Exam 2: Consolidation of Financial Information

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information117 Questions

Exam 3: Consolidations-Subsequent to the Date of Acquisition124 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statementsintra-Entity Asset Transactions127 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues115 Questions

Exam 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk93 Questions

Exam 8: Translation of Foreign Currency Financial Statements97 Questions

Exam 9: Partnerships: Formation and Operation88 Questions

Exam 10: Partnerships: Termination and Liquidation73 Questions

Exam 11: Accounting for State and Local Governments, Part I78 Questions

Exam 12: Accounting for State and Local Governments, Part II49 Questions

Select questions type

The financial balances for the Atwood Company and the Franz Company as of December 31, 2013, are presented below. Also included are the fair values for Franz Company's net assets. Atwood Franz Co Franz Co. (all numbers are in thousands) Book Value Book Value Fair Value Cash \ 870 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570) (240) (240) Accrued expenses (270) (60) (60) Long-term liabilities (2,700) (1,020) (1,120) Common stock (\ 20 par) (1,980) Common stock ( \5 par) (420) Additional paid-in capital (210) (180) Retained earnings (1,170) (480) Revenues (2,880) (660) Expenses 2,760 620 Note: Parenthesis indicate a credit balance Assume an acquisition business combination took place at December 31, 2013. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

Compute consolidated revenues at the date of the acquisition.

(Multiple Choice)

4.8/5  (24)

(24)

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2013. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs. The book values for both Flynn and Macek as of January 1, 2013 follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands. Flynn, Ine. Macek Company Book Value Fair Value Cash \ 900 \ 80 \ 80 Receivables 480 180 160 Inventory 660 260 300 Land 300 120 130 Buildings (net) 1,200 220 280 Equipment 360 100 75 Accounts payable 480 60 60 Long-term liabilities 1,140 340 300 Common stock 1,000 80 Additional paid-in capital 200 0 Retained earnings 1,080 480 What amount will be reported for consolidated buildings (net)?

(Multiple Choice)

4.9/5  (46)

(46)

Which of the following statements is true regarding a statutory merger?

(Multiple Choice)

4.9/5  (43)

(43)

Goodwill is often acquired as part of a business combination. Why, when separate incorporation is maintained, does Goodwill not appear on the Parent company's trial balance as a separate account?

(Essay)

4.8/5  (40)

(40)

Bale Co. acquired Silo Inc. on December 31, 2013, in an acquisition business combination transaction. Bale's net income for the year was $1,400,000, while Silo had net income of $400,000 earned evenly during the year. Bale paid $100,000 in direct combination costs, $50,000 in indirect costs, and $30,000 in stock issue costs to effect the combination.

Required:

What is consolidated net income for 2013?

(Essay)

4.8/5  (40)

(40)

Carnes has the following account balances as of May 1, 2012 before an acquisition transaction takes place. Inventory \ 100,000 Land 400,000 Buildings (net) 500,000 Common stock ( \1 0 par) 600,000 Additional paid-in capital 200,000 Retained Earnings 200,000 Revenues 450,000 Expenses 250,000 The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

(Multiple Choice)

4.7/5  (43)

(43)

Carnes has the following account balances as of May 1, 2012 before an acquisition transaction takes place. Inventory \ 100,000 Land 400,000 Buildings (net) 500,000 Common stock ( \1 0 par) 600,000 Additional paid-in capital 200,000 Retained Earnings 200,000 Revenues 450,000 Expenses 250,000 The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. What will be the consolidated additional paid-in capital as a result of this acquisition?

(Multiple Choice)

4.9/5  (33)

(33)

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2013. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs. The book values for both Flynn and Macek as of January 1, 2013 follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands. Flynn, Ine. Macek Company Book Value Fair Value Cash \ 900 \ 80 \ 80 Receivables 480 180 160 Inventory 660 260 300 Land 300 120 130 Buildings (net) 1,200 220 280 Equipment 360 100 75 Accounts payable 480 60 60 Long-term liabilities 1,140 340 300 Common stock 1,000 80 Additional paid-in capital 200 0 Retained earnings 1,080 480 What amount will be reported for consolidated equipment (net)?

(Multiple Choice)

4.7/5  (37)

(37)

Bullen Inc. acquired 100% of the voting common stock of Vicker Inc. on January 1, 2013. The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow, along with the book value of Bullen's accounts: Bullen Vicker Vicker Book Book Fair Value Value Value Retained earnings, 1/1/15 Cash and receivables 170,000 70,000 Inventory 230,000 170,000 210,000 Land 280,000 220,000 240,000 Buildings (net) 480,000 240,000 270,000 Equipment (net) 120,000 90,000 90,000 Liabilities 650,000 430,000 420,000 Common stock 360,000 80,000 Additional paid-in capital 20,000 40,000 Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding stock of Vicker. What is the consolidated balance for Land as a result of this acquisition transaction?

(Multiple Choice)

4.9/5  (36)

(36)

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands): On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated equipment (net) account at December 31, 2013.

