Flows148 Questions

Exam 6: Understanding Financial Markets and Institutions104 Questions

Exam 7: Valuing Bonds131 Questions

Exam 8: Valuing Stocks118 Questions

Exam 9: Characterizing Risk and Return113 Questions

Exam 10: Estimating Risk and Return106 Questions

Exam 11: Calculating the Cost of Capital124 Questions

Exam 12: Estimating Cash Flows on Capital Budgeting Projects116 Questions

Exam 13: Weighing Net Present Value and Other Capital Budgeting Criteria121 Questions

Exam 14: Working Capital Management and Policies129 Questions

Exam 15: Financial Planning and Forecasting90 Questions

Exam 16: Assessing Long-Term Debt, Equity, and Capital Structure115 Questions

Exam 18: Issuing Capital and the Investment Banking Process119 Questions

Exam 19: International Corporate Finance122 Questions

Exam 20: Mergers and Acquisitions and Financial Distress109 Questions

Select questions type

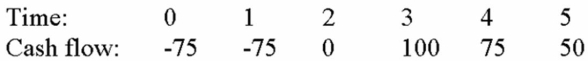

Compute the NPV for Project X and accept or reject the project with the cash flows shown below if the appropriate cost of capital is 10 percent.

(Multiple Choice)

4.9/5  (32)

(32)

Showing 121 - 121 of 121

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)