Exam 3: Basic Cost Management Concepts

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit CVP Analysis79 Questions

Exam 2: Implementing Strategy: The Value Chain, the Balanced Scorecard, and the Strategy Map70 Questions

Exam 3: Basic Cost Management Concepts98 Questions

Exam 4: Job Costing118 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis149 Questions

Exam 6: Process Costing106 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products96 Questions

Exam 8: Cost Estimation120 Questions

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit Cvp Analysis105 Questions

Exam 10: Strategy and the Master Budget146 Questions

Exam 11: Decision Making With a Strategic Emphasis137 Questions

Exam 12: Strategy and the Analysis of Capital Investments167 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing, Theory of Constraints, and Strategic Pricing94 Questions

Exam 14: Operational Performance Measurement: Sales, Direct-Cost Variances, and the Role of Nonfinancial Performance Measures178 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource-Capacity Management167 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales134 Questions

Exam 17: The Management and Control of Quality147 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard133 Questions

Exam 19: Strategic Performance Measurement: Investment Centers and Transfer Pricing151 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation108 Questions

Select questions type

Manufacturing firms use which of the following three inventory accounts?

(Multiple Choice)

4.8/5  (35)

(35)

Advanced Technical Services, Ltd. has many products and services in the medical field. The Clinical Division of the company does research and testing of consumer products on human participants in controlled clinical studies.

Required:

Determine for each cost below whether it is best classified as a fixed, variable, or step-fixed cost.

(1) Director's salary

(2) Part-time help

(3) Payment on purchase of medical equipment

(4) Allocation of company-wide advertising

(5) Patches used on participants' arms during the study

(6) Stipends paid to participants

(Essay)

4.9/5  (37)

(37)

How will unit (average) cost of manufacturing (materials, labor and overhead) usually change if the production level rises?

(Multiple Choice)

4.8/5  (43)

(43)

A manufacturer of machinery currently produces equipment for a single client. The client supplies all required raw material on a no-cost basis. The manufacturer contracts to complete the desired units from this raw material. The total production costs incurred by the manufacturer are correctly identified as:

(Multiple Choice)

4.9/5  (36)

(36)

The following costs are incurred by the Oakland Company, a manufacturer of furniture.

1) wood and fabric used in furniture

2) depreciation on machinery

3) property taxes on the factory

4) labor costs to manufacture the furniture

5) electricity cost to operate the machinery

6) factory rent

7) production supervisor's salary

8) sandpaper and other supplies

9) fire insurance on factory

10) commissions paid to salespersons

Required

Classify each cost as either variable or fixed.

(Essay)

4.8/5  (38)

(38)

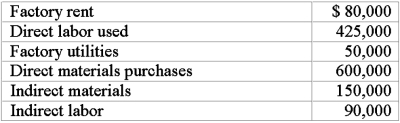

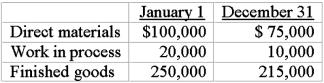

Dave's Lighting Inc. produces lamps for the construction industry. During the year, the company incurred the following costs:  Inventories for the year were:

Inventories for the year were:  Required:

Prepare a statement of cost of goods manufactured and cost of goods sold.

Required:

Prepare a statement of cost of goods manufactured and cost of goods sold.

(Essay)

4.9/5  (41)

(41)

A portion of the costs incurred by business organizations is designated as direct labor cost. As used in practice, the term direct labor cost has a wide variety of meanings. Unless the meaning intended in a given context is clear, misunderstanding and confusion are likely to ensue. If a user does not understand the elements included in direct labor cost, erroneous interpretations of the numbers might occur and could result in poor management decisions. Measurement of direct labor costs has two aspects: (1) the quantity of labor effort that is to be included, that is, the types of hours or other units of time that are to be counted; and (2) the unit price by which each of these quantities is multiplied to arrive at a monetary cost.

Required:

1) Distinguish between direct labor and indirect labor.

2) Presented below are labor cost elements that a company has been classified as direct labor, factory overhead, or either direct labor or factory overhead depending upon the situation.

Direct labor-Included in the company's direct labor are cost production efficiency bonuses and certain benefits for direct labor workers such as FICA (employer's portion), group life insurance, vacation pay, and workers' compensation insurance.

Factory overhead-The company's calculation of manufacturing overhead includes the cost of the following: wage continuation plans, the company sponsored cafeteria, the personnel department, and recreational facilities.

Direct labor or factory overhead-The costs that the company includes in this category are maintenance expense, overtime premiums, and shift premiums.

Explain the reasoning used by the company in classifying the cost elements in each of the three categories.

(Essay)

4.7/5  (35)

(35)

When cost relationships are linear, total variable costs will vary in proportion to changes in:

(Multiple Choice)

4.8/5  (36)

(36)

The cost of goods that were finished and transferred out of work-in-process during the current period is:

(Multiple Choice)

4.8/5  (38)

(38)

A manager of a small manufacturing firm is interested in knowing what the company's product costs are. Which of the following would be considered a product cost for the manager's company?

(Multiple Choice)

4.8/5  (37)

(37)

What should be the amount in the finished goods inventory at the beginning of the year?

(Multiple Choice)

4.9/5  (41)

(41)

Variable costs within the relevant range for a firm are assumed:

(Multiple Choice)

4.9/5  (41)

(41)

Lester-Sung, Inc. is a large general construction firm in the commercial building industry. The following is a list of costs incurred by this company:

1) The cost of an employee for 8 hours at $6.00 an hour.

2) The cost of insurance for the employees.

3) The cost of 1,000 board feet of 2 x 4 lumber.

4) The CEO's salary.

Required:

Classify each cost above using the following categories:

(a) General, selling and administrative cost

(b) Direct material

(c) Direct labor

(d) Overhead cost

(Essay)

4.9/5  (37)

(37)

Factory overhead costs for a given period were 2 times as much as the direct material costs. Prime costs totaled $8,000. Conversion costs totaled $11,350. What are the direct labor costs for the period?

(Multiple Choice)

5.0/5  (37)

(37)

Showing 61 - 80 of 98

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)