(Multiple Choice)

4.8/5  (40)

(40)

What term is used to refer to a business combination in which only one of the original companies continues to exist?

(Short Answer)

4.8/5  (32)

(32)

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands): On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated buildings (net) account at December 31, 2013.

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following statements is true regarding the acquisition method of accounting for a business combination?

(Multiple Choice)

4.8/5  (40)

(40)

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2012, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date. Atwood Franz Co Franz Co. (all numbers are in thousands) Book Value Book Value Fair Value 12/31/14 12/31/14 12/31/14 Cash \ 870 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570) (240) (240) Accrued expenses (270) (60) (60) Long-term liabilities (2,700) (1,020) (1,120) Common stock (\ 20 par) (1,980) Common stock ( \5 par) (420) Additional paid-in capital (210) (180) Retained earnings (1,170) (480) Revenues (2,880) (660) Expenses 2,760 620 Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2012. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands).

Compute consolidated retained earnings as a result of this acquisition.

(Multiple Choice)

4.9/5  (41)

(41)

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2013. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs. The book values for both Flynn and Macek as of January 1, 2013 follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands. Flynn, Ine. Macek Company Book Value Fair Value Cash \ 900 \ 80 \ 80 Receivables 480 180 160 Inventory 660 260 300 Land 300 120 130 Buildings (net) 1,200 220 280 Equipment 360 100 75 Accounts payable 480 60 60 Long-term liabilities 1,140 340 300 Common stock 1,000 80 Additional paid-in capital 200 0 Retained earnings 1,080 480 What amount will be reported for goodwill as a result of this acquisition?

(Multiple Choice)

4.7/5  (29)

(29)

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2012, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date. Atwood Franz Co Franz Co. (all numbers are in thousands) Book Value Book Value Fair Value 12/31/14 12/31/14 12/31/14 Cash \ 870 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570) (240) (240) Accrued expenses (270) (60) (60) Long-term liabilities (2,700) (1,020) (1,120) Common stock (\ 20 par) (1,980) Common stock ( \5 par) (420) Additional paid-in capital (210) (180) Retained earnings (1,170) (480) Revenues (2,880) (660) Expenses 2,760 620 Note: Parenthesis indicate a credit balance Assume a business combination took place at December 31, 2012. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands).

Compute consolidated equipment at date of acquisition.

(Multiple Choice)

4.9/5  (41)

(41)

What is the primary accounting difference between accounting for when the subsidiary is dissolved and when the subsidiary retains its incorporation?

(Multiple Choice)

4.8/5  (35)

(35)

The financial balances for the Atwood Company and the Franz Company as of December 31, 2013, are presented below. Also included are the fair values for Franz Company's net assets. Atwood Franz Co Franz Co. (all numbers are in thousands) Book Value Book Value Fair Value Cash \ 870 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570) (240) (240) Accrued expenses (270) (60) (60) Long-term liabilities (2,700) (1,020) (1,120) Common stock (\ 20 par) (1,980) Common stock ( \5 par) (420) Additional paid-in capital (210) (180) Retained earnings (1,170) (480) Revenues (2,880) (660) Expenses 2,760 620 Note: Parenthesis indicate a credit balance Assume an acquisition business combination took place at December 31, 2013. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

Compute consolidated long-term liabilities at the date of the acquisition.

(Multiple Choice)

4.8/5  (37)

(37)

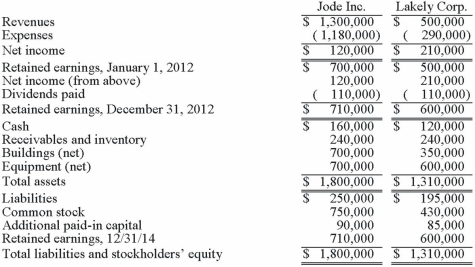

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2012, follow. Lakely's buildings were undervalued on its financial records by $60,000.  On December 31, 2012, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

Determine consolidated Additional paid-in Capital at December 31, 2012.

On December 31, 2012, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

Determine consolidated Additional paid-in Capital at December 31, 2012.

(Essay)

4.9/5  (40)

(40)

The financial balances for the Atwood Company and the Franz Company as of December 31, 2013, are presented below. Also included are the fair values for Franz Company's net assets. Atwood Franz Co Franz Co. (all numbers are in thousands) Book Value Book Value Fair Value Cash \ 870 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570) (240) (240) Accrued expenses (270) (60) (60) Long-term liabilities (2,700) (1,020) (1,120) Common stock (\ 20 par) (1,980) Common stock ( \5 par) (420) Additional paid-in capital (210) (180) Retained earnings (1,170) (480) Revenues (2,880) (660) Expenses 2,760 620 Note: Parenthesis indicate a credit balance Assume an acquisition business combination took place at December 31, 2013. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

Compute consolidated retained earnings at the date of the acquisition.

(Multiple Choice)

4.8/5  (41)

(41)

Showing 81 - 100 of 117

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)