Exam 18: Fixed Exchange Rates and Foreign Exchange Intervention

Exam 1: Introduction41 Questions

Exam 2: World Trade: An Overview25 Questions

Exam 3: Labor Productivity and Comparative Advantage: The Ricardian Model70 Questions

Exam 4: Specific Factors and Income Distribution70 Questions

Exam 5: Resources and Trade: the Heckscher-Ohlin Model66 Questions

Exam 6: The Standard Trade Model48 Questions

Exam 7: External Economies of Scale and the International Location of Production37 Questions

Exam 8: Firms in the Global Economy: Export Decisions, Outsourcing, and Multinational Enterprises69 Questions

Exam 9: The Instruments of Trade Policy74 Questions

Exam 10: The Political Economy of Trade Policy63 Questions

Exam 11: Trade Policy in Developing Countries43 Questions

Exam 12: Controversies in Trade Policy47 Questions

Exam 13: National Income Accounting and the Balance of Payments78 Questions

Exam 14: Exchange Rates and the Foreign Exchange Market: An Asset Approach76 Questions

Exam 15: Money,Interest Rates, and Exchange Rates65 Questions

Exam 16: Price Levels and the Exchange Rate in the Long Run80 Questions

Exam 17: Output and the Exchange Rate in the Short Run116 Questions

Exam 18: Fixed Exchange Rates and Foreign Exchange Intervention81 Questions

Exam 19: International Monetary Systems: An Historical Overview171 Questions

Exam 20: Financial Globalization: Opportunity and Crisis131 Questions

Exam 21: Optimum Currency Areas and the Euro104 Questions

Exam 22: Developing Countries: Growth, Crisis, and Reform116 Questions

Select questions type

Which one of the following statements is the MOST accurate?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

B

Explain how a country whose currency is the reserve currency can use monetary policy for macroeconomic stabilization.In particular,explain the result if that country doubled its domestic money supply.

Free

(Essay)

4.9/5  (36)

(36)

Correct Answer:

The immediate result of the doubling of the money supply in the reserve currency's country will be able to increase the exchange rate between the reserve currency and all other currencies.However,all other countries must fix their exchange rate to the reserve currency,so they will purchase the reserve currency and hold it as official international reserves (thus increase their own money supply)until the exchange rate has returned to normal.Thus,the reserve country has the power to affect its own economy and all other countries must adjust in response.

Which one of the following statements is most correct?

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

C

If assets are imperfect substitutes,then a decrease in the amount of domestic currency bonds held by the public will ________ the risk premium and ________ the amount of domestic currency bonds held by the central bank.

(Multiple Choice)

4.9/5  (36)

(36)

Why is it important to understand fixed exchange rates in the modern global economy?

(Essay)

4.9/5  (30)

(30)

This question concerns the mechanism of a reserve currency standard.

Two countries,X and Y,have two currencies,x and y,fixed to the reserve currency,the U.S.dollar.Suppose the exchange rate between x and the U.S.dollar is 3x per dollar.Suppose the exchange rate between y and the U.S.dollar is 5y per dollar.Explain (using numbers)the mechanism if the x-y exchange rate was 0.8 x per y.

(Essay)

5.0/5  (38)

(38)

Under the gold standard,if the dollar price of gold is pegged at $35 per ounce and the euro price of gold is pegged at 12 euro per ounce,what is the dollar/euro exchange rate?

(Essay)

4.9/5  (33)

(33)

Under fixed exchange rates,which one of the following statements is the MOST accurate?

(Multiple Choice)

4.7/5  (42)

(42)

From the Civil War up to 1914,the United States adhered to a

(Multiple Choice)

4.9/5  (34)

(34)

Describe the mechanism which would take place if the Bank of England decides to increase its money supply by purchasing domestic assets under the gold standard.

(Essay)

4.9/5  (37)

(37)

Use a figure to explain the potential effectiveness of fiscal policy to spur on the economy under a fixed exchange rate.

(Essay)

4.7/5  (33)

(33)

Under fixed exchange rates,which one of the following statements is the MOST accurate?

(Multiple Choice)

4.8/5  (28)

(28)

Which one of the following statements is the MOST accurate?

(Multiple Choice)

4.9/5  (36)

(36)

If the central bank does not purchase foreign assets when output increases but instead holds the money stock constant,can it still keep the exchange rate fixed at  ? Please explain.

? Please explain.

(Essay)

4.8/5  (32)

(32)

Industrialized countries typically ________ their floating exchange rates.Developing countries often ________ their floating exchange rates.

(Multiple Choice)

4.9/5  (30)

(30)

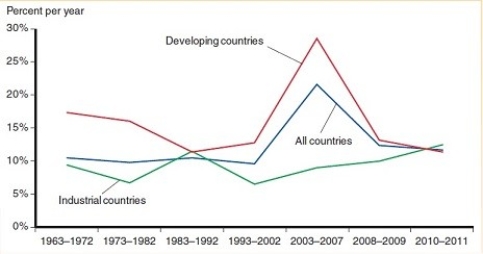

From the figure below,please provide an explanation for the large decline in the growth rate of international reserves held by developing countries in the 2008-2009 period.

(Essay)

4.9/5  (33)

(33)

Which one of the following statements is the MOST accurate?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 1 - 20 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)