Exam 10: Estimating Risk and Return

Exam 1: Introduction to Financial Management65 Questions

Exam 2: Reviewing Financial Statements115 Questions

Exam 3: Analyzing Financial Statements131 Questions

Exam 4: Time Value of Money 1: Analyzing Single Cash Flows143 Questions

Exam 5: Time Value of Money 2: Analyzing Annuity Cash Flows148 Questions

Exam 6: Understanding Financial Markets and Institutions104 Questions

Exam 7: Valuing Bonds131 Questions

Exam 8: Valuing Stocks118 Questions

Exam 9: Characterizing Risk and Return113 Questions

Exam 10: Estimating Risk and Return106 Questions

Exam 11: Calculating the Cost of Capital124 Questions

Exam 12: Estimating Cash Flows on Capital Budgeting Projects116 Questions

Exam 13: Weighing Net Present Value and Other Capital Budgeting Criteria121 Questions

Exam 14: Working Capital Management and Policies129 Questions

Exam 15: Financial Planning and Forecasting90 Questions

Exam 16: Assessing Long-Term Debt, Equity, and Capital Structure115 Questions

Exam 18: Issuing Capital and the Investment Banking Process119 Questions

Exam 19: International Corporate Finance122 Questions

Exam 20: Mergers and Acquisitions and Financial Distress109 Questions

Select questions type

A manager believes his firm will earn an 18 percent return next year. His firm has a beta of 1.75, the expected return on the market is 13 percent, and the risk-free rate is 5 percent. Compute the return the firm should earn given its level of risk and determine whether the manager is saying the firm is under-valued or over-valued.

(Multiple Choice)

4.7/5  (30)

(30)

This model includes an equation that relates a stock's required return to an appropriate risk premium:

(Multiple Choice)

4.8/5  (31)

(31)

You own $10,000 of Denny's Corp stock that has a beta of 3.2. You also own $15,000 of Qwest Communications (beta = 1.9) and $15,000 of Southwest Airlines (beta = 0.4). Assume that the market return will be 13 percent and the risk-free rate is 5.5 percent. What is the risk premium of the portfolio?

(Multiple Choice)

4.8/5  (31)

(31)

Required Return If the risk-free rate is 8 percent and the market risk premium is 2 percent, what is the required return for the market?

(Multiple Choice)

5.0/5  (40)

(40)

Stock A has a required return of 19%. Stock B has a required return of 11%. Assume a risk-free rate of 4.75%. By how much does Stock A's risk premium exceed the risk premium of Stock B?

(Multiple Choice)

4.9/5  (37)

(37)

Portfolio Beta You own $2,000 of City Steel stock that has a beta of 2.5. You also own $8,000 of Rent-N-Co (beta = 1.9) and $4,000 of Lincoln Corporation (beta = 0.25). What is the beta of your portfolio?

(Multiple Choice)

4.8/5  (31)

(31)

Which of these is the line on a graph of return and risk (standard deviation) from the risk-free rate through the market portfolio?

(Multiple Choice)

4.8/5  (38)

(38)

Risk Premium The annual return on the S&P 500 Index was 18.1 percent. The annual T-bill yield during the same period was 6.2 percent. What was the market risk premium during that year?

(Multiple Choice)

4.7/5  (37)

(37)

IBM's stock price is $22, it is expected to pay a $2 dividend, and analysts expect the firm to grow at 10% per year for the next 5 years. TDI's stock price is $10, it is expected to pay a $1 dividend, and analysts expect the firm to grow at 12% per year for the next 5 years. What is the difference in the two firms' required rate of returns?

(Multiple Choice)

4.7/5  (29)

(29)

Under/Over-Valued Stock A manager believes his firm will earn a 7.5 percent return next year. His firm has a beta of 2, the expected return on the market is 5 percent, and the risk-free rate is 2 percent. Compute the return the firm should earn given its level of risk and determine whether the manager is saying the firm is under-valued or over-valued.

(Multiple Choice)

4.9/5  (42)

(42)

CAPM Required Return A company has a beta of 3.25. If the market return is expected to be 14 percent and the risk-free rate is 5.5 percent, what is the company's required return?

(Multiple Choice)

4.8/5  (39)

(39)

In 2000, the S&P500 Index earned 11% while the T-bill yield was 4.4%. Given this information, which of the following statements is correct with respect to the market risk premium?

(Multiple Choice)

4.8/5  (30)

(30)

Stock A has a required return of 12%. Stock B has a required return of 15%. Assume a risk-free rate of 4.75%. Which of the following is a correct statement about the two stocks?

(Multiple Choice)

4.8/5  (43)

(43)

Investor enthusiasm causes an inflated bull market that drives prices too high, ending in a dramatic collapse in prices.

(Multiple Choice)

4.9/5  (40)

(40)

This has not been released to the public, but is known by few individuals, likely company insiders.

(Multiple Choice)

4.8/5  (34)

(34)

The average annual return on the S&P 500 Index from 1986 to 1995 was 17.6 percent. The average annual T-bill yield during the same period was 9.8 percent. What was the market risk premium during these ten years?

(Multiple Choice)

4.9/5  (36)

(36)

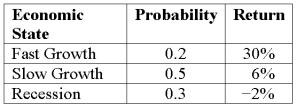

Expected Return Risk Compute the standard deviation of the expected return given these three economic states, their likelihoods, and the potential returns:

(Multiple Choice)

4.7/5  (46)

(46)

Showing 81 - 100 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)