Exam 2: Overview of Financial Reporting for State and Local Governments

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Organizations134 Questions

Exam 2: Overview of Financial Reporting for State and Local Governments135 Questions

Exam 3: Modified Accrual Accounting: Including the Role of Fund Balances and Budgetary Authority143 Questions

Exam 4: Accounting for the General and Special Revenue Funds125 Questions

Exam 5: Accounting for Other Governmental Fund Types: Capital Projects, Debt Service, and Permanent152 Questions

Exam 6: Proprietary Funds130 Questions

Exam 7: Fiduciary Trustfunds154 Questions

Exam 8: Government-Wide Statements, Capital Assets, Long-Term Debt143 Questions

Exam 9: Accounting for Special-Purpose Entities, Including Public Colleges and Universities105 Questions

Exam 10: Accounting for Private Not-For-Profit Organizations151 Questions

Exam 11: College and University Accounting Private Institutions125 Questions

Exam 12: Accounting for Hospitals and Other Health Care Providers100 Questions

Exam 13: Auditing, Tax-Exempt Organizations, and Evaluating Performance151 Questions

Exam 14: Financial Reporting by the Federal Government66 Questions

Select questions type

The Comprehensive Annual Financial Report (CAFR)contains four major sections:

introductory,financial,supplementary,and statistical.

(True/False)

4.8/5  (37)

(37)

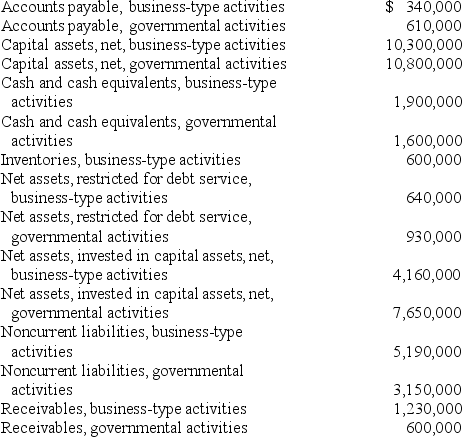

The following information is available for the preparation of the government-wide financial statements of the City of Aurora as of June 30,2014:

Assume all long-term liabilities were incurred in the acquisition of capital assets.

Required:

From the information given above,prepare,in good form,a Statement of Net Assets for the City of Aurora as of June 30,2014.Include the unrestricted net assets,which is to be computed from the information presented above.Include a total column.Aurora has no component units.

Assume all long-term liabilities were incurred in the acquisition of capital assets.

Required:

From the information given above,prepare,in good form,a Statement of Net Assets for the City of Aurora as of June 30,2014.Include the unrestricted net assets,which is to be computed from the information presented above.Include a total column.Aurora has no component units.

(Essay)

4.9/5  (22)

(22)

Which of the following is true with respect to the General Fund

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following is true regarding the government-wide Statement of Activities?

(Multiple Choice)

4.8/5  (34)

(34)

A statement of Cash Flows is required for which type of Fund?

(Multiple Choice)

4.8/5  (32)

(32)

Government-wide financial statements use the economic resources measurement focus and the accrual basis of accounting.

(True/False)

4.9/5  (38)

(38)

Where in the CAFR would one find the long-term liability for revenue bonds (paid from the revenues of an enterprise fund)?

(Multiple Choice)

4.9/5  (30)

(30)

GASB provides which method(s)for including component unit financial information with that of the primary government?

(Multiple Choice)

4.9/5  (38)

(38)

Funds other than the General Fund must be considered a major fund when

(Multiple Choice)

4.8/5  (23)

(23)

In addition to the government-wide statements,governments are required to prepare fund financial statements for which of the following category of funds?

(Multiple Choice)

4.7/5  (31)

(31)

Which of the following is true regarding the proprietary fund financial statements?

(Multiple Choice)

4.8/5  (35)

(35)

Governmental fund financial statements include columns for the General Fund and all other "major" governmental funds.

(True/False)

4.7/5  (40)

(40)

Which of the following is true regarding the proprietary fund financial statements?

(Multiple Choice)

4.8/5  (38)

(38)

Government-wide statements are to be prepared using the economic resources measurement focus and accrual basis of accounting.

(True/False)

4.9/5  (31)

(31)

Which of the following is not true regarding the Statement of Cash Flows for proprietary funds?

(Multiple Choice)

4.8/5  (37)

(37)

Blending of financial information is done only when component units and the primary government are so intertwined that they are essentially the same.

(True/False)

4.7/5  (41)

(41)

What is the rule for determining whether a governmental fund,other than the General Fund,is a major fund?

(Essay)

4.8/5  (38)

(38)

Which of the following is considered Required Supplementary Information (RSI)?

(Multiple Choice)

4.8/5  (33)

(33)

Showing 81 - 100 of 135

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)