Exam 10: Auditing the Revenue Process

Exam 1: An Introduction to Assurance and Financial Statement Auditing46 Questions

Exam 2: The Financial Statement Auditing Environment63 Questions

Exam 3: Audit Planning, Types of Audit Tests, and Materiality74 Questions

Exam 4: Risk Assessment55 Questions

Exam 5: Evidence and Documentation95 Questions

Exam 6: Internal Control in a Financial Statement Audit103 Questions

Exam 7: Auditing Internal Control Over Financial Reporting64 Questions

Exam 8: Audit Sampling: An Overview and Application to Tests of Controls67 Questions

Exam 9: Audit Sampling: An Application to Substantive Tests of Account Balances54 Questions

Exam 10: Auditing the Revenue Process94 Questions

Exam 11: Auditing the Purchasing Process80 Questions

Exam 12: Auditing the Human Resource Management Process64 Questions

Exam 13: Auditing the Inventory Management Process74 Questions

Exam 14: Auditing the Financing Investing Process: Prepaid Expenses Intangible Assets and Property Plant and Equipment71 Questions

Exam 15: Auditing the Financing Investing Process: Long-Term Liabilities Stockholders Equity and Income Statement Accounts63 Questions

Exam 16: Auditing the Financinginvesting Process: Cash and Investments68 Questions

Exam 17: Completing the Audit Engagement83 Questions

Exam 18: Reports on Audited Financial Statements74 Questions

Exam 19: Professional Conduct, Independence, and Quality Control72 Questions

Exam 20: Legal Liability65 Questions

Exam 21: Assurance, Attestation, and Internal Auditing Services99 Questions

Select questions type

The revenue process affects numerous accounts in the financial statements.

(True/False)

4.7/5  (38)

(38)

The confirmation of customers' accounts receivable rarely provides reliable evidence about the completeness assertion because

(Multiple Choice)

4.7/5  (38)

(38)

Which one of the following would the auditor consider to be an incompatible operation if the cashier receives remittances from the mailroom?

(Multiple Choice)

4.7/5  (41)

(41)

In auditing accounts receivable, the negative form of confirmation request most likely would be used when

(Multiple Choice)

4.7/5  (36)

(36)

Audit documents often include an aged trial balance of accounts receivable as of the balance sheet date. This aging is used by the auditor to

(Multiple Choice)

4.8/5  (45)

(45)

A CPA auditing an electric utility wishes to determine whether all customers are being billed. The CPA's best direction of test is from the

(Multiple Choice)

4.8/5  (36)

(36)

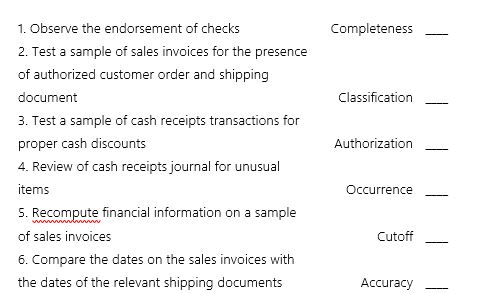

Match the test of controls described below to the appropriate assertion it is used to test:

(Essay)

4.8/5  (37)

(37)

Which of the following is not an inherent risk factor for the revenue process?

(Multiple Choice)

4.9/5  (30)

(30)

Revenue is realized when a product or service is exchanged for cash or a promise to pay cash or other assets that can be converted into cash.

(True/False)

4.9/5  (40)

(40)

Cooper, CPA is auditing the financial statements of a small rural municipality. The receivable balances represent residents' delinquent real estate taxes. Internal control at the municipality is weak. To determine the existence of the accounts receivable balances at the balance sheet date, Cooper would most likely

(Multiple Choice)

4.7/5  (37)

(37)

Which of the following procedures would ordinarily be expected to best reveal improper cutoff of sales at the balance sheet date?

(Multiple Choice)

4.8/5  (43)

(43)

During a review of a small business entity's internal control system, the auditor discovered that the accounts receivable clerk approves credit memos and has access to cash. Which of the following controls would be most effective in offsetting this weakness?

(Multiple Choice)

5.0/5  (35)

(35)

To determine whether the system of internal control operated effectively to minimize errors of failure to invoice a shipment, the auditor would select a sample of transactions from the population represented by the

(Multiple Choice)

4.9/5  (34)

(34)

An auditor reconciles the total of the accounts receivable subsidiary ledger to the general ledger control account as of October 31. By this procedure, the auditor would be most likely to learn about which of the following?

(Multiple Choice)

4.8/5  (28)

(28)

Customers having substantial year-end past due balances fail to reply after second request confirmation forms have been mailed directly to them. Which of the following is the most appropriate audit procedure?

(Multiple Choice)

4.7/5  (43)

(43)

Tracing copies of sales invoices to shipping documents will provide evidence that all

(Multiple Choice)

5.0/5  (36)

(36)

To reduce the risks associated with accepting e-mail responses to requests for confirmation of accounts receivable, an auditor most likely would

(Multiple Choice)

4.9/5  (36)

(36)

An auditor's purpose in reviewing credit ratings of customers with delinquent accounts receivable most likely is to obtain evidence concerning management's assertions about

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following misstatements is not related to the completeness assertion for revenue?

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is the best argument against the use of negative accounts receivable confirmations?

(Multiple Choice)

4.9/5  (35)

(35)

Showing 61 - 80 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)