Exam 13: Revenue Recognition Issues

Exam 1: An Overview of the International External Reporting Environment58 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financial Reporting69 Questions

Exam 3: Theories of Financial Accounting76 Questions

Exam 4: An Overview of Accounting for Assets75 Questions

Exam 5: Depreciation of Property, Plant and Equipment63 Questions

Exam 6: Revaluations and Impairment Testing of Non-Current Assets52 Questions

Exam 7: Inventory63 Questions

Exam 8: Accounting for Intangibles55 Questions

Exam 9: An Overview of Accounting for Liabilities58 Questions

Exam 10: Accounting for Leases64 Questions

Exam 12: Accounting for Financial Instruments70 Questions

Exam 13: Revenue Recognition Issues61 Questions

Exam 14: The Statement of Comprehensive Income and Statement of Changes in Equity65 Questions

Exam 15: Accounting for Income Taxes97 Questions

Exam 16: The Statement of Cash Flows69 Questions

Exam 17: Events Occurring After the Reporting Date66 Questions

Exam 18: Related-Party Disclosures63 Questions

Exam 21: Further Consolidation Issues I: Accounting for Intragroup Transactions46 Questions

Exam 22: Further Consolidation Issues II: Accounting for Non-Controlling Interests30 Questions

Exam 23: Further Consolidation Issues III: Accounting for Indirect Ownership Interest46 Questions

Exam 24: Accounting for Foreign Currency Transactions55 Questions

Exam 25: Translating the Financial Statements of Foreign Operations33 Questions

Exam 26: Accounting for Corporate Social Responsibility52 Questions

Select questions type

IASB (2011)Revenue from Contracts with Customers specifies the accounting treatment in the case that the outcome of a construction contract cannot be reliably assessed.The treatment specified is:

(Multiple Choice)

4.8/5  (37)

(37)

In considering whether to recognise revenue when there are associated options:

(Multiple Choice)

4.9/5  (36)

(36)

Using the cost method to calculate the percentage of completion,the formula for the current period revenue or gross profit to be recognised is:

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following statements is incorrect with respect to revenue recognition of construction contracts?

(Multiple Choice)

4.9/5  (35)

(35)

Describe,with examples,how the recognition of revenue,at the time of sale,is affected when products require transportation.

(Essay)

4.8/5  (41)

(41)

Explain the difference between revenue and gains as defined in the IASB Conceptual Framework.

(Essay)

4.9/5  (35)

(35)

IASB and FASB initiated a joint project to address some inconsistencies of recognition of revenue in contracts with customers with other accounting standards.Discuss two of these inconsistencies.

(Essay)

4.7/5  (40)

(40)

Lonsdale Plc sells mobile phones and provides a one-year warranty.Lonsdale is able to recognise revenue at point-of-sale in accordance with IASB (2011)Revenue from Contracts with Customers because:

(Multiple Choice)

4.9/5  (38)

(38)

When goods are sold on extended credit there is an implicit financing arrangement contained in the sale agreement.In order to separate the financing element from the sale,it is necessary to calculate the applicable interest rate inherent in the agreement.What advice does IASB (2011)Revenue from Contracts with Customers provide about this?

(Multiple Choice)

4.9/5  (36)

(36)

On 1 July 2013 Bigwell Plc sells a machine to Archer Plc in exchange for a promissory note that requires Archer Plc to make five payments of €8000,the first to be made on 30 June 2014.The machine cost Bigwell Plc €20 000 to manufacture.Bigwell Plc would normally sell this type of machine for €30 326 for cash or short-term credit.The implicit interest rate in the agreement is 10%.What are the appropriate journal entries to record the sale agreement and the first two instalments using the gross method?

(Multiple Choice)

4.8/5  (44)

(44)

There are various appropriate accounting treatments when a sale is made subject to a right of return.These methods include:

(Multiple Choice)

4.9/5  (29)

(29)

With the percentage-of-completion method of accounting for construction contracts,profit is recognised in proportion to the work performed in each reporting period.

(True/False)

4.8/5  (30)

(30)

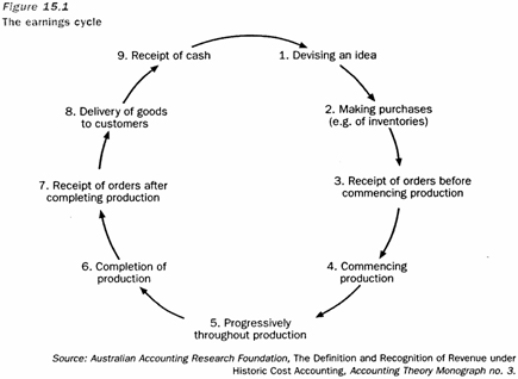

The following is a diagram of the earnings cycle as presented by Coombes and Martin (1982).  For products such as precious metals or agricultural products revenue is recognised at which point in the earnings cycle shown above?

For products such as precious metals or agricultural products revenue is recognised at which point in the earnings cycle shown above?

(Multiple Choice)

4.9/5  (29)

(29)

When making a provision for doubtful debts,debtors' subsidiary ledgers are not adjusted,as the provision is made in anticipation of likely non-recoverability of amounts owing,although the identity of who will not pay is unknown.

(True/False)

4.8/5  (46)

(46)

Which of the following is not a disclosure requirement of IASB (2011)Revenue from Contracts with Customers?

(Multiple Choice)

4.7/5  (42)

(42)

When it is probable that total contract costs will exceed total contract revenue,the expected loss should not be recognised as an expense until the future economic sacrifice eventuates.

(True/False)

4.7/5  (34)

(34)

The general rule under modified historical-cost accounting is that holding gains on non-current assets should be:

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following statements is not in accordance with IASB (2011)Revenue from Contracts with Customers with respect to revenue recognition when right of return exists?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 21 - 40 of 61

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)