Exam 11: Decision Making With a Strategic Emphasis

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit CVP Analysis79 Questions

Exam 2: Implementing Strategy: The Value Chain, the Balanced Scorecard, and the Strategy Map70 Questions

Exam 3: Basic Cost Management Concepts98 Questions

Exam 4: Job Costing118 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis149 Questions

Exam 6: Process Costing106 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products96 Questions

Exam 8: Cost Estimation120 Questions

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit Cvp Analysis105 Questions

Exam 10: Strategy and the Master Budget146 Questions

Exam 11: Decision Making With a Strategic Emphasis137 Questions

Exam 12: Strategy and the Analysis of Capital Investments167 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing, Theory of Constraints, and Strategic Pricing94 Questions

Exam 14: Operational Performance Measurement: Sales, Direct-Cost Variances, and the Role of Nonfinancial Performance Measures178 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource-Capacity Management167 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales134 Questions

Exam 17: The Management and Control of Quality147 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard133 Questions

Exam 19: Strategic Performance Measurement: Investment Centers and Transfer Pricing151 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation108 Questions

Select questions type

Feel the Difference, Inc. manufactures bath and beauty products such as soaps, skin creams, lotions, and other products primarily for people with dry and sensitive skin. It has just introduced a new line of product that removes the spotting and wrinkling in skin associated with aging. It sells these products in pharmacies and department stores at prices slightly higher than those of other brands because of Feel the Difference's excellent reputation for quality and effectiveness.

Feel the Difference currently has very low utilization of plant capacity. Two years ago, in anticipation of rapid growth, the company opened a new large manufacturing plant, which has yet to be utilized more than 50 percent. Partly for this reason, Feel the Difference has sought new partners and was able, with the help of financial analysts, to locate suitable business partners. The first potential partner identified in this search was a large supermarket chain, All-Mart, which is interested in the partnership because it wants Feel the Difference to manufacture an age cream to sell in its stores. The product would be essentially the same as the Feel the Difference product but would be packaged in the All-Mart brand name. The agreement would pay Feel the Difference $2.00 per unit and would allow All-Mart a limited right to advertise the product as manufactured for All-Mart by Feel the Difference. Feel the Difference's CFO has made some calculations and has determined that the direct materials, direct labor and other variable costs needed for the All-Mart order would be about $1.00 per unit as compared to the full cost of $2.50 (materials, labor, and overhead) for the equivalent Feel the Difference product.

Required:

Should Feel the Difference accept the proposal from All-Mart? Why or why not? (Include strategic considerations)

(Essay)

4.7/5  (32)

(32)

One of the key management functions is to perform a regular review of product profitability. Which question(s) below would not be asked when performing the analysis?

(Multiple Choice)

4.7/5  (43)

(43)

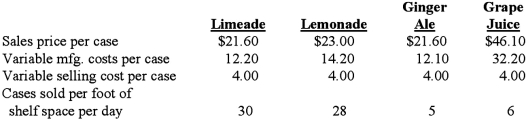

The Sand Cruiser is a takeout food store at a popular beachside resort. Teresa Texton, owner of the Sand Cruiser, was deciding how much refrigerator space to devote to four different beverages. Appropriate data on the four beverages follow:  Teresa had a maximum front shelf space of fourteen feet to devote to the four beverages. She wanted a minimum of two feet and a maximum of seven feet of front shelf for each beverage. The contribution margin per case for Limeade is:

Teresa had a maximum front shelf space of fourteen feet to devote to the four beverages. She wanted a minimum of two feet and a maximum of seven feet of front shelf for each beverage. The contribution margin per case for Limeade is:

(Multiple Choice)

4.7/5  (35)

(35)

When a firm has surplus capacity as opposed to constrained capacity (i.e., resource constraints), relevant costs for decision-making (e.g., determining short-term product mix) will be:

(Multiple Choice)

4.9/5  (36)

(36)

Depreciation expense is a relevant cost in a decision only in the context of:

(Multiple Choice)

4.9/5  (36)

(36)

When there is limited capacity, the minimum acceptable price for a special sales order will equal the _______________ from the product that is sacrificed plus the variable costs of the ordered product.

(Multiple Choice)

4.7/5  (28)

(28)

If the company accepts the offer from the outside supplier, the monthly avoidable costs (costs that would no longer be incurred) would be:

(Multiple Choice)

4.9/5  (39)

(39)

Operating at or near full capacity will require a firm considering a special sales order to potentially recognize the:

(Multiple Choice)

5.0/5  (48)

(48)

Assuming that Product Line C is discontinued and the manufacturing space formerly devoted to this line is rented for $6,000 per year, operating income for the company will:

(Multiple Choice)

4.8/5  (40)

(40)

Lyman Company has the opportunity to increase annual credit sales $100,000 by selling to a new, riskier group of customers. The expenses of collecting credit sales are expected to be 15 percent of credit sales. The company's manufacturing and selling expenses are 70% of sales, and its effective tax rate is 40%. If Lyman should accept this opportunity, the company's after-tax profits would increase by:

(Multiple Choice)

4.9/5  (31)

(31)

A truck, costing $25,000 and uninsured, was wrecked the very first day it was used. It can either be disposed of for $5,000 cash and be replaced with a similar truck costing $27,000, or rebuilt for $20,000 and be brand new as far as operating characteristics and looks are concerned. The net relevant cost of the replacing option is:

(Multiple Choice)

4.8/5  (35)

(35)

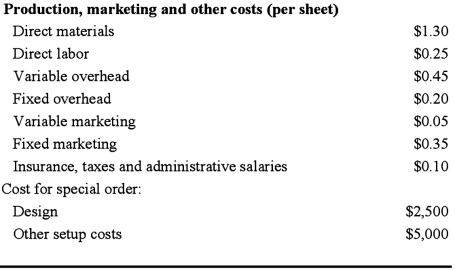

SportsCards Inc. manufactures baseball cards sold in packs of 10 in drugstores and grocery stores throughout the country. It is the second leading firm in an industry with four major firms. SportsCards has been approached by Zip Cereal Inc., which would like to order a special edition of cards to use as a promotion with its new cereal. SportsCards would be solely responsible for designing and producing the cards. Zip wants to order 30,000 sets and has offered $25,500 for the total order. Each set will consist of 30 cards. SportsCards currently produces cards in sheets of 120.  SportsCards would incur no marketing costs for the special order. It has the capacity to accept this order without interrupting regular production.

Required:

1. Based solely on a short-term financial analysis, should SportsCards accept the special order? Why or why not? Support your answer with appropriate calculations.

2. What are the important strategic issues in the decision?

SportsCards would incur no marketing costs for the special order. It has the capacity to accept this order without interrupting regular production.

Required:

1. Based solely on a short-term financial analysis, should SportsCards accept the special order? Why or why not? Support your answer with appropriate calculations.

2. What are the important strategic issues in the decision?

(Essay)

4.9/5  (40)

(40)

The practice of setting prices below average variable cost and plans to raise prices later to recover the losses from the lower prices, is referred to as:

(Multiple Choice)

4.8/5  (22)

(22)

Showing 121 - 137 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)